Lululemon 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

lululemon athletica inc. and Subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

exposure is partly mitigated by a natural hedge in that a significant portion of the Company’s operating costs are also

denominated in Canadian dollars. The Company is also exposed to changes in interest rates. The Company does not

hedge foreign currency and interest rate exposure in a manner that would entirely eliminate the effect of changes in

foreign currency exchange rates, or interest rates on net income and cash flows.

The aggregate foreign exchange gains (losses) included in income amount to $477, $174, and $(110) for the

years ended January 30, 2011, January 31, 2010, and February 1, 2009, respectively.

Concentration of credit risk

The Company is not exposed to significant credit risk on its cash and cash equivalents and trade accounts

receivable. Cash and cash equivalents are held with high quality financial institutions. Trade accounts receivable are

primarily from certain franchisees and wholesale accounts. The Company does not require collateral to support the

trade accounts receivable; however, in certain circumstances, the Company may require parties to provide payment

for goods prior to delivery of the goods. The accounts receivable are net of an allowance for doubtful accounts,

which is established based on management’s assessment of the credit risks of the underlying accounts.

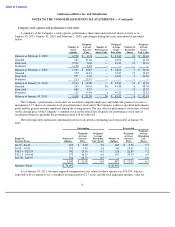

Stock-based compensation

The Company accounts for stock-based compensation using the fair value method. The fair value of awards

granted is estimated at the date of grant and recognized as employee compensation expense on a straight-line basis

over the requisite service period with the offsetting credit to additional paid-in capital. For awards with service

performance conditions, the total amount of compensation expense to be recognized is based on the number of

awards expected to vest and is adjusted to reflect those awards that do ultimately vest. For awards with performance

conditions, the Company recognizes the compensation expense if and when the Company concludes that it is

probable that the performance condition will be achieved. The Company reassesses the probability of achieving the

performance condition at each reporting date. For awards with market conditions, all compensation expense is

recognized irrespective of whether such conditions are met.

Certain employees are entitled to share-based awards from the principal stockholder of the Company. These

awards are accounted for by the Company as employee compensation expense in accordance with the above-noted

policies.

Earnings per share

Earnings per share is calculated using the weighted-average number of common shares outstanding during the

period. Diluted earnings per share is calculated by dividing net income available to common stockholders for the

period by the diluted weighted-average number of common shares outstanding during the period. Diluted earnings

per share reflects the potential dilution from common shares issuable through stock options and performance stock

units using the treasury stock method.

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the

United States requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements as well as the

reported amounts of revenues and expenses during the reporting period.

Recently issued accounting standards

In January 2010, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

(“ASU”) 2010-06, Fair Value Measurements and Disclosures Topic 820: Improving Disclosures about Fair Value

Measurements (“ASU 2010-06”). ASU 2010-06 requires new disclosures regarding transfers in and out of the

61