NVIDIA 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

available-for-sale debt instruments that are considered other-than-temporarily impaired due to the existence of a credit loss, if we do not intend to sell and it is

more likely than not that we will be required to sell the instrument before recovery of its remaining amortized cost basis (amortized cost basis less any

current-period credit loss), we separate the amount of the impairment into the amount that is credit related and the amount due to all other factors. The credit

loss component is recognized in earnings.

Stock-based Compensation

Our stock-based compensation cost for equity awards is measured at grant date, based on the fair value of the awards, and is recognized as expense over

the requisite employee service period. We recognize stock-based compensation expense using the straight-line attribution method. We estimate the fair value

of employee stock options on the date of grant using a binomial model and we use the closing trading price of our common stock on the date of grant as the

fair value of awards of restricted stock units, or RSUs. The determination of fair value of share-based payment awards on the date of grant using an option-

pricing model is affected by our stock price as well as assumptions regarding a number of highly complex and subjective variables. These variables include,

but are not limited to, the expected stock price volatility over the term of the awards, actual and projected employee stock option exercise behaviors, vesting

schedules, death and disability probabilities, expected volatility and risk-free interest. Our management has determined that the use of implied volatility is

expected to be more reflective of market conditions and, therefore, can reasonably be expected to be a better indicator of our expected volatility than historical

volatility. The risk-free interest rate assumption is based upon observed interest rates appropriate for the term of our employee stock options. The dividend

yield assumption is based on the history and expectation of dividend payouts. We began segregating options into groups for employees with relatively

homogeneous exercise behavior in order to calculate the best estimate of fair value using the binomial valuation model.

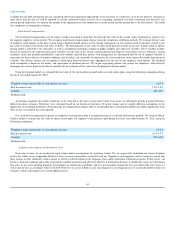

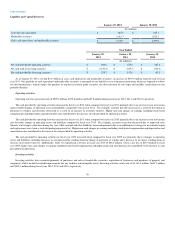

Using the binomial model, we estimated the fair value of the stock options granted under our stock option plans using the following assumptions during

the fiscal year ended January 29, 2012 :

Weighted average expected life of stock options (in years) 3.0-5.4

Risk free interest rate 1.9%-3.8%

Volatility 46%-65%

Dividend yield —

Accounting standards also require forfeitures to be estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures

differ from those estimates. Forfeitures were estimated based on our historical experience. If factors change and we employ different assumptions in the

application of accounting standards in future periods, the compensation expense that we record under these accounting standards may differ significantly from

what we have recorded in the current period.

Our stock-based compensation expense for employee stock purchase plan is recognized using an accelerated amortization method. We used the Black-

Scholes model to estimate the fair value of shares issued under our employee stock purchase plan during the fiscal year ended January 29, 2012, using the

following assumptions:

Weighted average expected life of stock options (in years) 0.5-2.0

Risk free interest rate 0.1%-0.7%

Volatility 57%-61%

Dividend yield —

Litigation, Investigation and Settlement Costs

From time to time, we are involved in legal actions and/or investigations by regulatory bodies. We are aggressively defending our current litigation

matters for which we are responsible. However, there are many uncertainties associated with any litigation or investigations, and we cannot be certain that

these actions or other third-party claims against us will be resolved without costly litigation, fines and/or substantial settlement payments. If that occurs, our

business, financial condition and results of operations could be materially and adversely affected. If information becomes available that causes us to determine

that a loss in any of our pending litigation, investigations or settlements is probable, and we can reasonably estimate the loss associated with such events, we

will record the loss in accordance with U.S.GAAP. However, the actual liability in any such litigation or investigations may be materially different from our

estimates, which could require us to record additional costs.

44