NVIDIA 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Tegra 3 is currently available to consumers in the Asus Transformer Prime, with additional products expected throughout calendar year 2012. Tegra 3

phones have been announced by HTC, LG, Fujitsu, ZTE and Tianyu. Tegra 3 tablets have been announced from ASUS, Acer, Fujitsu, Lenovo, Toshiba and

ZTE and we continue to work with a number of other device makers on Tegra 3-powered devices.

In addition, ZTE, the world's fourth-largest cell phone manufacturer, has announced the first phone to use an Icera baseband processor. The ZTE

Mimosa X uses Tegra 2 and the Icera i450 baseband processor to deliver superphone performance to the large and rapidly growing mainstream market in

China.

During the second quarter of fiscal year 2012, we completed the acquisition of Icera, an innovator of baseband processors for 3G and 4G cellular phones

and tablets. Icera's technology uses a custom-built, low-power processor and a software-based baseband which assist manufacturers to develop multiple

products from a common platform, reduce development costs and accelerate time to market. Icera's high-speed wireless modem products have been approved

by more than 50 carriers across the globe. In addition to leveraging on the existing Icera business, the objective of the acquisition is to accelerate and enhance

the combination of our application processor with Icera's baseband processor for use in mobile devices such as smartphone and tablets. Please refer to Note 7

of the Notes to the Consolidated Financial Statements in Part IV, Item 15 of this Form 10-K for additional information regarding this business combination.

Critical Accounting Policies and Estimates

Management’s discussion and analysis of financial condition and results of operations are based upon our consolidated financial statements, which have

been prepared in accordance with U.S. GAAP. The preparation of these financial statements requires us to make estimates and judgments that affect the

reported amounts of assets, liabilities, revenue, cost of revenue, expenses and related disclosure of contingencies. On an on-going basis, we evaluate our

estimates, including those related to revenue recognition, cash equivalents and marketable securities, accounts receivable, inventories, income taxes, goodwill,

stock-based compensation, warranty liabilities, litigation, investigation and settlement costs and other contingencies. We base our estimates on historical

experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making

judgments about the carrying values of assets and liabilities.

We believe the following critical accounting policies affect our significant judgments and estimates used in the preparation of our consolidated financial

statements. Our management has discussed the development and selection of these critical accounting policies and estimates with the Audit Committee of our

Board of Directors, or Board. The Audit Committee has reviewed our disclosures relating to our critical accounting policies and estimates in this Annual

Report on Form 10-K.

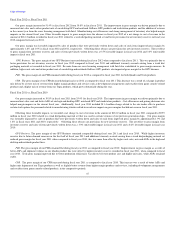

Revenue Recognition

Product Revenue

We recognize revenue from product sales when persuasive evidence of an arrangement exists, the product has been delivered, the price is fixed or

determinable and collection is reasonably assured. For most sales, we use a binding purchase order and in certain cases we use a contractual agreement as

evidence of an arrangement. We consider delivery to occur upon shipment provided title and risk of loss have passed to the customer based on the shipping

terms. At the point of sale, we assess whether the arrangement fee is fixed or determinable and whether collection is reasonably assured. If we determine that

collection of a fee is not reasonably assured, we defer the fee and recognize revenue at the time collection becomes reasonably assured, which is generally

upon receipt of payment.

Our policy on sales to certain distributors, with rights of return, is to defer recognition of revenue and related cost of revenue until the distributors resell

the product, as the level of returns cannot be reasonably estimated.

Our customer programs primarily involve rebates, which are designed to serve as sales incentives to resellers of our products in various target markets.

We accrue for 100% of the potential rebates and do not apply a breakage factor. We recognize a liability for these rebates at the later of the date at which we

record the related revenue or the date at which we offer the rebate. Rebates typically expire six months from the date of the original sale, unless we reasonably

believe that the customer intends to claim the rebate. Unclaimed rebates are reversed to revenue.

Our customer programs also include marketing development funds, or MDFs. We account for MDFs as either a reduction of revenue or an operating

expense, depending on the nature of the program. MDFs represent monies paid to retailers, system builders, original equipment manufacturers, or OEMs,

distributors and add-in card partners that are earmarked for market segment

39