Lululemon 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

lululemon athletica inc. and Subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

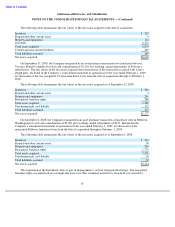

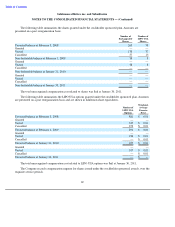

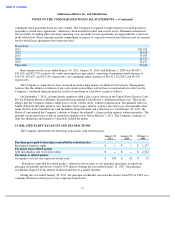

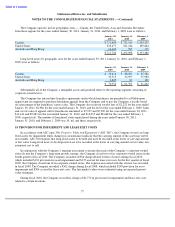

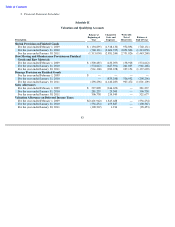

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and

deferred tax liabilities at January 30, 2011 and January 31, 2010 are presented below:

We have recorded deferred tax assets in respect of foreign tax credits and other deductible temporary differences

of $7,894.

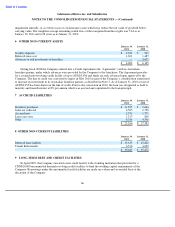

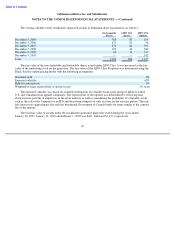

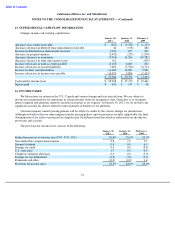

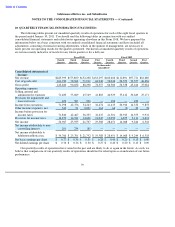

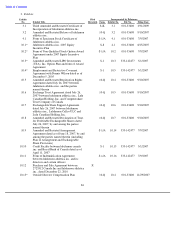

The Company’s current and deferred taxes from federal, state and foreign sources were as follows:

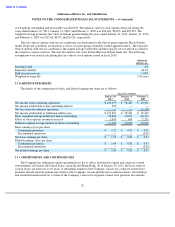

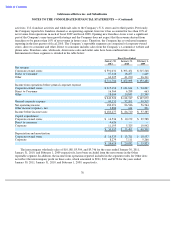

United States income taxes and foreign withholding taxes are not provided on undistributed earnings of foreign

subsidiaries which are considered to be indefinitely reinvesting in the operations of such subsidiaries. The amount of

these earnings was approximately $196,763 at January 30, 2011 and $113,466 at January 31, 2010. Where excess

cash from unremitted earnings has accumulated in our foreign operations and it is advantageous for tax reasons, these

earnings may be remitted.

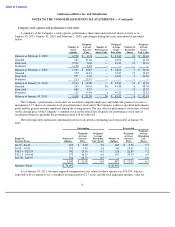

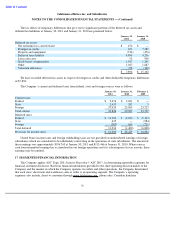

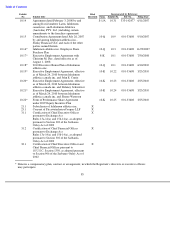

17 SEGMENTED FINANCIAL INFORMATION

The Company applies ASC Topic 280, Segment Reporting (“ASC 280”),

in determining reportable segments for

financial statement disclosure. Based on financial information provided to the chief operating decision maker of the

Company and the manner in which the Company operates its outlets and other operations, the Company determined

that each store, showroom and warehouse sales or outlet is an operating segment. The Company’s operating

segments also include, direct to consumer through www.lululemon.com , phone sales, Canadian franchise

75

January 30,

January 31,

2011

2010

Deferred tax assets

Net operating loss carryforward

$

472

$

—

Foreign tax credits

672

7,582

Property and equipment

(734

)

(476

)

Deferred lease liability

4,896

4,256

Lease exit costs

92

908

Stock

-

based compensation

1,567

1,245

Other

1,027

1,687

Valuation allowance

(98

)

(100

)

$

7,894

$

15,102

January 30,

January 31,

February 1,

2011

2010

2009

Current taxes

Federal

$

9,476

$

3,621

$

—

State

2,435

243

5

Foreign

37,935

25,965

23,727

Total current

49,846

29,829

23,732

Deferred taxes

Federal

$

11,182

$

(2,030

)

$

(5,143

)

State

635

—

(

984

)

Foreign

(583

)

630

(721

)

Total deferred

11,234

(1,400

)

(6,848

)

Provision for income taxes

$

61,080

$

28,429

$

16,884