Lululemon 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

lululemon athletica inc. and Subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

reviewed monthly. Receivables are written off against the allowance when management believes that the amount

receivable will not be recovered. As at January 30, 2011, January 31, 2010 and February 1, 2009 the Company

recorded an insignificant allowance for doubtful accounts.

Inventories

Inventories, consisting of finished goods and raw materials, are stated at the lower of cost and market value.

Cost is determined using weighted-average costs. For finished goods, market is defined as net realizable value, and

for raw materials, market is defined as replacement cost. Cost of inventories includes acquisition costs and all costs

incurred to deliver inventory to the Company’s distribution centers including freight, non-refundable taxes, duty and

other landing costs.

The Company periodically reviews its inventories and makes provisions as necessary to appropriately value

obsolete or damaged goods. The amount of the provision is equal to the difference between the cost of the inventory

and its estimated net realizable value based upon assumptions about future demand, selling prices and market

conditions. In addition, as part of inventory valuations, the Company accrues for inventory shrinkage based on

historical trends from actual physical inventory counts. Inventory shrinkage estimates are made to reduce the

inventory value for lost or stolen items. The Company performs physical inventory counts and cycle counts

throughout the year and adjusts the shrink reserve accordingly.

Property and equipment

Property and equipment are recorded at cost less accumulated depreciation. Direct internal and external costs

related to software used for internal purposes which are incurred during the application development stage or for

upgrades that add functionality are capitalized. All other costs related to internal use software are expensed as

incurred.

Leasehold improvements are amortized on a straight-line basis over the lesser of the length of the lease, without

consideration of option renewal periods, and the estimated useful life of the assets, to a maximum of five years. All

other property and equipment are amortized using the declining balance method as follows. Amortization

commences when an asset is ready for its intended use.

Goodwill and intangible assets

Intangible assets are recorded at cost. Non-competition agreements are amortized on a straight-line basis over

their estimated useful life of five years. Reacquired franchise rights are amortized on a straight-line basis over their

estimated useful lives of 10 years.

Goodwill represents the excess of the net assets acquired and liabilities assumed over the aggregate of the

consideration transferred, the fair value of any non-controlling interest in the acquiree and the acquisition-date fair

value of the Company’

s previously held equity interest. Goodwill and intangible assets with indefinite lives are tested

annually for impairment or more frequently when an event or circumstance indicates that goodwill or indefinite life

intangible assets might be impaired. The Company’s operating segment for goodwill is its corporate-owned stores.

Impairment of long-lived assets

Long-lived assets, including intangible assets with finite lives, held for use are evaluated for impairment when

the occurrence of events or a change in circumstances indicates that the carrying value of the assets may not be

57

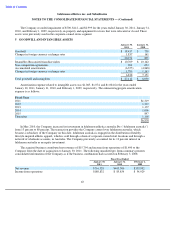

Furniture and fixtures

20

%

Computer hardware and software

30

%

Equipment and vehicles

30

%