Lululemon 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

unless we are able to obtain replacement products in a timely manner, we risk the loss of net revenue resulting from

the inability to sell those products and related increased administrative and shipping costs.

Additionally, if defects in the manufacture of our products are not discovered until after such products are

purchased by our customers, our customers could lose confidence in the technical attributes of our products and our

results of operations could suffer and our business could be harmed.

We do not have long-term contracts with our suppliers and accordingly could face significant disruptions in

supply from our current sources.

We generally do not enter into long-term formal written agreements with our suppliers, including those for

Luon, and typically transact business with our suppliers on an order-by-order basis. There can be no assurance that

there will not be a significant disruption in the supply of fabrics or raw materials from current sources or, in the event

of a disruption, that we would be able to locate alternative suppliers of materials of comparable quality at an

acceptable price, or at all. Identifying a suitable supplier is an involved process that requires us to become satisfied

with their quality control, responsiveness and service, financial stability and labor and other ethical practices. Any

delays, interruption or increased costs in the supply of fabric or manufacture of our products arising from a lack of

long-term contracts could have an adverse effect on our ability to meet customer demand for our products and result

in lower net revenue and income from operations both in the short and long-term. Similarly, there can no assurance

that the suppliers of our fabrics, such as Luon, will not sell the same fabric to our competitors.

We do not have patents or exclusive intellectual property rights in our fabrics and manufacturing technology. If

our competitors sell similar products to ours, our net revenue and profitability could suffer.

The intellectual property rights in the technology, fabrics and processes used to manufacture our products are

owned or controlled by our suppliers and are generally not unique to us. Our ability to obtain intellectual property

protection for our products is therefore limited and we currently own no patents or exclusive intellectual property

rights in the technology, fabrics or processes underlying our products. As a result, our current and future competitors

are able to manufacture and sell products with performance characteristics, fabrics and styling similar to our

products. Because many of our competitors, such as The Gap, Inc., which includes the Athleta brand, Nike, Inc. and

adidas AG, which includes the adidas and Reebok brands, have significantly greater financial, distribution, marketing

and other resources than we do, they may be able to manufacture and sell products based on our fabrics and

manufacturing technology at lower prices than we can. If our competitors do sell similar products to ours at lower

prices, our net revenue and profitability could suffer.

Our future success is substantially dependent on the continued service of our senior management.

Our future success is substantially dependent on the continued service of our senior management. The loss of the

services of our senior management could make it more difficult to successfully operate our business and achieve our

business goals.

We also may be unable to retain existing management, technical, sales and client support personnel that are

critical to our success, which could result in harm to our customer and employee relationships, loss of key

information, expertise or know-how and unanticipated recruitment and training costs.

We do not maintain a key person life insurance policy on Mr. Wilson, Ms. Day or any of the other members of

our senior management team. As a result, we would have no way to cover the financial loss if we were to lose the

services of members of our senior management team.

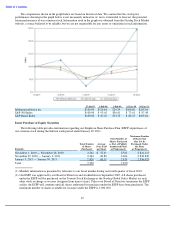

Our operating results are subject to seasonal and quarterly variations in our net revenue and income from

operations, which could cause the price of our common stock to decline.

We have experienced, and expect to continue to experience, significant seasonal variations in our net revenue

and income from operations. Seasonal variations in our net revenue are primarily related to increased sales of our

products during our fourth fiscal quarter, reflecting our historical strength in sales during the holiday season. We

generated approximately 36%, 39% and 29% of our full year gross profit during the fourth quarters of fiscal 2010,

17