Lululemon 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

lululemon athletica inc. and Subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

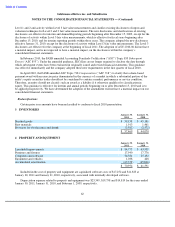

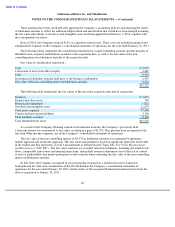

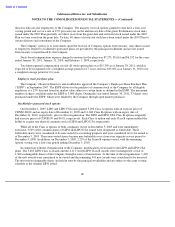

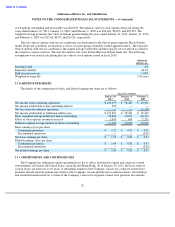

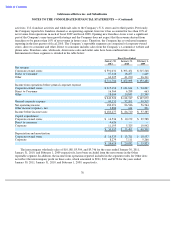

The vesting schedule of the stockholder sponsored awards in lululemon share equivalents is as follows:

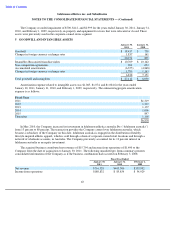

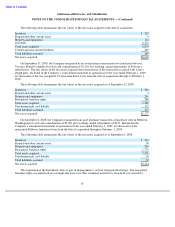

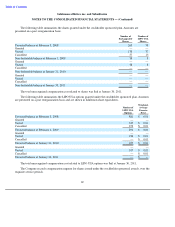

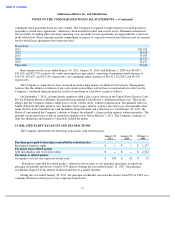

The fair value of the non-forfeitable and forfeitable shares issued under LIPO Class A was measured at the fair

value of the underlying stock on the grant date. The fair value of the LIPO Class B options was determined using the

Black-Scholes option pricing model with the following assumptions:

The expected volatility was based on available information on volatility from a peer group of publicly traded

U.S. and Canadian retail apparel companies. The expected life of the options was determined by reviewing data

about exercise patterns of employees in the retail industry as well as considering the probability of a liquidity event

such as the sale of the Company or an IPO and the potential impact of such an event on the exercise pattern. The risk-

free interest rate approximates the yield on benchmark Government of Canada bonds for terms similar to the contract

life of the options.

The total fair value of awards under the stockholder sponsored plans that vested during the years ended

January 30, 2011, January 31, 2010 and February 1, 2009 was $261, $464,and $1,137, respectively.

70

Exchangeable

LIPO USA

LIPO USA

Shares

Shares

Options

December 5, 2005

788

87

105

December 5, 2006

631

60

96

December 5, 2007

276

60

393

December 5, 2008

199

43

384

December 5, 2009

66

14

315

December 5, 2010

—

—

182

Total

1,960

264

1,475

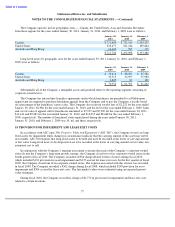

Dividend yield

0%

Expected volatility

45%

Risk

-

free interest rate

5%

Weighted

-

average expected life of option (years)

5.0 years