NVIDIA 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

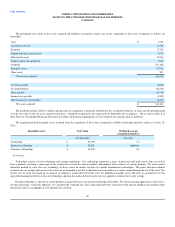

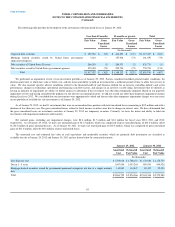

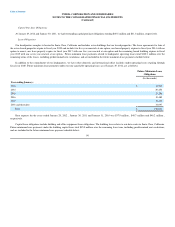

As of January 29, 2012, we recorded a total cumulative net charge of $475.9 million, of which $466.4 million has been charged against cost of revenue

and the remainder has been charged to sales, general and administrative to cover customer warranty, repair, return, replacement and other costs arising from a

weak die/packaging material set in certain versions of our previous generation MCP and GPU products used in notebook configurations. Included in the

charge are the costs of implementing a settlement with the plaintiffs of a putative consumer class action lawsuit related to this same matter and other related

estimated consumer class action settlements.

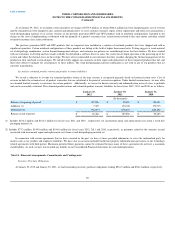

The previous generation MCP and GPU products that are impacted were included in a number of notebook products that were shipped and sold in

significant quantities. Certain notebook configurations of these products are failing in the field at higher than normal rates. Testing suggests a weak material

set of die/package combination, system thermal management designs, and customer use patterns are contributing factors for these failures. We have worked

with our customers to develop and have made available for download a software driver to cause the system fan to begin operation at the powering up of the

system and reduce the thermal stress on these chips. We have also recommended to our customers that they consider changing the thermal management of the

products in their notebook system designs. We intend to fully support our customers in their repair and replacement of these impacted products that fail, and

their other efforts to mitigate the consequences of these failures. The weak die/packaging material combination is not used in any of our products that are

currently in production.

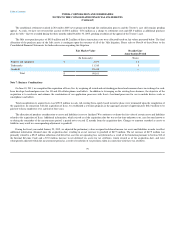

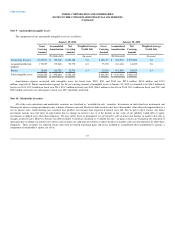

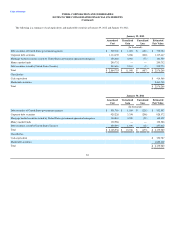

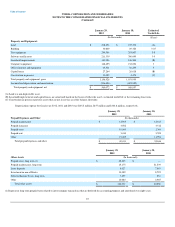

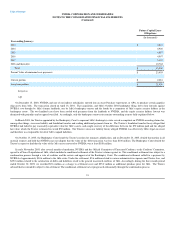

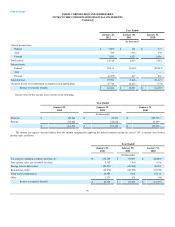

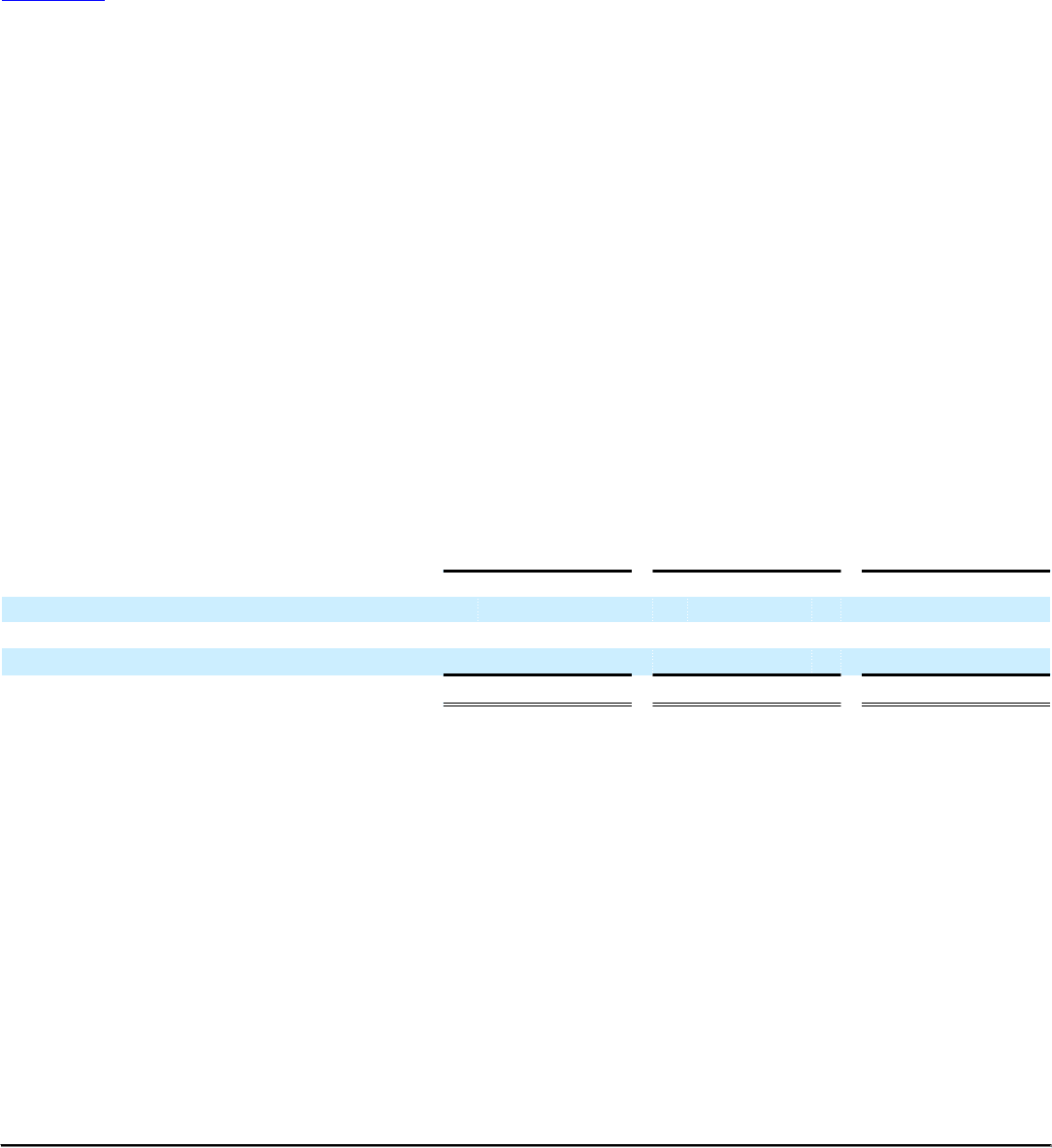

Accrual for estimated product returns and product warranty liabilities

We record a reduction to revenue for estimated product returns at the time revenue is recognized primarily based on historical return rates. Cost of

revenue includes the estimated cost of product warranties that are calculated at the point of revenue recognition. Under limited circumstances, we may offer

an extended limited warranty to customers for certain products. Additionally, we accrue for known warranty and indemnification issues if a loss is probable

and can be reasonably estimated. The estimated product returns and estimated product warranty liabilities for fiscal years 2012 , 2011 and 2010 are as follows:

January 29,

2012 January 30,

2011 January 31,

2010

(In thousands)

Balance at beginning of period $ 107,896 $ 92,655 $ 150,631

Additions (1) 7,329 194,108 170,715

Deductions (2) (96,819) (178,867) (228,691)

Balance at end of period $ 18,406 $ 107,896 $ 92,655

(1) Includes $186.2 million and $164.5 million for fiscal years 2011 and 2010 , respectively, for incremental repair and replacement costs from a weak die/

packaging material set.

(2) Includes $73.3 million, $149.8 million and $196.0 million for fiscal years 2012, 2011 and 2010, respectively, in payments related to the warranty accrual

associated with incremental repair and replacement costs from a weak die/packaging material set.

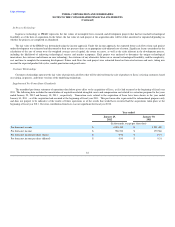

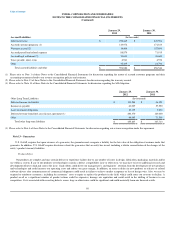

In connection with certain agreements that we have executed in the past, we have at times provided indemnities to cover the indemnified party for

matters such as tax, product and employee liabilities. We have also on occasion included intellectual property indemnification provisions in our technology

related agreements with third parties. Maximum potential future payments cannot be estimated because many of these agreements do not have a maximum

stated liability. As such, we have not recorded any liability in our Consolidated Financial Statements for such indemnifications.

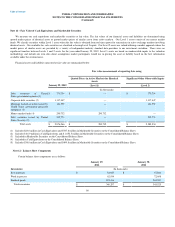

Note 14 - Financial Arrangements, Commitments and Contingencies

Inventory Purchase Obligations

At January 29, 2012 and January 30, 2011, we had outstanding inventory purchase obligations totaling $561.3 million and $546.4 million, respectively.

89