NVIDIA 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

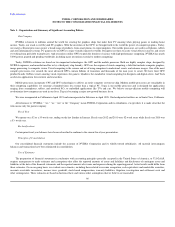

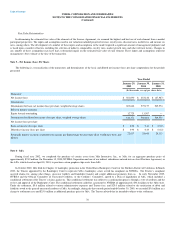

Our calculation of current and deferred tax assets and liabilities is based on certain estimates and judgments and involves dealing with uncertainties in

the application of complex tax laws. Our estimates of current and deferred tax assets and liabilities may change based, in part, on added certainty or finality to

an anticipated outcome, changes in accounting standards or tax laws in the United States, or foreign jurisdictions where we operate, or changes in other facts

or circumstances. In addition, we recognize liabilities for potential United States and foreign income tax contingencies based on our estimate of whether, and

the extent to which, additional taxes may be due. If we determine that payment of these amounts is unnecessary or if the recorded tax liability is less than our

current assessment, we may be required to recognize an income tax benefit or additional income tax expense in our financial statements, accordingly.

As of January 29, 2012, we had a valuation allowance of $212.3 million related to state and certain foreign deferred tax assets that management

determined are not likely to be realized due, in part, to projections of future taxable income and potential utilization limitations of tax attributes acquired as a

result of stock ownership changes. To the extent realization of the deferred tax assets becomes more-likely-than-not, we would recognize such deferred tax

asset as an income tax benefit during the period.

Our deferred tax assets do not include the excess tax benefit related to stock-based compensation that are a component of our federal and state net

operating loss and research tax credit carryforwards in the amount of $526.0 million as of January 29, 2012. Consistent with prior years, the excess tax benefit

reflected in our net operating loss and research tax credit carryforwards will be accounted for as a credit to stockholders' equity, if and when realized. In

determining if and when excess tax benefits have been realized, we have elected to utilize the with-and-without approach with respect to such excess tax

benefits. We have also elected to ignore the indirect tax effects of stock-based compensation deductions for financial and accounting reporting purposes, and

specifically to recognize the full effect of the research tax credit in income from continuing operations.

We recognize the benefit from a tax position only if it is more-likely-than-not that the position would be sustained upon audit based solely on the

technical merits of the tax position. Our policy is to include interest and penalties related to unrecognized tax benefits as a component of income tax expense.

Please refer to Note 15 of these Notes to the Consolidated Financial Statements for additional information.

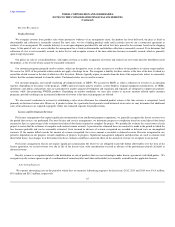

Comprehensive Income (Loss)

Comprehensive income (loss) consists of net income (loss) and other comprehensive income or loss. Other comprehensive income or loss components

include unrealized gains or losses on available-for-sale securities, net of tax.

Net Income (Loss) Per Share

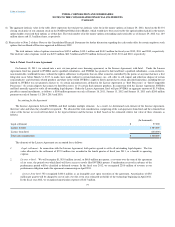

Basic net income (loss) per share is computed using the weighted average number of common shares outstanding during the period. Diluted net income

(loss) per share is computed using the weighted average number of common and potentially dilutive shares outstanding during the period, using the treasury

stock method. Under the treasury stock method, the effect of stock options outstanding is not included in the computation of diluted net income (loss) per

share for periods when their effect is anti-dilutive.

Cash and Cash Equivalents

We consider all highly liquid investments that are readily convertible into cash and have an original maturity of three months or less at the time of

purchase to be cash equivalents. As of January 29, 2012 and January 30, 2011, our cash and cash equivalents were $667.9 million and $665.4 million,

respectively, which include $ 290.7 million and $132.6 million invested in money market funds for fiscal year 2012 and fiscal year 2011, respectively.

Marketable Securities

Marketable securities consist primarily of highly liquid investments with maturities of greater than three months when purchased. We generally classify

our marketable securities at the date of acquisition as available-for-sale. These securities are reported at fair value with the related unrealized gains and losses

included in accumulated other comprehensive income (loss), a component of stockholders’ equity, net of tax. Any unrealized losses which are considered to

be other-than-temporary impairments are recorded in the other income (expense) section of our consolidated statements of operations. Realized gains (losses)

on the sale of marketable securities are determined using the specific-identification method and recorded in the other income (expense) section of our

consolidated statements of operations.

69