Qantas 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

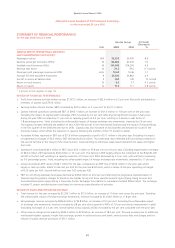

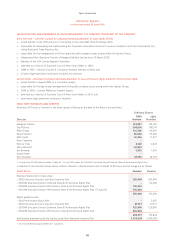

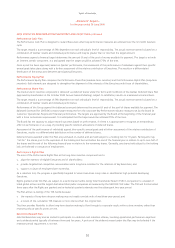

STATEMENT OF FINANCIAL POSITION

as at 30 June 2005

The net assets of the Qantas Group increased by 10.0 per cent to $6,426.9 million during the financial year. The major movements are

discussed below.

REVIEW OF TOTAL ASSETS

x Total cash and current receivables increased by $581.9 million mainly reflecting an increase of $538.5 million in net cash as discussed

below. Trade and sundry debtors also increased by 4.1 per cent compared to an increase in RPKs of 7.0 per cent reflecting tight

control of working capital.

x Property, plant and equipment increased by 2.9 per cent due to aircraft acquisitions under the aircraft fleet plan (24 aircraft entered

service during the financial year), partially offset by depreciation and amortisation charges and the sale and operating leaseback of

aircraft during the year. Significant investment was also made in airline product and aircraft reconfigurations.

REVIEW OF TOTAL LIABILITIES

x Interest-bearing liabilities decreased by 6.0 per cent to $5,549.7 million due mainly to the repayment of borrowings during the year

and favourable foreign exchange rate movements, partially offset by new borrowings to fund fleet acquisitions.

REVIEW OF TOTAL EQUITY

x Contributed equity increased by $178.5 million due to the issue of 52.5 million shares as part of the Dividend Reinvestment Plan.

GEARING

x Qantas Group gearing (including the notional capitalisation of non-cancellable operating leases) on a hedged basis at 30 June 2005

was 45:55 compared to 48:52 at 31 December 2004 and 49:51 at 30 June 2004. The decrease in gearing was principally a result of

the profit earned during the year, partially offset by capital investment in product and fleet.

x Gearing is determined by dividing the book value of the Qantas Group’s net debt (short and long-term plus the present value of

non-cancellable operating leases less related hedge receivables and cash and cash equivalents) by the same amount plus the book

value of total equity.

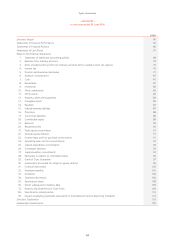

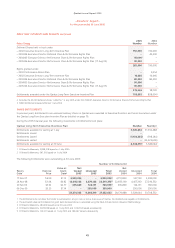

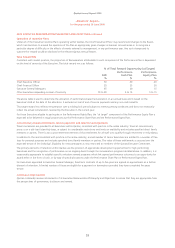

STATEMENT OF CASH FLOWS

for the year ended 30 June 2005

For the purposes of the Statements of Cash Flows, cash includes cash at bank and on hand, cash at call, short-term money market

securities and term deposits.

REVIEW OF CASH FLOWS FROM OPERATING ACTIVITIES

x Cash flows provided by operations decreased by 2.5 per cent to $1,950.0 million primarily due to higher tax payments in the current

year (due to a refund received from the Australian Taxation Office in the prior year relating to realised foreign exchange losses on the

hedging of aircraft acquisitions) and adverse working capital movements.

REVIEW OF CASH FLOWS FROM INVESTING ACTIVITIES

x Cash flows used in investing activities decreased by $836.4 million to $1,396.2 million.

x Total capital expenditure of $1,682.9 million for the year predominantly related to the acquisition of aircraft under the aircraft fleet

plan, aircraft progress payments, reconfigurations, product investment, engine modifications and spares.

x Proceeds from the sale and leaseback of non-current assets of $257.9 million relate to the sale and subsequent leaseback of five A320

aircraft. Included in this amount was $18.8 million in relation to an A320 aircraft. The rights to this aircraft were sold prior to delivery

of the aircraft to a lessor and leased back via operating lease.

x Payments for investments made during the year of $44.6 million mainly comprised the investments in Jetstar Asia Airways Pte Limited,

Jet Turbine Services Pty Limited, Thai Air Cargo Co., Ltd. and the acquisition of the remaining 49 per cent equity in Caterair Airport

Services (Sydney) Pty Limited.

REVIEW OF CASH FLOWS FROM FINANCING ACTIVITIES

x Cash flows used in financing activities decreased by $402.1 million to $15.3 million.

x Repayments of borrowings of $1,144.5 million comprised repayments of short-term borrowings, swaps, loans and leases.

x Proceeds from borrowings/swaps of $1,302.9 million included secured loans required to purchase new aircraft under the Fleet Plan.

x Dividend payments of $175.0 million represent total dividends paid and is net of $178.5 million which was converted directly to

shares issued under the Dividend Reinvestment Plan.

The Qantas Group held cash of $1,903.8 million and had access to additional funding of $1,270.0 million as at 30 June 2005. The latter

comprised a $500.0 million stand-by facility and a $770.0 million revolving facility under a syndicated loan.

Qantas Annual Report 2005

~Discussion and Analysis of Performance Summary~