NVIDIA 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In addition, litigation has often been brought against a company in connection with the announcement of a government investigation or inquiry from a

regulatory agency. Such lawsuits could result in the diversion of management's time and attention away from business operations, which could harm our

business. In addition, the costs of defense and any damages resulting from litigation, a ruling against us, or a settlement of the litigation could adversely affect

our cash flow and financial results.

We are subject to the risks of owning real property.

During fiscal year 2009, we purchased real property in Santa Clara, California that includes approximately 25 acres of land and ten commercial

buildings. We also own real property in China and India. We have limited experience in the ownership and management of real property and are subject to

the risks of owning real property, including:

• the possibility of environmental contamination and the costs associated with mitigating any environmental problems;

• adverse changes in the value of these properties, due to interest rate changes, changes in the market in which the property is located, or other

factors;

• the risk of loss if we decide to sell and are not able to recover all capitalized costs;

• increased cash commitments for the possible construction of a campus;

• the possible need for structural improvements in order to comply with zoning, seismic and other legal or regulatory requirements;

• increased operating expenses for the buildings or the property or both;

• possible disputes with third parties, such as neighboring owners or others, related to the buildings or the property or both; and

• the risk of financial loss in excess of amounts covered by insurance, or uninsured risks, such as the loss caused by damage to the buildings as a

result of earthquakes, floods and or other natural disasters.

Expensing employee equity compensation adversely affects our operating results and could also adversely affect our competitive position.

Since inception, we have used equity through our equity incentive plans and our employee stock purchase program as a fundamental component of our

compensation packages. We believe that these programs directly motivate our employees and, through the use of vesting, encourage our employees to remain

with us.

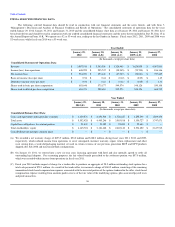

We record compensation expense for stock options, restricted stock units and our employee stock purchase plan using the fair value of those awards in

accordance with generally accepted accounting principles in United States of America, or U.S. GAAP. Stock-based compensation expense was $136.4

million, $100.4 million and $107.1 million for fiscal years 2012, 2011 and 2010, respectively, related to on-going vesting of equity awards, which negatively

impacted our operating results.

To the extent that expensing employee equity compensation makes it more expensive to grant stock options and restricted stock units or to continue to

have an employee stock purchase program, we may decide to incur increased cash compensation costs. In addition, actions that we may take to reduce stock-

based compensation expense that may be more severe than any actions our competitors may implement and may make it difficult to attract retain and motivate

employees, which could adversely affect our competitive position as well as our business and operating results.

We may be required to record a charge to earnings if our goodwill or amortizable intangible assets become impaired, which could negatively impact our

operating results.

Under U.S. GAAP, we review our amortizable intangible assets and goodwill for impairment when events or changes in circumstances indicate the

carrying value may not be recoverable. Goodwill is tested for impairment at least annually. The carrying value of our goodwill or amortizable assets from

acquisitions may not be recoverable due to factors such as a decline in stock price and market capitalization, reduced estimates of future cash flows and

slower growth rates in our industry or in any of our business units. Estimates of future cash flows are based on an updated long-term financial outlook of our

operations. However, actual performance in the near-term or long-term could be materially different from these forecasts, which could impact future

estimates. For example, if one of our business units does not meet its near-term and longer-term forecasts, the goodwill assigned to the business unit could be

impaired. We may be required to record a charge to earnings in our financial statements during a period in which an impairment of our goodwill or

amortizable intangible assets is determined to exist, which may negatively impact our results of operations.

26