NVIDIA 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

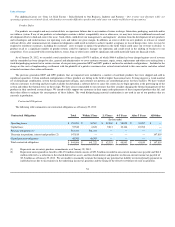

enterprises represented approximately 51% of our total investment portfolio, while the financial sector accounted for approximately 24% of our total

investment portfolio. All of our investments are with A/A2 or better rated securities.

We performed an impairment review of our investment portfolio as of January 29, 2012. Based on our quarterly impairment review, we concluded that

our investments were appropriately valued and did not record any impairment during fiscal year 2012. In the fourth quarter of fiscal year 2011 we recovered

$3.1 million of the other than temporary impairment charge previously recorded. This was recorded as other income in fiscal year 2011.

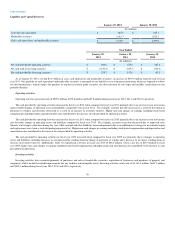

Net realized gains, excluding any impairment charges, were $ 0.4 million, $ 1.5 million and $ 1.8 million for fiscal years 2012, 2011 and 2010

respectively. As of January 29, 2012, we had a net unrealized gain of $ 11.5 million, which was comprised of gross unrealized gains of $ 12.0 million, offset

by $ 0.5 million of gross unrealized losses. As of January 30, 2011, we had a net unrealized gain of $ 10.5 million, which was comprised of gross unrealized

gains of $11.0 million, offset by $ 0.5 million of gross unrealized losses.

Our accounts receivable are highly concentrated and make us vulnerable to adverse changes in our customers’ businesses, and to downturns in the

industry and the worldwide economy. Two customers accounted for approximately 27% of our accounts receivable balance at January 29, 2012. While we

strive to limit our exposure to uncollectible accounts receivable using a combination of credit insurance and letters of credit, difficulties in collecting accounts

receivable could materially and adversely affect our financial condition and results of operations. These difficulties are heightened during periods when

economic conditions worsen. We continue to work directly with more foreign customers and it may be difficult to collect accounts receivable from them. We

maintain an allowance for doubtful accounts for estimated losses resulting from the inability of our customers to make required payments. This allowance

consists of an amount identified for specific customers and an amount based on overall estimated exposure. If the financial condition of our customers were to

deteriorate, resulting in an impairment in their ability to make payments, additional allowances may be required, we may be required to defer revenue

recognition on sales to affected customers, and we may be required to pay higher credit insurance premiums, any of which could adversely affect our

operating results. In the future, we may have to record additional reserves or write-offs and/or defer revenue on certain sales transactions which could

negatively impact our financial results.

Our cash balances are held in numerous locations throughout the world, including substantial amounts held outside of the United States. As of January

29, 2012, we had cash, cash equivalents and marketable securities of $1.23 billion held within the United States and $1.90 billion held outside of the United

States. Most of the amounts held outside the United States may be repatriated to the United States but, under current law, would be subject to U.S. federal

income taxes, less applicable foreign tax credits. Further, repatriation of some foreign balances may be restricted by local laws. As of January 29, 2012, we

have not provided for U.S. federal and state income taxes on approximately $1.29 billion of undistributed earnings of non-United States subsidiaries, as such

earnings are considered indefinitely reinvested outside the United States. Although we have no current need to do so, if we repatriate foreign earnings for

cash requirements in the United States, we would incur U.S. federal and state income tax, less applicable foreign tax credits, and reduced by the current

amount of our U.S. federal and state net operating loss and other tax credit carryforwards. Further, in addition to the $1.23 billion of cash, cash equivalents

and marketable securities held within the United States and available to fund our U.S. operations and any other U.S. cash needs, we have access to external

sources of financing if cash is needed in the United States other than by repatriation of foreign earnings where U.S. income tax may otherwise be due.

Accordingly, we do not reasonably expect any material impact on our business, as a whole, or to our financial flexibility with respect to our current cash

balances held outside of the United States.

Patent Cross License Agreement

On January 10, 2011, we entered into a new six-year patent cross licensing agreement, or the License Agreement, with Intel. Under the License

Agreement, Intel has granted to NVIDIA and its qualified subsidiaries, and NVIDIA has granted to Intel and Intel’s qualified subsidiaries, a non-exclusive,

non-transferable, worldwide license, without the right to sublicense to all patents that are either owned or controlled by the parties at any time that have a first

filing date on or before March 31, 2017, to make, have made (subject to certain limitations), use, sell, offer to sell, import and otherwise dispose of certain

semiconductor- and electronic-related products anywhere in the world. NVIDIA’s rights to Intel’s patents have certain specified limitations, including but not

limited to, NVIDIA was not granted a license to: (1) certain microprocessors, defined in the License Agreement as “Intel Processors” or “Intel Compatible

Processors;” (2) certain chipsets that connect to Intel Processors; or (3) certain flash memory products. In connection with the License Agreement, NVIDIA

and Intel mutually agreed to settle all outstanding legal disputes. Under the License Agreement, Intel will pay NVIDIA an aggregate amount of $1.5 billion,

payable in annual installments, as follows: a $300 million payment on each of January 18, 2011, January 13, 2012 and January 15, 2013 and a $200 million

payment on each of January 15, 2014, 2015 and 2016. Please refer to Note 4 of the Notes to the Consolidated Financial Statements in Part IV, Item 15 of this

Form 10-K for further information regarding this cross license and the settlement.

52