Lululemon 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

continue to generate interest income to the extent that our cash generated from operations exceeds our cash used for

investment. We have maintained relatively small outstanding balances on our credit facilities and expect to continue

to do so.

Provision for income taxes depends on the statutory tax rates in the countries where we sell our products.

Historically we have generated taxable income in Canada and we have generated tax losses in the United States. For

periods up to and including the second quarter of fiscal 2007, we recorded a full valuation allowance against our

losses in the United States. In the third and fourth quarters of fiscal 2007, we earned taxable income in the United

States. During the second quarter of fiscal 2008, after considering a number of factors, including recent taxable

income, utilization of previously unrealized net operating losses, or NOLs, our growth strategy as well as other

business and macroeconomic factors, we determined that we would more likely than not realize the benefit of

deferred tax assets through future taxable income. We have recorded deferred tax assets in respect of foreign tax

credits and other deductible temporary differences of $7.9 million as at January 30, 2011.

Several factors have contributed to our effective tax rate fluctuating in recent periods. First, in fiscal 2008 and

fiscal 2007, we generated losses in the United States which we were unable to offset against our income in Canada.

Second, we incurred stock-based compensation expense of $7.3 million, $5.6 million and $6.5 million in fiscal 2010,

fiscal 2009 and fiscal 2008, respectively, a portion of which were not deductible for tax purposes in Canada and the

United States during these periods. Third, the Canadian corporate tax rate decreased from 35% to 32% in fiscal 2008.

Fourth, in fiscal 2008 we began to release the valuation against US loss carry forwards. Our effective tax rate in

fiscal 2010 was 33%, compared to 33% in fiscal 2009 and 29% in fiscal 2008.

We anticipate that in the future we may start to sell our products directly to some customers located outside of

Canada, the United States and Australia, in which case we would become subject to taxation based on the foreign

statutory rates in the countries where these sales take place and our effective tax rate could fluctuate accordingly.

Results of Operations

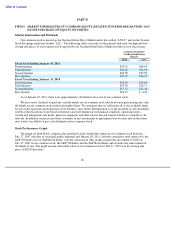

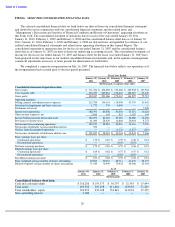

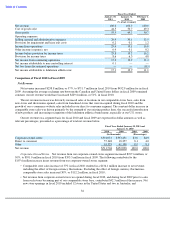

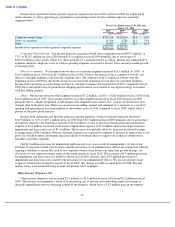

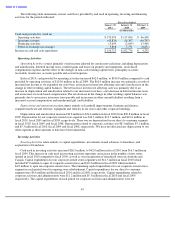

The following tables summarize key components of our results of operations for the periods indicated, both in

dollars and as a percentage of net revenue:

33

Fiscal Year Ended

January 30,

January 31,

February 1,

2011

2010

2009

(In thousands)

Consolidated statements of operations:

Net revenue

$

711,704

$

452,898

$

353,488

Cost of goods sold

316,757

229,812

174,421

Gross profit

394,947

223,086

179,067

Operating expenses:

Selling, general and administrative expenses

212,784

136,161

118,098

Provision for impairment and lease exit costs

1,772

379

4,405

Income from operations

180,391

86,546

56,564

Other income (expense), net

2,886

164

821

Income before provision for income taxes

183,277

86,710

57,385

Provision for income taxes

61,080

28,429

16,884

Net income from continuing operations

122,197

58,281

40,501

Net income attributable to non

-

controlling interest

350

—

—

Net loss from discontinued operations

—

—

(

1,138

)

Net income attributable to lululemon athletica inc.

$

121,847

$

58,281

$

39,363