Lululemon 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

lululemon athletica inc. and Subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

impairment annually, or as events occur or circumstances arise which may reduce the fair value of goodwill below

carrying value. The weighted-average remaining useful lives of the reacquired franchise rights was 5.24 as at

January 30, 2011 and 6.28 years as at January 31, 2010.

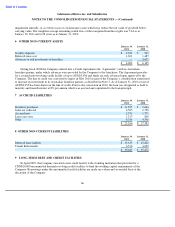

During fiscal 2008 the Company entered into a Credit Agreement (the “Agreement”) with its Australian

franchise partner, under which advances were provided by the Company to the franchisee. The Agreement provides

for a secured non-revolving credit facility of up to AUD$3,900 and funds are only advanced upon approval by the

Company. The line of credit was converted to equity in May 2010 as part of the Company’

s consideration transferred

to increase its investment in its Australian franchise partner, as described in Note 5. As of January 31, 2010 a total of

AUD$3,255 has been drawn on the line of credit. Prior to the conversion in 2010, the loan was designated as held to

maturity and beared interest at 8% per annum which was accrued and capitalized to the loan principal.

8 OTHER NON-CURRENT LIABILITIES

In April 2007, the Company executed a new credit facility with a lending institution that provided for a

CDN$20,000 uncommitted demand revolving credit facilities to fund the working capital requirements of the

Company. Borrowings under the uncommitted credit facilities are made on a when-and-as-needed basis at the

discretion of the Company.

66

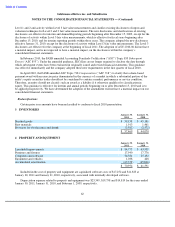

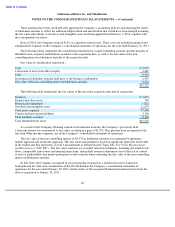

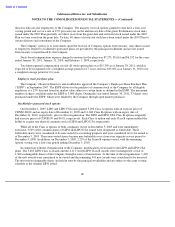

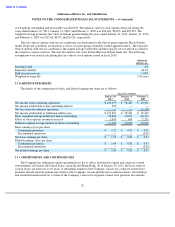

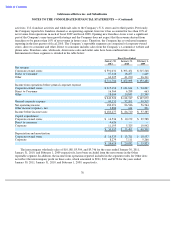

6

OTHER NON

-

CURRENT ASSETS

January 30,

January 31,

2011

2010

Security deposits

$

2,762

$

945

Deferred lease cost

1,301

1,487

Advances to and investments in franchise

—

3,673

$

4,063

$

6,105

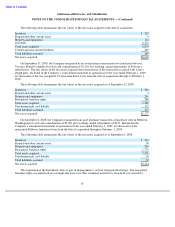

7

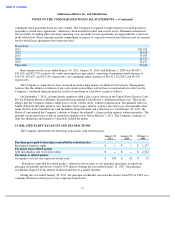

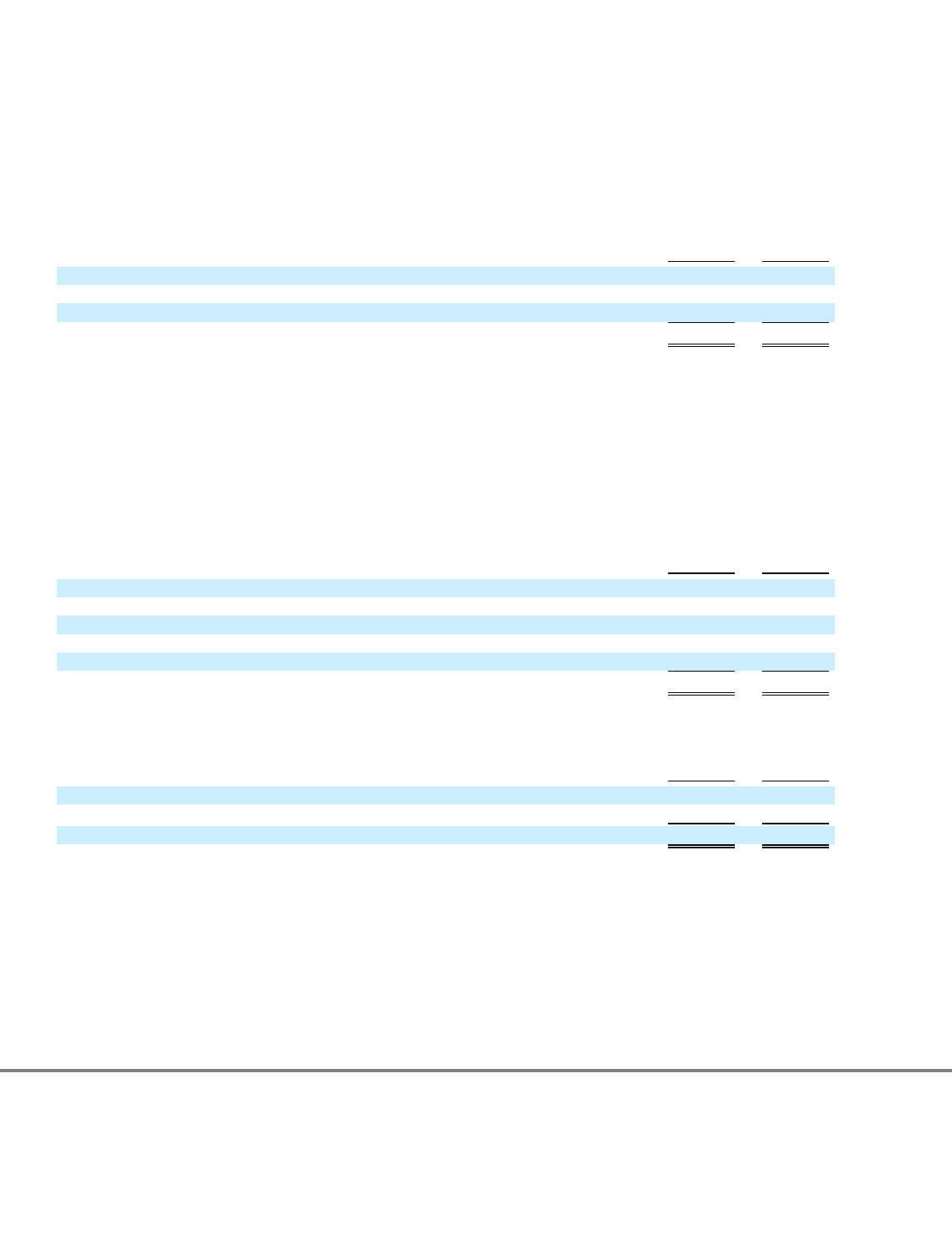

ACCRUED LIABILITIES

January 30,

January 31,

2011

2010

Inventory purchases

$

11,925

$

7,664

Sales tax collected

4,505

2,758

Accrued rent

2,750

1,771

Lease exit costs

1,317

800

Other

4,769

4,590

$

25,266

$

17,583

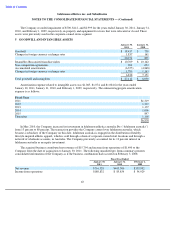

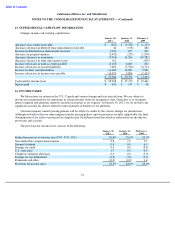

January 30,

January 31,

2011

2010

Deferred lease liability

$

13,129

$

10,822

Tenant Inducements

6,516

4,650

$

19,645

$

15,472

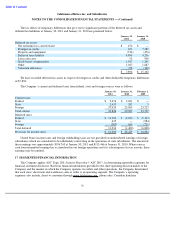

9

LONG

-

TERM DEBT AND CREDIT FACILITIES