Lululemon 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

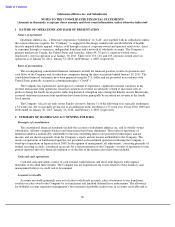

lululemon athletica inc. and Subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

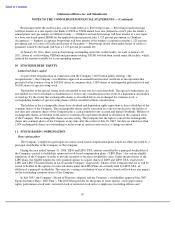

Revenue recognition

Net revenue includes sales of apparel to customers through corporate-owned and operated retail stores, direct to

consumer through www.lululemon.com and phone sales, initial license and franchise fees, royalties from franchisees

and sales of apparel to franchisees, sales through a network of wholesale accounts, and sales from company-operated

showrooms.

Sales to customers through corporate-owned retail stores and phone sales are recognized at the point of sale, net

of an estimated allowance for sales returns.

Sales of apparel to customers through the Company’s retail internet site are recognized when goods are shipped,

net of an estimated allowance for sales returns.

Franchise royalties are calculated as a percentage of franchise sales and are recognized in the month that the

franchisee makes the sale.

Sales of apparel to franchisees and wholesale accounts are recognized when goods are shipped and collection is

reasonably assured.

All revenues are reported net of sales taxes collected for various governmental agencies.

Revenues from the Company’s gift cards are recognized when tendered for payment, or upon redemption.

Outstanding customer balances are included in “Unredeemed gift card liability” on the consolidated balance sheets.

There are no expiration dates on the Company’

s gift cards, and lululemon does not charge any service fees that cause

a decrement to customer balances.

While the Company will continue to honor all gift cards presented for payment, management may determine the

likelihood of redemption to be remote for certain card balances due to, among other things, long periods of inactivity.

In these circumstances, to the extent management determines there is no requirement for remitting card balances to

government agencies under unclaimed property laws, card balances may be recognized in the consolidated

statements of operations in “Net revenue.” For the years ended January 30, 2011, January 31, 2010 and February 1,

2009, net revenue recognized on unredeemed gift card balances was $1,406, $2,183, and $nil, respectively.

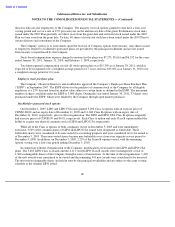

Cost of goods sold

Cost of goods sold includes the cost of purchased merchandise, including in-bound freight, duty and

nonrefundable taxes incurred in delivering the goods to the Company’s distribution centers. It also includes all

occupancy costs such as minimum rent, contingent rent where applicable, property taxes, utilities and depreciation

expense for the Company’s corporate-owned store locations and all costs incurred in operating the Company’s

distribution centers and production, design and merchandise departments, hemming and shrink and valuation

reserves. Production, design, merchandise and distribution center costs include salaries and benefits as well as

operating expenses, which include occupancy costs and depreciation expense for the Company’s distribution centers.

Store pre-opening costs

Operating costs incurred prior to the opening of new stores are expensed as incurred.

Income taxes

The Company follows the liability method with respect to accounting for income taxes. Deferred income tax

assets and liabilities are determined based on temporary differences between the carrying amounts and the tax basis

of assets and liabilities. Deferred income tax assets and liabilities are measured using enacted tax rates that are

expected to be in effect when these differences are anticipated to reverse. Deferred income tax assets are reduced by

59