NVIDIA 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

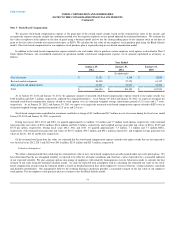

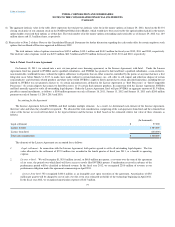

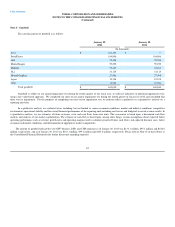

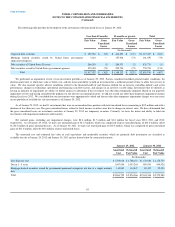

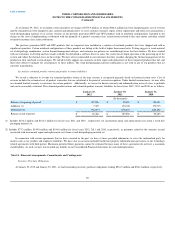

Note 8 - Goodwill

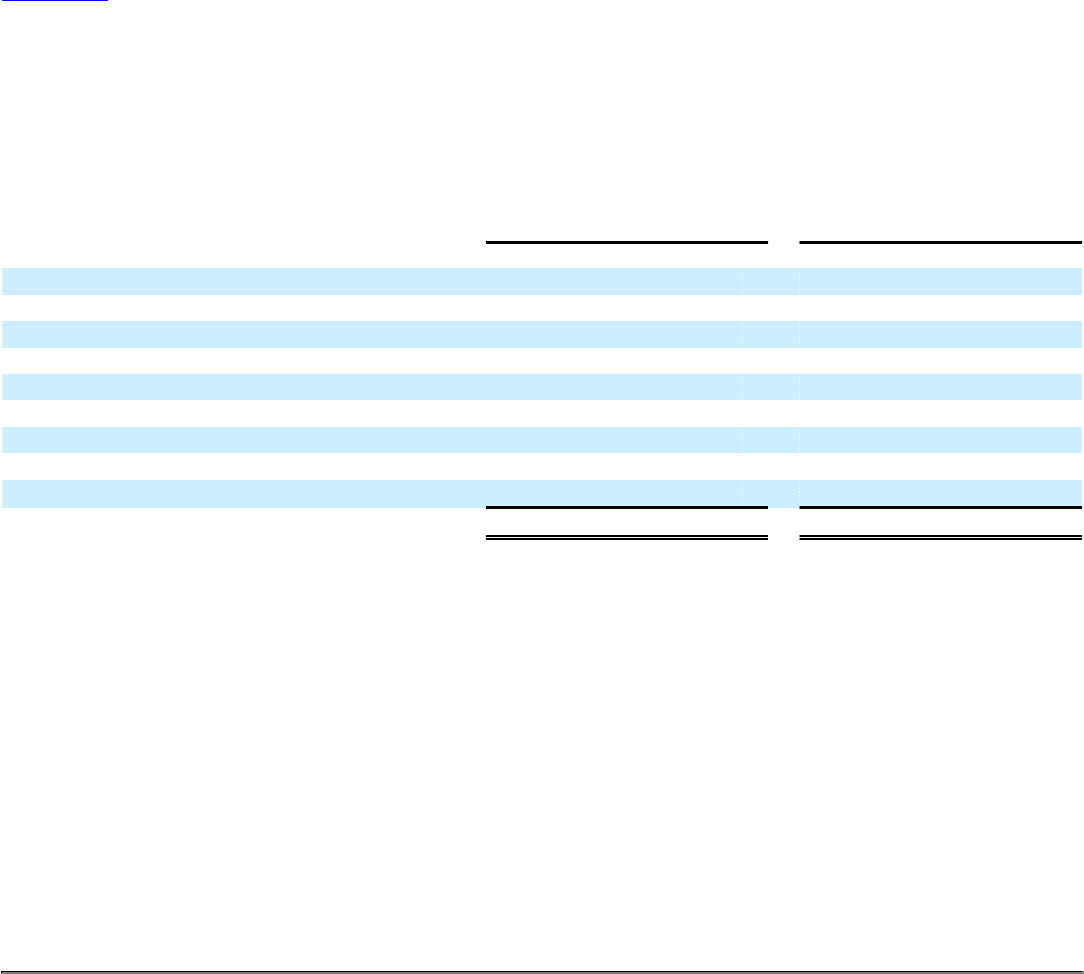

The carrying amount of goodwill is as follows:

January 29,

2012 January 30,

2011

(In thousands)

Icera $ 271,186 $ —

PortalPlayer 104,896 104,896

3dfx 75,326 75,326

Mental Images 59,252 59,252

MediaQ 35,167 35,167

ULi 31,115 31,115

Hybrid Graphics 27,906 27,906

Ageia 19,198 19,198

Other 16,984 16,984

Total goodwill $ 641,030 $ 369,844

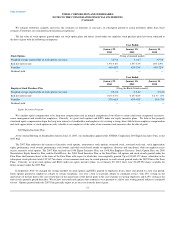

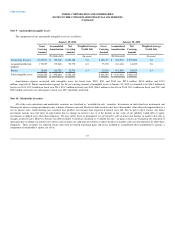

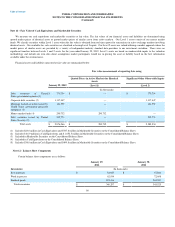

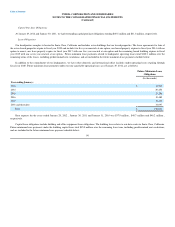

Goodwill is subject to our annual impairment test during the fourth quarter of our fiscal year, or earlier if indicators of potential impairment exist,

using a fair value-based approach. We completed our most recent annual impairment test during the fourth quarter of fiscal year 2012 and concluded that

there was no impairment. For the purposes of completing our most recent impairment test, we perform either a qualitative or a quantitative analysis on a

reporting unit basis.

In a qualitative analysis, we evaluate factors including, but not limited to, macro economic conditions, market and industry conditions, competitive

environment, operational stability and the overall financial performance of the reporting units including cost factors and budgeted-to-actual revenue results. In

a quantitative analysis, we use estimates of future revenues, costs and cash flows from such units. This assessment is based upon a discounted cash flow

analysis and analysis of our market capitalization. The estimate of cash flow is based upon, among other things, certain assumptions about expected future

operating performance such as revenue growth rates and operating margins used to calculate projected future cash flows, risk-adjusted discount rates, future

economic and market conditions, and determination of appropriate market comparables.

The amount of goodwill allocated to our GPU business, PSB, and CPB segments as of January 29, 2012 was $133.1 million, $95.1 million and $412.8

million, respectively, and as of January 30, 2011 was $133.1 million, $95.1 million and $141.6 million, respectively. Please refer to Note 18 of these Notes to

the Consolidated Financial Statements for further discussion regarding segments.

82