Qantas 2005 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.114

Spirit of Australia

~Notes to the Financial Statements~

for the year ended 30 June 2005

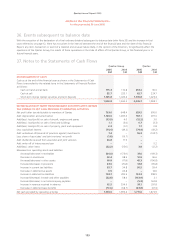

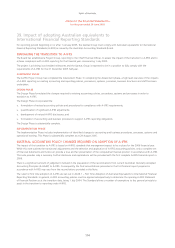

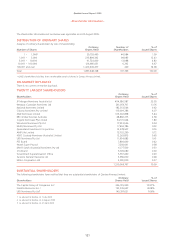

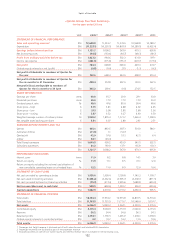

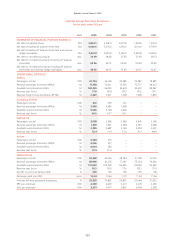

39. Impact of adopting Australian equivalents to

International Financial Reporting Standards

For reporting periods beginning on or after 1 January 2005, the Qantas Group must comply with Australian equivalents to International

Financial Reporting Standards (A-IFRS) as issued by the Australian Accounting Standards Board.

MANAGING THE TRANSITION TO A-IFRS

The Board has established a Project Group, reporting to the Chief Financial Officer, to assess the impact of the transition to A-IFRS and to

achieve compliance with A-IFRS reporting for the financial year commencing 1 July 2005.

The project is achieving its scheduled milestones and the Qantas Group is expected to be in a position to fully comply with the

requirements of A-IFRS for the 31 December 2005 half-year.

ASSESSMENT PHASE

The A-IFRS Project Group has completed the Assessment Phase. In completing the Assessment phase, a high level overview of the impacts

of A-IFRS reporting on existing accounting and reporting policies, procedures, systems, processes, business structures and staff has been

undertaken.

DESIGN PHASE

The Design Phase formulated the changes required to existing accounting policies, procedures, systems and processes in order to

transition to A-IFRS.

The Design Phase incorporated the:

x formulation of revised accounting policies and procedures for compliance with A-IFRS requirements;

x quantification of significant A-IFRS adjustments;

x development of revised A-IFRS disclosures; and

x formulation of accounting and business processes to support A-IFRS reporting obligations.

The Design Phase is substantially complete.

IMPLEMENTATION PHASE

The Implementation Phase includes implementation of identified changes to accounting and business procedures, processes, systems and

operational training. This Phase is substantially complete as at 29 August 2005.

MATERIAL ACCOUNTING POLICY CHANGES REQUIRED ON ADOPTION OF A-IFRS

The impact of the transition to A-IFRS is based on A-IFRS standards that management expect to be in place for the 2006 financial year.

While this note outlines the transitional adjustments and the selection and application of A-IFRS accounting policies, only a complete set

of financial statements and notes can provide a true and fair presentation of the comparative financial position in accordance with A-IFRS.

This note provides only a summary. Further disclosure and explanations will be provided with the first complete A-IFRS financial report in

2006.

There is a significant amount of judgement involved in the preparation of the reconciliations from current Australian Generally Accepted

Accounting Principles (A-GAAP) to A-IFRS. Consequently, the final reconciliations presented in the first financial report prepared in

accordance with A-IFRS may vary from the reconciliations provided in this Note.

The rules for first time adoption of A-IFRS are set out in AASB 1 – First Time Adoption of Australian Equivalents to International Financial

Reporting Standards. In general, A-IFRS accounting policies must be applied retrospectively to determine the opening A-IFRS Statement

of Financial Position as at the transition date, being 1 July 2004. The Standard allows a number of exemptions to this general principle to

assist in the transition to reporting under A-IFRS.