NVIDIA 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

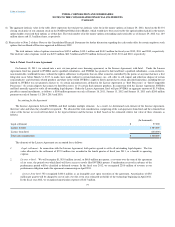

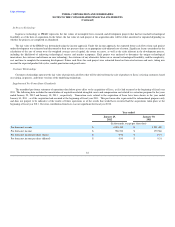

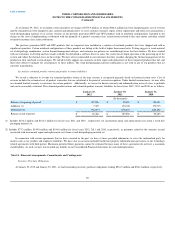

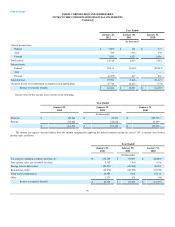

Note 11 – Fair Value of Cash Equivalents and Marketable Securities

We measure our cash equivalents and marketable securities at fair value. The fair values of our financial assets and liabilities are determined using

quoted market prices of identical assets or quoted market prices of similar assets from active markets. Our Level 1 assets consist of our money market

funds. We classify securities within Level 1 assets when the fair value is obtained from real time quotes for transactions in active exchange markets involving

identical assets. Our available-for- sale securities are classified as having Level 2 inputs. Our Level 2 assets are valued utilizing a market approach where the

market prices of similar assets are provided by a variety of independent industry standard data providers to our investment custodian. There were no

significant transfers between Levels 1 and 2 assets for the year ended January 29, 2012. Level 3 assets are based on unobservable inputs to the valuation

methodology and include our own data about assumptions market participants would use in pricing the asset or liability based on the best information

available under the circumstances.

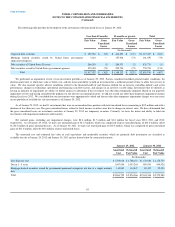

Financial assets and liabilities measured at fair value are summarized below:

Fair value measurement at reporting date using

Quoted Prices in Active Markets for Identical

Assets Significant Other Observable Inputs

January 29, 2012 (Level 1) (Level 2)

(In thousands)

Debt securities of United

States government agencies (1) $ 770,754 $ — $ 770,754

Corporate debt securities (2) 1,117,447 — 1,117,447

Mortgage backed securities issued by

United States government-sponsored

enterprises (3)

161,559 — 161,559

Money market funds (4) 290,732 290,732 —

Debt securities issued by United

States Treasury (5) 535,774 — 535,774

Total assets $ 2,876,266 $ 290,732 $ 2,585,534

(1) Includes $23.0 million in Cash Equivalents and $747.8 million in Marketable Securities on the Consolidated Balance Sheet.

(2) Includes $ 64.9 million in Cash Equivalents and $ 1,052.5 million in Marketable Securities on the Consolidated Balance Sheet.

(3) Included in Marketable Securities on the Consolidated Balance Sheet.

(4) Included in Cash Equivalents on the Consolidated Balance Sheet.

(5) Includes $36.0 million in Cash Equivalents and $499.8 million in Marketable Securities on the Consolidated Balance Sheet.

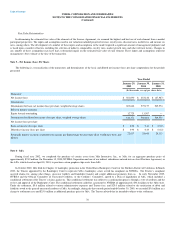

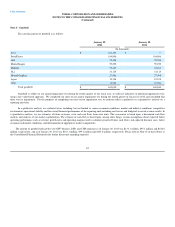

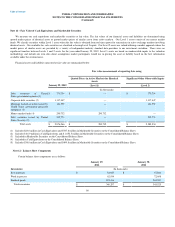

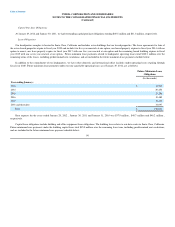

Note 12 - Balance Sheet Components

Certain balance sheet components are as follows:

January 29,

2012 January 30,

2011

Inventories: (In thousands)

Raw materials $ 84,927 $ 67,880

Work in-process 62,934 72,698

Finished goods 192,436 204,947

Total inventories $ 340,297 $ 345,525

86