Lululemon 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

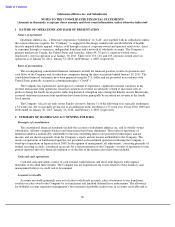

balances to government agencies under unclaimed property laws, card balances may be recognized in the

consolidated statements of operations in “Net revenue.”

Accounts Receivable. Accounts receivable primarily arise out of sales to wholesale accounts, sales of products

and royalties on sales owed to us by our franchises, and landlord deferred lease inducements. The allowance for

doubtful accounts represents management’s best estimate of probable credit losses in accounts receivable. This

allowance is established based on the specific circumstances associated with the credit risk of the receivable, the size

of the accounts receivable balance, aging of accounts receivable balances and our collection history and other

relevant information. The allowance for doubtful accounts is reviewed on a monthly basis. Receivables are charged

to the allowance when management believes the account will not be recovered.

Inventory. Inventory is valued at the lower of cost and market. Cost is determined using weighted-average

costs. For finished goods, market is defined as net realizable value, and for raw materials, market is defined as

replacement cost. Cost of inventories includes acquisition and production costs including raw material and labor, as

applicable, and all costs incurred to deliver inventory to our distribution centers including freight, non-refundable

taxes, duty and other landing costs.

We periodically review our inventories and make provisions as necessary to appropriately value obsolete or

damaged goods. The amount of the provision is equal to the difference between the book cost of the inventory and its

estimated market value based upon assumptions about future demands, selling prices and market conditions. In

addition, as part of inventory valuations, we provide for inventory shrinkage based on historical trends from actual

physical inventories. Inventory shrinkage estimates are made to reduce the inventory value for lost or stolen items.

We perform physical inventory counts throughout the year and adjust the shrink provision accordingly. In fiscal

2010, we wrote-off $1.0 million of inventory and in fiscal 2009 we wrote-off $0.8 million of inventory.

Property and Equipment. Property and equipment are recorded at cost less accumulated depreciation. Direct

internal and external costs related to software used for internal purposes which are incurred during the application

development stage or for upgrades that add functionality are capitalized. All other costs related to internal use

software are expensed as incurred. Leasehold improvements are amortized on a straight-line basis over the lesser of

the length of the lease, without consideration of option renewal periods and the estimated useful life of the assets, up

to a maximum of five years. All other property and equipment are amortized using the declining balance method as

follows:

We recognize a liability for the fair value of a required asset retirement obligation, or ARO, when such

obligation is incurred. Our AROs are primarily associated with leasehold improvements which, at the end of a lease,

we are contractually obligated to remove in order to comply with the lease agreement. At the inception of a lease

with such conditions, we record an ARO liability and a corresponding capital asset in an amount equal to the

estimated fair value of the obligation. The liability is estimated based on a number of assumptions requiring

management’s judgment, including store closing costs, cost inflation rates and discount rates, and is accreted to its

projected future value over time. The capitalized asset is depreciated using the convention for depreciation of

leasehold improvement assets. Upon satisfaction of the ARO conditions, any difference between the recorded ARO

liability and the actual retirement costs incurred is recognized as an operating gain or loss in the consolidated

statements of operations.

We recognize a liability for a cost associated with a lease exit activity when such obligation is incurred. A lease

exit activity is measured initially at its fair value in the period in which the liability is incurred. We estimate fair

value at the cease-use date of its operating leases as the remaining lease rentals, reduced by estimated sublease

rentals that could be reasonably obtained for the property, even where we does not intend to enter into a sublease.

Estimating the cost of certain lease exit costs involves subjective assumptions, including the time it would take to

sublease the leased location and the related potential sublease income. The estimated accruals for these costs could be

significantly affected if future experience differs from that used in the initial estimate. Lease exit costs are included

in provision for impairment and lease exit costs.

46

Furniture and fixtures

20

%

Computer hardware and software

30

%

Equipment and vehicles

30

%