Lululemon 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

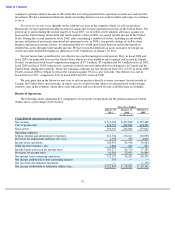

Table of Contents

In the past, securities class action litigation has often been instituted against companies following periods of

volatility in their stock price. This type of litigation, even if it does not result in liability for us, could result in

substantial costs to us and divert management’s attention and resources.

A significant number of our outstanding shares are eligible for resale and may be sold on the Nasdaq Global

Select Market and the Toronto Stock Exchange. The large number of shares eligible for public sale could

depress the market price of our common stock.

The market price of our common stock could decline as a result of sales of a large number of shares of our

common stock in the market, and the perception that these sales could occur may also depress the market price of our

common stock. On July 31, 2008, we filed a registration statement on Form S-3ASR (as subsequently amended by a

post-effective amendment on Form S-3

filed on March 30, 2009) in the United States registering the issuance of up to

20,935,041 shares of our common stock upon the exchange of the then-outstanding exchangeable shares of Lulu

Canadian Holding, Inc. Additionally, we filed a universal shelf registration statement on Form S-3ASR on July 6,

2010, registering the possible issuance and/or resale of shares of our common stock, preferred stock, debt securities,

warrants and units. Sales of our common stock in the public market may make it more difficult for us to sell equity

securities in the future at a time and at a price that we deem appropriate. These sales also could cause our stock price

to fall and make it more difficult for you to sell shares of our common stock.

Our current directors and executive officers own a significant percentage of our stock and will be able to

exercise significant influence over our affairs.

Our current directors and executive officers beneficially own 33% of our common stock. As a result, these

stockholders, if acting together, would be able to influence or control matters requiring approval by our stockholders,

including the election of directors and the approval of mergers, acquisitions or other extraordinary transactions. They

may also have interests that differ from yours and may vote in a way with which you disagree and which may be

adverse to your interests. This concentration of ownership may have the effect of delaying, preventing or deterring a

change of control of our company, could deprive our stockholders of an opportunity to receive a premium for their

common stock as part of a sale of our company and might ultimately affect the market price of our common stock.

23

•

changes in product mix between high and low margin products;

•

capital commitments;

•

our entry into new markets;

•

timing of new store openings;

•

percentage of sales from new stores versus established stores;

•

additions or departures of key personnel;

• actual or anticipated sales of our common stock, including sales by our directors, officers or significant

stockholders;

•

significant developments relating to our manufacturing, distribution, joint venture or franchise relationships;

•

customer purchases of new products from us and our competitors;

•

investor perceptions of the apparel industry in general and our company in particular;

•

changes in accounting standards, policies, guidance, interpretation or principles; and

•

speculative trading of our common stock in the investment community.