NVIDIA 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

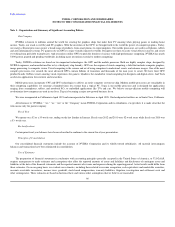

Adoption of New and Recently Issued Accounting Pronouncements

In September 2011, the Financial Accounting Standards Board, or FASB issued amended guidance to simplify how entities test goodwill for impairment.

The amended guidance permits an assessment of qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit in

which goodwill resides is less than its carrying value. For reporting units in which this assessment concludes it is more likely than not that the fair value is

more than its carrying value, the amended guidance eliminates the requirement to perform further goodwill impairment testing as outlined in the previously

issued standards. The updated guidance is elective for annual and interim impairment tests performed beginning with our fiscal year 2013 and early adoption

is permitted. We elected to early adopt the new guidance during the fourth quarter of fiscal year 2012 and it did not impact the results of our consolidated

financial statements.

In June 2011, the FASB issued guidance regarding the presentation of comprehensive income. The new standard requires the presentation of

comprehensive income, the components of net income and the components of other comprehensive income either in a single continuous statement of

comprehensive income or in two separate but consecutive statements. In December 2011, the FASB further amended this guidance and deferred the

requirement to separately present within net income reclassification adjustments of items out of accumulated other comprehensive income. The updated

guidance is effective on a retrospective basis for financial statements issued for fiscal years, and interim periods within those fiscal years, beginning after

December 15, 2011. The adoption of this guidance will not have a material impact on our consolidated financial statements.

In May 2011, the FASB issued additional guidance on fair value measurements that clarifies the application of existing guidance and disclosure

requirements, changes certain fair value measurement principles and requires additional disclosures about fair value measurements. The updated guidance is

effective on a prospective basis for financial statements issued for fiscal years, and interim periods within those fiscal years, beginning after December 15,

2011. The adoption of this guidance will not have a material impact on our consolidated financial statements.

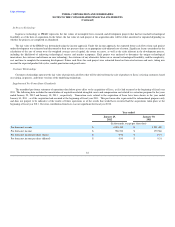

Note 2 – Stock Option Purchase

During the three months ended April 26, 2009, we completed a cash tender offer for certain employee stock options. The tender offer applied to

outstanding stock options held by employees with an exercise price equal to or greater than $17.50 per share. None of the non-employee members of our

Board of Directors or our officers who file reports under Section 16(a) of the Securities Exchange Act of 1934, as amended, or the Securities Exchange Act,

were eligible to participate in the tender offer. All eligible options with exercise prices equal to or greater than $17.50 per share but less than $28.00 per share

were eligible to receive a cash payment of $3.00 per option in exchange for the cancellation of the eligible option. All eligible options with exercise prices

equal to or greater than $28.00 per share were eligible to receive a cash payment of $2.00 per option in exchange for the cancellation of the eligible option.

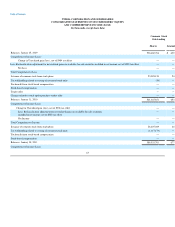

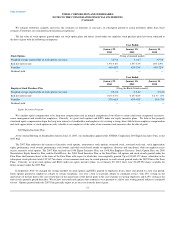

Our consolidated statement of operations for fiscal year 2010 includes stock-based compensation charges related to the stock option purchase (in

thousands):

Cost of revenue $ 11,412

Research and development 90,456

Sales, general and administrative 38,373

Total $ 140,241

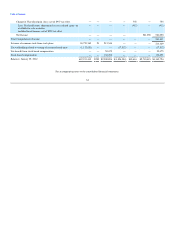

A total of 28.5 million options were tendered under the offer for an aggregate cash purchase price of 78.1 million, which was paid in exchange for the

cancellation of the eligible options. As a result of the tender offer, we incurred a charge of $140.2 million consisting of $124.1 million related to the remaining

unamortized stock based compensation expense associated with the unvested portion of the options tendered in the offer, $11.6 million related to stock-based

compensation expense resulting from amounts paid in excess of the fair value of the underlying options, plus $4.5 million related to associated payroll taxes,

professional fees and other costs.

72