NVIDIA 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Our next annual evaluation of the goodwill by reporting unit will be performed during the fourth quarter of fiscal year 2013. If we were to encounter

challenging economic conditions, such as a decline in our operating results, an unfavorable industry or macroeconomic environment, a substantial decline in

our stock price, or any other adverse change in market conditions, we may be required to perform the two-step quantitative goodwill impairment analysis. In

addition, if such conditions have the effect of changing one of the critical assumptions or estimates we use to calculate the value of our goodwill, we may be

required to record goodwill impairment charges in future periods, whether in connection with our next annual impairment assessment or prior to that, if any

triggering event occurs outside of the quarter during which the annual goodwill impairment assessment is performed. It is not possible at this time to

determine if any such future impairment charge would result or, if it does, whether such charge would be material to our results of operations.

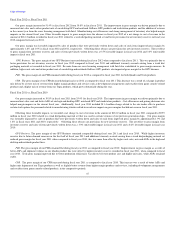

Quantitative Assessment

We utilized a quantitative assessment to test goodwill impairment for one reporting unit during the fourth quarter of fiscal year 2012 and concluded that

there was no impairment as the fair value of our reporting unit exceeded its carrying value by approximately 30%. This assessment was based upon a

discounted cash flow analysis and an analysis of market comparables.

Our estimates of cash flow were based upon, among other things, certain assumptions about expected future operating performance, such as revenue

growth rates, operating margins, risk-adjusted discount rates, and future economic and market conditions. Our estimates of discounted cash flow may differ

from actual cash flow due to, among other things, economic conditions, changes to our business model or changes in operating performance. Additionally,

certain estimates of discounted cash flow involve businesses with limited financial history and developing revenue models, which increases the risk of

differences between the projected and actual performance. The long-term financial forecasts that we utilize represent the best estimate that we have at this

time and we believe that its underlying assumptions are reasonable. Significant differences between our estimates and actual cash flow could materially affect

our future financial results, which could impact our future estimates of the fair value of our reporting unit. Determining the fair value of our reporting unit

also requires us to use judgment in the selection of appropriate market comparables.

Any significant reductions in the actual amount of cash flows realized by our reporting unit, reductions in the value of market comparables, or reductions

in our market capitalization could impact future estimates of the fair value of our reporting unit. Such events could ultimately result in a charge to our earnings

in future periods due to the potential for a write-down of the goodwill associated with our reporting unit.

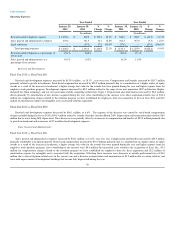

Cash Equivalents and Marketable Securities

Cash equivalents consist of financial instruments which are readily convertible into cash and have original maturities of three months or less at the time

of acquisition. Marketable securities consist primarily of highly liquid investments with maturities of greater than three months when purchased. We

generally classify our marketable securities at the date of acquisition as available- for- sale. These securities are reported at fair value with the related

unrealized gains and losses included in accumulated other comprehensive income (loss), a component of stockholder’s equity, net of tax. Any unrealized

losses which are considered to be other-than-temporary impairments are recorded in the other income (expense) section of our consolidated statements of

operations. Realized gains (losses) on the sale of marketable securities are determined using the specific-identification method and recorded in the other

income (expense) section of our consolidated statements of operations. Please refer to Note 10 of the Notes to the Consolidated Financial Statements in

Part IV, Item 15 of this Form 10-K. We measure our cash equivalents and marketable securities at fair value. The fair values of our financial assets and

liabilities are determined using quoted market prices of identical assets or quoted market prices of similar assets from active markets. Our Level 1 assets

consist of our money market funds. We classify securities within Level 1 assets when the fair value is obtained from real time quotes for transactions in active

exchange markets involving identical assets. Our available-for- sale securities are classified as having Level 2 inputs. Our Level 2 assets are valued utilizing

a market approach where the market prices of similar assets are provided by a variety of independent industry standard data providers to our investment

custodian. Most of our cash equivalents and marketable securities are valued based on Level 2 inputs. We do not have any investment classified as Level 3

as of January 29, 2012.

All of our available-for-sale investments are subject to a periodic impairment review. We record a charge to earnings when a decline in fair value is

significantly below cost basis and judged to be other-than-temporary, or have other indicators of impairments. If the fair value of an available-for-sale debt

instrument is less than its amortized cost basis, an other-than - temporary impairment is triggered in circumstances where (1) we intend to sell the instrument,

(2) it is more likely than not that we will be required to sell the instrument before recovery of its amortized cost basis, or (3) a credit loss exists where we do

not expect to recover the entire amortized cost basis of the instrument. If we intend to sell or it is more likely than not that we will be required to sell the

available-for-sale debt instrument before recovery of its amortized cost basis, we recognize an other-than- temporary impairment in earnings equal to the

entire difference between the debt instruments’ amortized cost basis and its fair value. For

43