Lululemon 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

lululemon athletica inc. and Subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

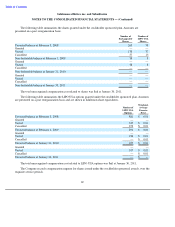

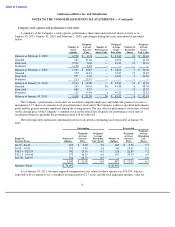

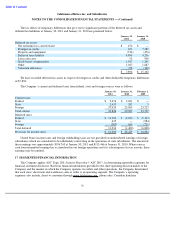

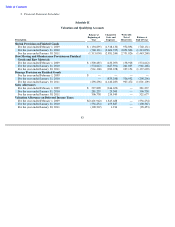

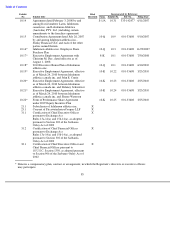

The Company operates in four geographic areas — Canada, the United States, Asia and Australia. Revenues

from these regions for the years ended January 30, 2011, January 31, 2010, and February 1, 2009 were as follows:

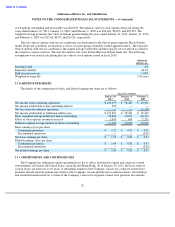

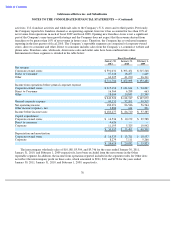

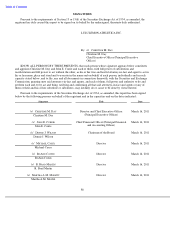

Long-lived assets by geographic area for the years ended January 30, 2011, January 31, 2010, and February 1,

2009 were as follows:

Substantially all of the Company’s intangible assets and goodwill relate to the reporting segment consisting of

corporate-owned stores.

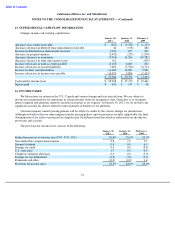

The Company has entered into franchise agreements under which franchisees are permitted to sell lululemon

apparel and are required to purchase lululemon apparel from the Company and to pay the Company a royalty based

on a percentage of the franchisee’s gross sales. The Company also received royalty fees of $2,222 for the year ended

January 30, 2011, $2,980 for the year ended January 31, 2010, and $4,145 for the year ended February 1, 2009. Sales

and cost of sales of apparel sold to franchisees amounted to $7,927 and $5,309 for the year ended January 30, 2011,

$11,441 and $9,081 for the year ended January 31, 2010, and $12,055 and $8,668 for the year ended February 1,

2009, respectively. The number of franchised stores repurchased during the years ended January 30, 2011,

January 31, 2010, and February 1, 2009 was 10, nil, and three, respectively.

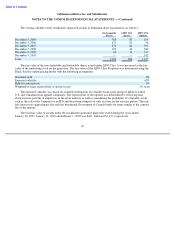

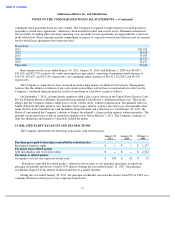

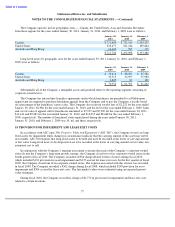

18 PROVISION FOR IMPAIRMENT AND LEASE EXIT COSTS

In accordance with ASC topic 360, Property, Plant and Equipment (“ASC 360”), the Company reviews its long-

lived assets for impairment when changes in circumstances indicate that the carrying amount of the asset may not be

recoverable. ASC 360 requires that long-lived assets to be held and used be recorded at the lower of carrying amount

or fair value. Long-

lived assets to be disposed of are to be recorded at the lower of carrying amount or fair value, less

estimated cost to sell.

In conjunction with the Company’s ongoing assessment to ensure that each of the Company’s corporate-owned

stores fit into the Company’s long-term growth strategy, the Company closed two of its corporate-

owned stores in the

fourth quarter of fiscal 2010. The Company recorded a $366 charge related to these closures during fiscal 2010,

which included $194 provision for asset impairment and $172 accrual for lease exit costs. In the first quarter of fiscal

2009, the Company closed one of its corporate-owned stores. The expense associated with this closure was recorded

in fiscal 2008. The Company recorded a $562 charge during fiscal 2008, which included $258 provision for asset

impairment and $304 accrual for lease exit costs. The fair market values were estimated using an expected present

value technique.

During fiscal 2010, the Company recorded a charge of $1,772 in provision for impairment and lease exit costs

related to certain locations.

77

January 30,

January 31,

February 1,

2011

2010

2009

Canada

$

371,604

$

271,169

$

243,525

United States

323,477

181,144

109,844

Australia and Hong Kong

16,623

585

119

$

711,704

$

452,898

$

353,488

January 31,

January 31,

February 1,

2010

2010

2009

Canada

$

33,616

$

28,507

$

25,582

United States

33,513

32,997

35,980

Australia and Hong Kong

3,825

87

100

$

70,954

$

61,591

$

61,662