NVIDIA 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

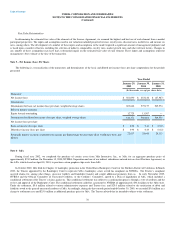

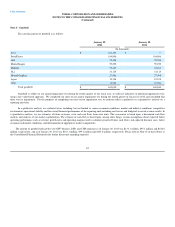

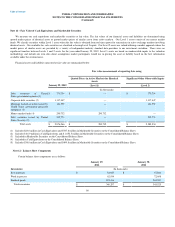

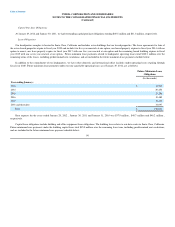

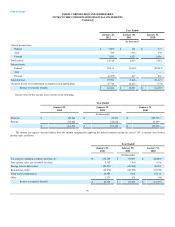

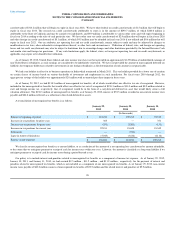

January 29,

2012 January 30,

2011

Accrued Liabilities: (In thousands)

Deferred revenue $ 270,649 $ 245,596

Accrued customer programs (1) 143,972 171,163

Warranty accrual (2) 18,406 107,896

Accrued payroll and related expenses 88,879 71,915

Accrued legal settlement (3) 30,600 30,600

Taxes payable, short- term 6,941 4,576

Other 35,439 24,798

Total accrued liabilities and other $ 594,886 $ 656,544

(1) Please refer to Note 1 of these Notes to the Consolidated Financial Statements for discussion regarding the nature of accrued customer programs and their

accounting treatment related to our revenue recognition policies and estimates.

(2) Please refer to Note 13 of these Notes to the Consolidated Financial Statements for discussion regarding the warranty accrual.

(3) Please refer to Note 14 of these Notes to the Consolidated Financial Statements for discussion regarding the 3dfx litigation.

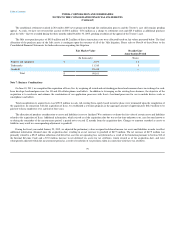

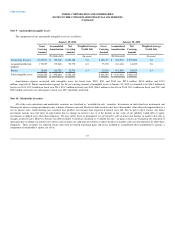

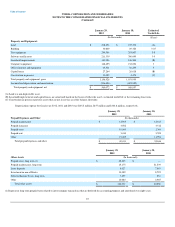

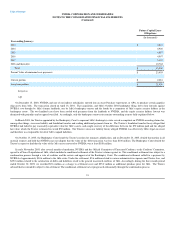

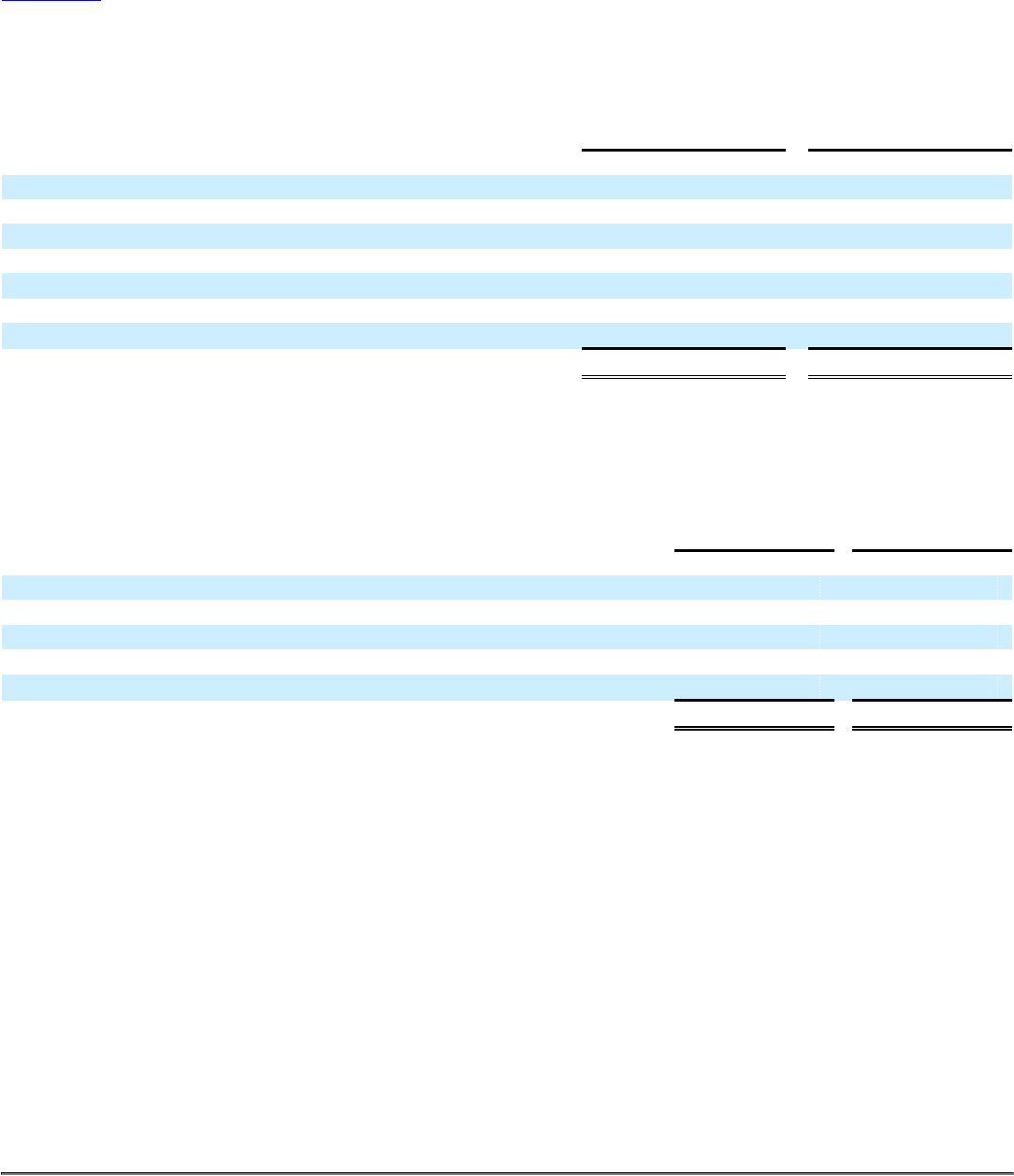

January 29,

2012 January 30,

2011

Other Long Term Liabilities: (In thousands)

Deferred income tax liability $ 133,288 $ 46,129

Income tax payable 63,007 57,590

Asset retirement obligations 10,199 9,694

Deferred revenue from Intel cross license agreement (1) 200,370 163,000

Other 48,943 71,300

Total other long-term liabilities $ 455,807 $ 347,713

(1) Please refer to Note 4 of these Notes to the Consolidated Financial Statements for discussion regarding our revenue recognition under this agreement.

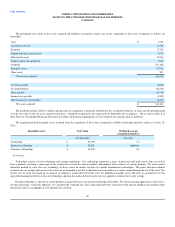

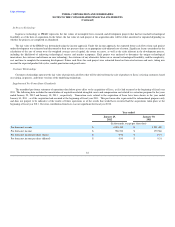

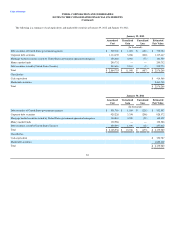

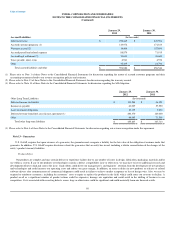

Note 13 - Guarantees

U.S. GAAP, requires that upon issuance of a guarantee, the guarantor must recognize a liability for the fair value of the obligation it assumes under that

guarantee. In addition, U.S. GAAP requires disclosures about the guarantees that an entity has issued, including a tabular reconciliation of the changes of the

entity’s product warranty liabilities.

Product Defect

Our products are complex and may contain defects or experience failures due to any number of issues in design, fabrication, packaging, materials and/or

use within a system. If any of our products or technologies contains a defect, compatibility issue or other error, we may have to invest additional research and

development efforts to find and correct the issue. Such efforts could divert our management’s and engineers’ attention from the development of new products

and technologies and could increase our operating costs and reduce our gross margin. In addition, an error or defect in new products or releases or related

software drivers after commencement of commercial shipments could result in failure to achieve market acceptance or loss of design wins. Also, we may be

required to reimburse customers, including for customers’ costs to repair or replace the products in the field, which could cause our revenue to decline. A

product recall or a significant number of product returns could be expensive, damage our reputation and could result in the shifting of business to our

competitors. Costs associated with correcting defects, errors, bugs or other issues could be significant and could materially harm our financial results.

88