NVIDIA 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

Employees are eligible to participate if they are employed by us or an affiliate of us as designated by the Board. Employees who participate in an

offering may have up to 10% of their earnings withheld pursuant to the Purchase Plan up to certain limitations and applied on specified dates determined by

the Board to the purchase of shares of common stock. The Board may increase this percentage at its discretion, up to 15% . The price of common stock

purchased under the Purchase Plan will be equal to the lower of the fair market value of the common stock on the commencement date of each offering period

and the purchase date of each offering period at 85% at the fair market value of the common stock on the relevant purchase date. During fiscal years 2012 ,

2011 and 2010 , employees purchased approximately 5.8 million , 6.7 million , and 5.9 million shares, respectively, with weighted-average prices of $8.18 ,

$6.59 , and $6.76 per share, respectively, and grant-date fair values of $5.47 , $4.06 and $4.60 per share, respectively. Employees may end their participation

in the Purchase Plan at any time during the offering period, and participation ends automatically on termination of employment with us and in each case their

contributions are refunded.

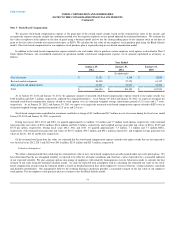

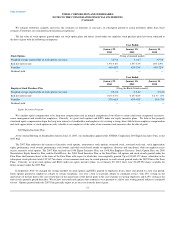

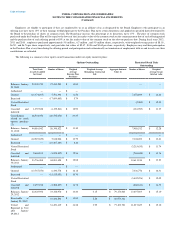

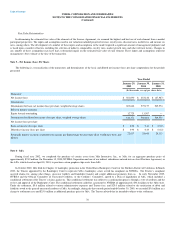

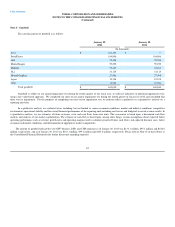

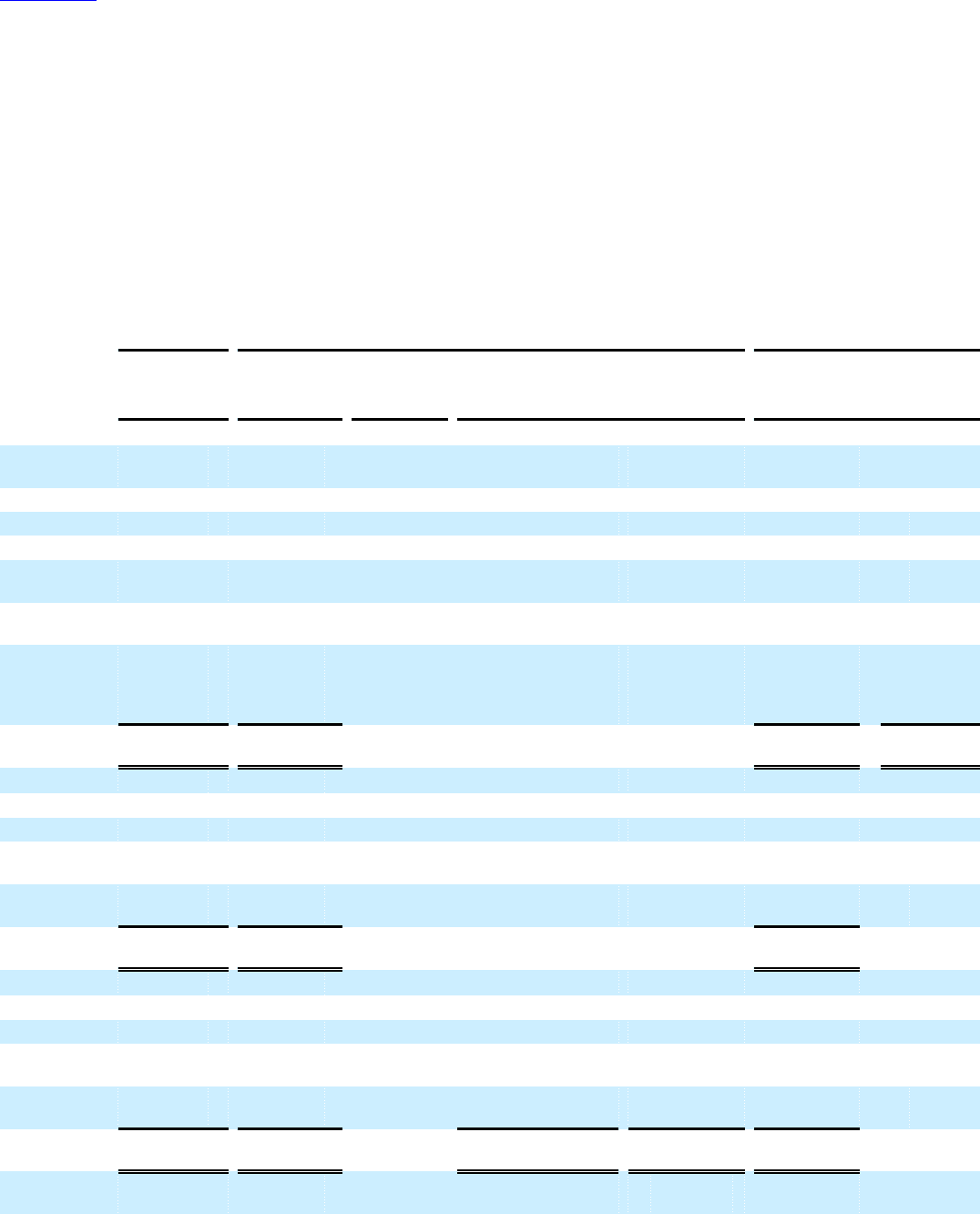

The following is a summary of our equity award transactions under our equity incentive plans:

Options Outstanding Restricted Stock Units

Outstanding

Total Stock

Awards Available

for Grant

Number of Shares Weighted

Average

Exercise Price

Per Share

Weighted Average

Remaining Contractual

Life

Aggregate Intrinsic

Value (1) Number of Shares Weighted

Average Grant-

date fair value

Balances, January

25, 2009 29,500,759 97,454,280 $ 13.83 — —

Authorized — — $ —

Granted (15,374,295) 7,701,396 $ 11.50 7,672,899 $ 12.26

Exercised — (17,099,663) $ 5.74

Vested Restricted

Stock (2,400) $ 12.40

Canceled and

forfeited 1,357,528 (1,175,541) $ 12.90 (181,987) $ 11.37

Cancellations

related to stock

options purchase

(2)

28,532,050 (28,532,050) $ 23.35

Balances, January

31, 2010 44,016,042 58,348,422 $ 11.30 7,488,512 $ 12.28

Authorized — — $ — — —

Granted (12,923,659) 5,818,966 $ 13.79 7,104,693 $ 13.61

Exercised — (18,287,483) $ 8.16

Vested Restricted

Stock (3,215,633) $ 11.74

Canceled and

forfeited 2,644,105 (1,878,447) $ 12.56 (765,658) $ 13.76

Balances, January

30, 2011 33,736,488 44,001,458 $ 12.88 10,611,914 $ 13.23

Authorized — — $ —

Granted (13,767,554) 6,430,778 $ 16.18 7,336,776 $ 16.31

Exercised — (15,515,053) $ 10.70

Vested Restricted

Stock (3,442,076) $ 12.02

Canceled and

forfeited 2,457,018 (1,588,207) $ 14.78 (868,811) $ 14.72

Balances, January

29, 2012 22,425,952 33,328,976 $ 14.44 4.15 $ 79,174,063 13,637,803 $ 15.10

Exercisable at

January 29, 2012 21,434,294 $ 13.80 2.28 $ 66,073,341

Vested and

Expected to Vest

after January

29,2012

31,451,419 $ 14.38 3.95 $ 77,103,721 11,017,627 $ 15.10