Lululemon 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

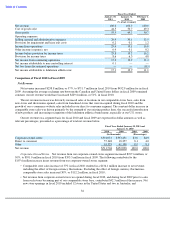

Direct to Consumer. Net revenue from our direct to consumer segment increased $16.6 million, or 1,020%, to

$18.3 million in fiscal 2009 from $1.6 million in fiscal 2008. The increase in net revenue from our direct to consumer

segment was primarily due to the launch of our e-commerce in fiscal 2009, which contributed $16.8 million in net

revenues. This increase was offset by decreased phonesale revenue, which shifted to e-commerce, of $0.2 million.

Other. Net revenue from our other segment increased $4.9 million, or 13%, to $41.2 million in fiscal 2009

from $36.3 million in fiscal 2008. An increase in outlet revenues of $5.0 million contributed to the increase in net

revenues from our other segment. This increase in outlet revenue resulted from a $3.2 million increase in revenue at

existing outlet locations and a $1.8 million increase in net revenue from two new outlet locations that opened in fiscal

2009. New and existing wholesale accounts contributed $4.4 million to the increase, and increased showroom sales

revenue contributed $1.6 million. The increase in net revenue from our other segment was offset by temporary store

locations opened in fiscal 2008 but not fiscal 2009, which had contributed $3.2 million, and decreased warehouse

revenue due to fewer warehouse sales in fiscal 2009 compared to fiscal 2008, of $0.6 million. $2.2 million of

franchise net revenue shifted to the corporate-owned stores segment when we acquired two franchise stores in

Victoria, British Columbia and one franchise store in Bellevue, Washington.

Gross Profit

Gross profit increased $44.0 million, or 25%, to $223.1 million in fiscal 2009 from $179.1 million in fiscal

2008. The increase in gross profit was driven principally by increased net revenues which ultimately resulted in an

increased gross profit.

The increase in gross profit was partially offset by increased fixed costs, such as occupancy and depreciation,

increased costs related to our design, production, distribution and merchandising departments, as well as increased

discounts, shrinkage and other as a result of increased sales volume.

Gross profit, as a percentage of net revenue, or gross margin, decreased 140 basis points, to 49.3% in fiscal 2009

from 50.7% in fiscal 2008. The decrease in gross margin resulted from:

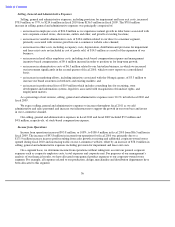

This was partially offset by a decrease in expenses related to our production, design, merchandising and

distribution departments, relative to the increase in net revenue, which had a leveraging effect on gross margin and

contributed an increase of 60 basis points.

Our costs of goods sold in fiscal 2009 and fiscal 2008 included $0.8 million and $0.8 million, respectively, of

stock-based compensation expense.

39

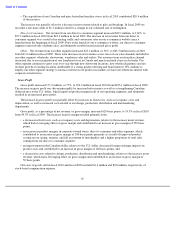

• Comparable store sales increase of 9% in fiscal 2009 resulted in a $26.6 million increase to net revenue,

excluding the effect of foreign currency fluctuations. Including the effect of foreign currency fluctuations,

comparable store sales increased 8%, or $24.1 million, in fiscal 2009;

•

Net revenue related to gift card breakage contributed $2.2 million of the increase. Based on historical gift card

breakage, we recognize into revenue a portion of gift card sales for which we estimate redemption is remote

over the estimated period of redemption. This includes a one-time credit of $1.3 million recorded in the first

quarter of fiscal 2009 related to a change in our estimated rate of redemption; and

• The acquisition of two Victoria, British Columbia and one Bellevue, Washington franchise stores in

September 2008 contributed $5.1 million before entering the comparative store base.

• unfavorable foreign exchange differences of 130 basis points on product costs, depreciation, occupancy and

production, design, merchandising and distribution departments as a result of the weakening Canadian dollar;

• a decrease in corporate-owned stores, franchise and other product margins, which contributed a decrease in

gross margin of 60 basis points as a result of increased direct product costs, markdowns and discounts; and

•

an increase in write

-

downs and other of 10 basis points.