NVIDIA 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

With respect to RSUs, subject to certain exceptions, RSUs granted to employees vest over a four year period, subject to continued service, with 25%

vesting on a pre-determined date that is close to the anniversary of the date of grant and 12.5% vesting semi-annually thereafter until fully vested. We do have

unvested RSUs that continue to vest pursuant to a three vesting period, subject to continued service.

Unless terminated sooner, the 2007 Plan is scheduled to terminate on April 23, 2017. Our Board may suspend or terminate the 2007 Plan at any time. No

awards may be granted under the 2007 Plan while the 2007 Plan is suspended or after it is terminated. The Board may also amend the 2007 Plan at any time.

However, if legal, regulatory or listing requirements require stockholder approval, the amendment will not go into effect until the stockholders have approved

the amendment.

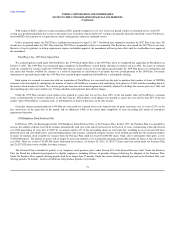

PortalPlayer, Inc. 1999 Stock Option Plan

We assumed options issued under the PortalPlayer, Inc. 1999 Stock Option Plan, or the 1999 Plan, when we completed our acquisition of PortalPlayer on

January 5, 2007. The 1999 Plan was terminated upon completion of PortalPlayer’s initial public offering of common stock in 2004. No shares of common

stock are available for issuance under the 1999 Plan other than to satisfy exercises of stock options granted under the 1999 Plan prior to its termination and

any shares that become available for issuance as a result of expiration or cancellation of an option that was issued pursuant to the 1999 Plan. Previously

authorized yet unissued shares under the 1999 Plan were cancelled upon completion of PortalPlayer’s initial public offering.

Each option we assumed in connection with our acquisition of PortalPlayer was converted into the right to purchase that number of shares of NVIDIA

common stock determined by multiplying the number of shares of PortalPlayer common stock underlying such option by 0.3601 and then rounding down to

the nearest whole number of shares. The exercise price per share for each assumed option was similarly adjusted by dividing the exercise price by 0.3601 and

then rounding up to the nearest whole cent. Vesting schedules and expiration dates did not change.

Under the 1999 Plan, incentive stock options were granted at a price that was not less than 100% of the fair market value of PortalPlayer’s common

stock, as determined by its board of directors, on the date of grant. Non-statutory stock options were granted at a price that was not less than 85% of the fair

market value of PortalPlayer’s common stock, as determined by its board of directors, on the date of grant.

Generally, options granted under the 1999 Plan are exercisable for a period of ten years from the date of grant, and shares vest at a rate of 25% on the

first anniversary of the grant date of the option, and an additional 1/48th of the shares upon completion of each succeeding full month of continuous

employment thereafter.

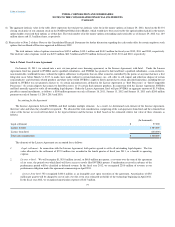

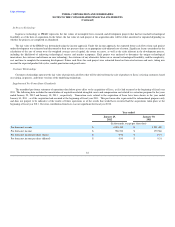

1998 Employee Stock Purchase Plan

In February 1998, our Board approved the 1998 Employee Stock Purchase Plan, or the Purchase Plan. In June 1999, the Purchase Plan was amended to

increase the number of shares reserved for issuance automatically each year at the end of our fiscal year for the next 10 years (commencing at the end of fiscal

year 2000 and ending 10 years later in 2009) by an amount equal to 2% of the outstanding shares on each such date, including on an as-if-converted basis

preferred stock and convertible notes, and outstanding options and warrants, calculated using the treasury stock method; provided that the maximum number

of shares of common stock available for issuance from the Purchase Plan could not exceed 52,000,000 shares which, due to subsequent stock-splits, is now

78,000,0000 shares. The number of shares will no longer be increased annually as we reached the maximum permissible number of shares at the end of fiscal

year 2006. There are a total of 78,000,000 shares authorized for issuance. At January 29, 2012, 51,792,571 shares had been issued under the Purchase Plan

and 26,207,429 shares were available for future issuance.

The Purchase Plan is intended to qualify as an “employee stock purchase plan” under Section 423 of the Internal Revenue Code. Under the Purchase

Plan, the Board has authorized participation by eligible employees, including officers, in periodic offerings following the adoption of the Purchase Plan.

Under the Purchase Plan, separate offering periods shall be no longer than 27 months. Under the current offering adopted pursuant to the Purchase Plan, each

offering period is 24 months , which is divided into four purchase periods of six months .

75