NVIDIA 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

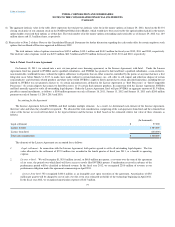

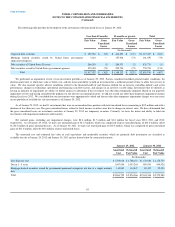

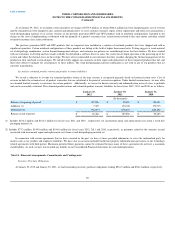

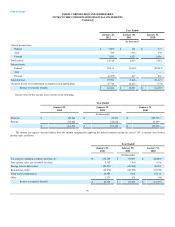

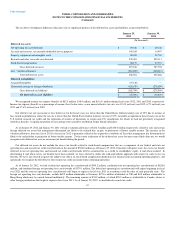

January 29,

2012 January 30,

2011 Estimated

Useful Life

(In thousands) (Years)

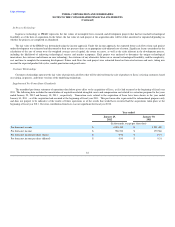

Property and Equipment:

Land $ 218,496 $ 217,372 (A)

Building 30,869 29,326 3-25

Test equipment 299,506 293,807 3-5

Software and licenses 211,339 306,699 3-5

Leasehold improvements 143,986 146,508 (B)

Computer equipment 168,455 132,896 3

Office furniture and equipment 45,521 36,239 5

Capital leases 27,264 26,618 (B)

Construction in process 11,092 4,474 (C)

Total property and equipment, gross 1,156,528 1,193,939

Accumulated depreciation and amortization (596,456) (625,082)

Total property and equipment, net $ 560,072 $ 568,857

(A) Land is a non-depreciable asset.

(B) Leasehold improvements and capital leases are amortized based on the lesser of either the asset’s estimated useful life or the remaining lease term.

(C) Construction in process represents assets that are not in service as of the balance sheet date.

Depreciation expense for fiscal years 2012, 2011 and 2010 was $145.2 million, $157 million and $164.8 million, respectively.

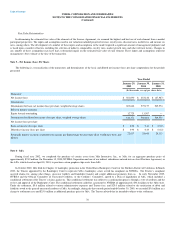

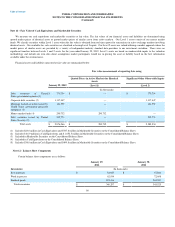

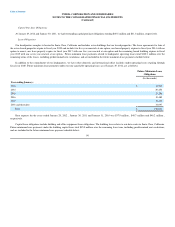

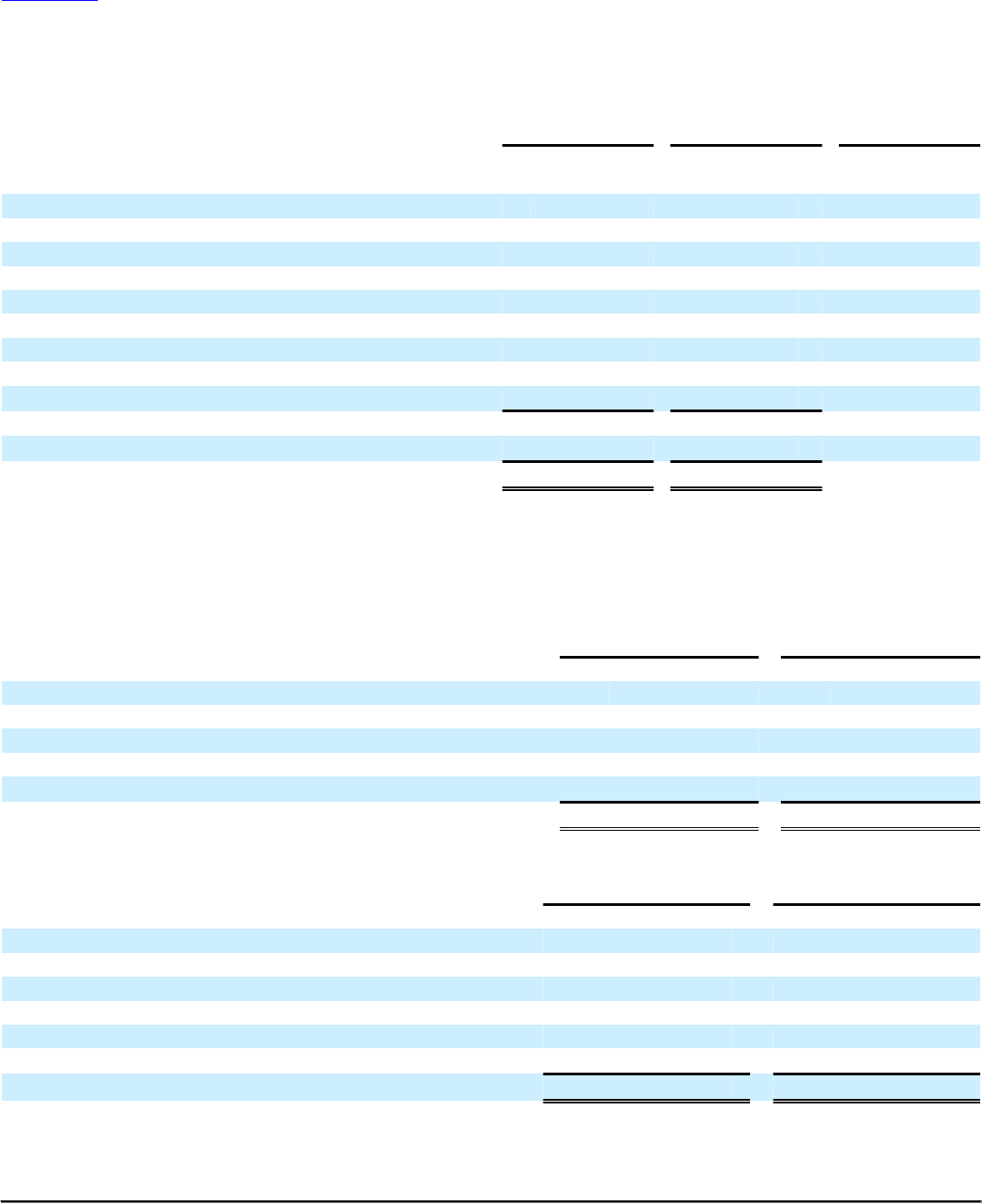

January 29,

2012 January 30,

2011

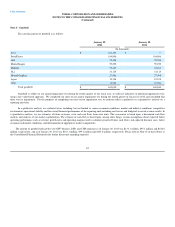

Prepaid Expenses and Other (In thousands)

Prepaid maintenance $ 12,965 $ 12,165

Prepaid insurance 3,502 3,512

Prepaid taxes 10,069 1,364

Prepaid rent 3,410 3,599

Other 19,465 11,996

Total prepaid expenses and other $ 49,411 $ 32,636

January 29,

2012 January 30,

2011

Other Assets (In thousands)

Prepaid taxes, long term (1) $ 68,805 $ —

Prepaid maintenance, long term 15,175 21,239

Lease deposits 8,027 7,003

Investment in non-affiliates 10,382 8,792

Deferred Income Taxes, long term 7,459 851

Other 10,484 2,965

Total other assets $ 120,332 $ 40,850

(1) Represents long-term prepaid taxes related to inter-company transactions that are deferred for accounting purposes and amortized over eight years.

87