NVIDIA 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

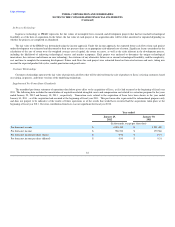

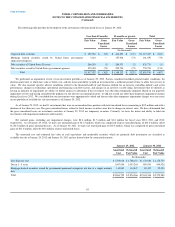

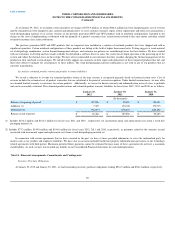

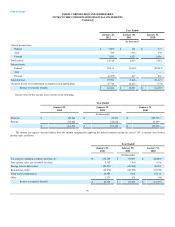

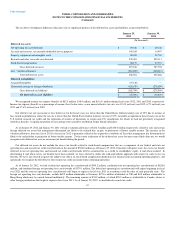

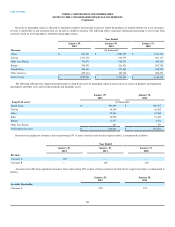

Future Capital Lease

Obligations

(In thousands)

Year ending January:

2013 $ 4,821

2014 4,926

2015 4,887

2016 4,997

2017 5,147

2018 and thereafter 10,762

Total $ 35,540

Present Value of minimum lease payments $ 23,455

Current portion $ 2,016

Long term portion $ 21,439

Litigation

3dfx

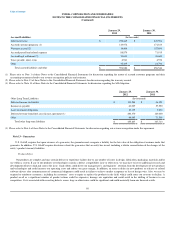

On December 15, 2000, NVIDIA and one of our indirect subsidiaries entered into an Asset Purchase Agreement, or APA, to purchase certain graphics

chip assets from 3dfx. The transaction closed on April 18, 2001. That acquisition, and 3dfx's October 2002 bankruptcy filing, led to four lawsuits against

NVIDIA: two brought by 3dfx's former landlords, one by 3dfx's bankruptcy trustee and the fourth by a committee of 3dfx's equity security holders in the

bankruptcy estate. The two landlord cases have been settled with payments from the landlords to NVIDIA, and the equity security holders lawsuit was

dismissed with prejudice and no appeal was filed. Accordingly, only the bankruptcy trustee suit remains outstanding as more fully explained below.

In March 2003, the Trustee appointed by the Bankruptcy Court to represent 3dfx's bankruptcy estate served a complaint on NVIDIA asserting claims for,

among other things, successor liability and fraudulent transfer and seeking additional payments from us. The Trustee's fraudulent transfer theory alleged that

NVIDIA had failed to pay reasonably equivalent value for 3dfx's assets, and sought recovery of the difference between the $70 million paid and the alleged

fair value, which the Trustee estimated to exceed $50 million. The Trustee's successor liability theory alleged NVIDIA was effectively 3dfx's legal successor

and therefore was responsible for all of 3dfx's unpaid liabilities.

On October 13, 2005, the Bankruptcy Court heard the Trustee's motion for summary adjudication, and on December 23, 2005, denied that motion in all

material respects and held that NVIDIA may not dispute that the value of the 3dfx transaction was less than $108 million. The Bankruptcy Court denied the

Trustee's request to find that the value of the 3dfx assets conveyed to NVIDIA was at least $108 million.

In early November 2005, after several months of mediation, NVIDIA and the Official Committee of Unsecured Creditors, or the Creditors' Committee,

agreed to a Plan of Liquidation of 3dfx, which included a conditional settlement of the Trustee's claims against us. This conditional settlement was subject to a

confirmation process through a vote of creditors and the review and approval of the Bankruptcy Court. The conditional settlement called for a payment by

NVIDIA of approximately $30.6 million to the 3dfx estate. Under the settlement, $5.6 million related to various administrative expenses and Trustee fees, and

$25.0 million related to the satisfaction of debts and liabilities owed to the general unsecured creditors of 3dfx. Accordingly, during the three month period

ended October 30, 2005, we recorded $5.6 million as a charge to settlement costs and $25.0 million as additional purchase price for 3dfx. The Trustee

advised that he intended to object to the settlement. The conditional settlement never progressed substantially through the confirmation process.

91