Lululemon 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

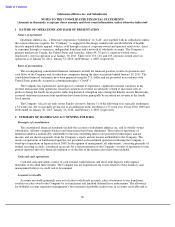

lululemon athletica inc. and Subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

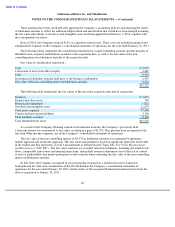

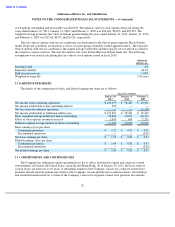

These amounts have been calculated after applying the Company’s accounting policies and adjusting the results

of lululemon australia to reflect the additional depreciation and amortization that would have been charged assuming

the fair value adjustments to inventory and intangible assets had been applied from February 1, 2010, together with

the consequential tax effects.

In fiscal 2010, the Company incurred $181 of acquisition-related costs. These costs are included in general and

administrative expenses in the Company’

s consolidated statements of operations for the year ended January 30, 2011.

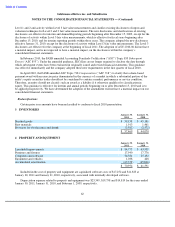

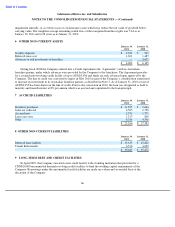

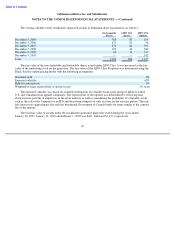

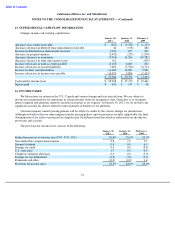

The following tables summarize the consideration transferred to acquire lululemon australia and the amounts of

identified assets acquired and liabilities assumed at the acquisition date, as well as the fair value of the non-

controlling interest in lululemon australia at the acquisition date:

Fair value of consideration transferred :

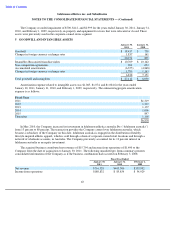

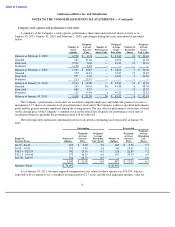

The following table summarizes the fair values of the net assets acquired at the date of acquisition:

As a result of the Company obtaining control over lululemon australia, the Company’s previously held

13 percent interest was remeasured to fair value, resulting in a gain of $1,792. This gain has been recognized in the

line item Other income (expense), net in the Company’s consolidated statements of operations.

The fair value of the non-controlling interest of $3,554 in lululemon australia was estimated by applying a

market approach and an income approach. This fair value measurement is based on significant inputs not observable

in the market and thus represents a Level 3 measurement as defined in ASC Topic 820, Fair Value Measurements

and Disclosures (“ASC 820”). The fair value estimates use standard valuation techniques, including discounted cash

flows, comparable transactions and internal projections, and include assumed adjustments due to the lack of control

or lack of marketability that market participants would consider when estimating the fair value of the non-

controlling

interest in lululemon australia.

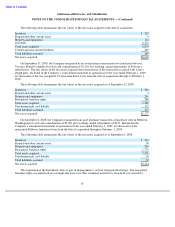

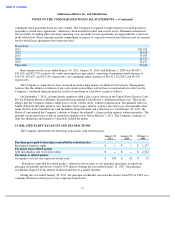

In July 2010, the Company reacquired in an asset purchase transaction a franchised store in Saskatoon,

Saskatchewan for total cash consideration of $6,610. Included in the Company’s consolidated statements of

operations for the year ended January 30, 2011 are the results of the reacquired Saskatoon franchised store from the

date of acquisition to January 30, 2011.

64

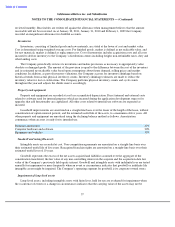

Cash

$

5,872

Conversion of note receivable to equity

3,481

Total

9,353

Investment in lululemon australia held prior to the business combination

2,345

Fair value of the non

-

controlling interest in lululemon australia

3,554

$

15,252

Inventory

$

3,053

Prepaid and other assets

709

Property and equipment

1,812

Goodwill and intangible assets

11,874

Total assets acquired

17,448

Current and non

-

current liabilities

2,196

Total liabilities assumed

2,196

Total identifiable net assets

$

15,252