NVIDIA 2012 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Legal and regulatory requirements differ among jurisdictions worldwide. Violations of these laws and regulations could result in fines; criminal

sanctions against us, our officers, or our employees; prohibitions on the conduct of our business; and damage to our reputation. Although we have policies,

controls, and procedures designed to ensure compliance with foreign laws, many of these laws and regulations are ambiguous and are often interpreted and

enforced in unpredictable ways.

The economic conditions in our primary overseas markets, particularly in Asia, may negatively impact the demand for our products abroad. All of our

international sales to date have been denominated in United States dollars. Accordingly, an increase in the value of the United States dollar relative to foreign

currencies could make our products less competitive in international markets or require us to assume the risk of denominating certain sales in foreign

currencies. We anticipate that these factors will impact our business to a greater degree as we further expand our international business activities.

Our investment portfolio may become impaired by deterioration of the capital markets.

Our cash equivalent and short-term investment portfolio as of January 29, 2012 consisted of cash and cash equivalents, commercial paper, mortgage-

backed securities issued by Government-sponsored enterprises, money market funds and debt securities of corporations, municipalities and the United

States government and its agencies. We follow an established investment policy and set of guidelines, designed to preserve principal, minimize risk, monitor

and help mitigate our exposure to interest rate and credit risk. The policy sets forth credit quality standards and limits our exposure to any one issuer, as well

as our maximum exposure to various asset classes, variety of financial instruments, consisting principally of cash and cash equivalents, commercial paper,

mortgage-backed securities issued by Government-sponsored enterprises, money market funds and debt securities of corporations, municipalities and the

United States government and its agencies.

Should financial market conditions worsen in the future, investments in some financial instruments may pose risks arising from market liquidity and

credit concerns. In addition, any deterioration of the capital markets could cause our other income and expense to vary from expectations. As of

January 29, 2012 we had no material impairment charges associated with our short-term investment portfolio, and although we believe our current investment

portfolio has very little risk of material impairment, we cannot predict future market conditions or market liquidity, or credit availability, and can provide no

assurance that our investment portfolio will remain materially unimpaired.

Risks Related to Regulatory, Legal, Our Common Stock and Other Matters

We are subject to litigation arising from alleged defects in our previous generation MCP and GPU products which, if determined adversely to us, could

harm our business.

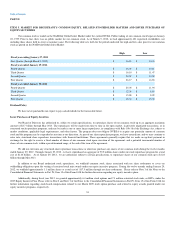

As of January 29, 2012, we recorded a total cumulative net warranty charge of $475.9 million, of which $466.4 million has been charged against cost of

revenue, to cover anticipated customer warranty, repair, return, replacement and other costs arising from a weak die/packaging material set used in certain

versions of our previous generation MCP and GPU products shipped after July 2008 and used in notebook configuration. The previous generation MCP and

GPU products that are impacted were included in a number of notebook products that were shipped and sold in significant quantities. Certain notebook

configurations of these MCP and GPU products are failing in the field at higher than normal rates. Testing suggests a weak material set of die/package

combination, system thermal management designs, and customer use patterns are contributing factors for these failures. We have worked with our customers

to develop and have made available for download a software driver to cause the system fan to begin operation at the powering up of the system and reduce the

thermal stress on these chips. We have also recommended to our customers that they consider changing the thermal management of the products in their

notebook system designs. Although we believe this issue has been nearly fully remediated, we remain committed to fully support our customers in their repair

and replacement of these impacted products that fail, and their other efforts to mitigate the consequences of these failures.

We continue to not see any abnormal failure rates in any systems using NVIDIA products other than certain notebook configurations. However, we are

continuing to test and otherwise investigate other products. There can be no assurance that we will not discover defects in other products.

In September, October and November 2008, several putative securities class action lawsuits were filed against us, asserting various claims related to the

impacted MCP and GPU products. Such lawsuits could result in the diversion of management's time and attention away from business operations, which

could harm our business. In addition, the costs of defense and any damages resulting from this litigation, a ruling against us, or a settlement of the litigation

could adversely affect our cash flow and financial results.

23