Lululemon 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

lululemon athletica inc. and Subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

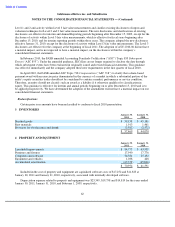

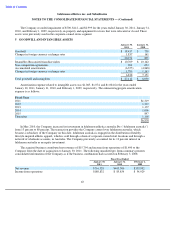

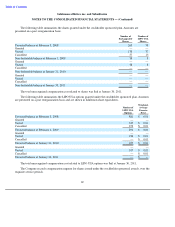

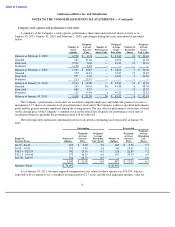

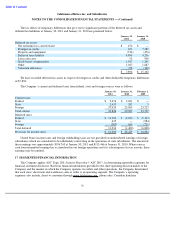

The following table summarizes the fair values of the net assets acquired at the date of acquisition:

On September 15, 2008, the Company reacquired in an asset purchase transaction two franchised stores in

Victoria, British Columbia for total cash consideration of $1,181 less working capital adjustments of $4 from a

related party. The fair values of the net assets acquired were measured as if the transaction occurred with a arm’s

length party. Included in the Company’s consolidated statement of operations for the year ended February 1, 2009,

are the results of the two reacquired Victoria franchised stores from the date of acquisition through to February 1,

2009.

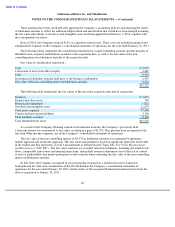

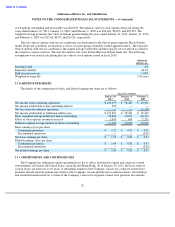

The following table summarizes the fair values of the net assets acquired as of September 15, 2008:

On September 8, 2008, the Company reacquired in an asset purchase transaction a franchised store in Bellevue,

Washington for total cash consideration of $2,067 plus working capital adjustments of $157. Included in the

Company’s consolidated statement of operations for the year ended February 1, 2009, are the results of the

reacquired Bellevue franchised store from the date of acquisition through to February 1, 2009.

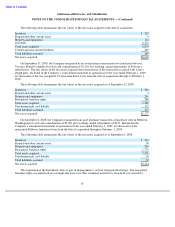

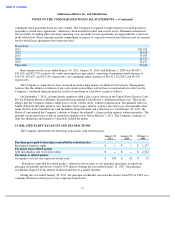

The following table summarizes the fair values of the net assets acquired as of September 8, 2008:

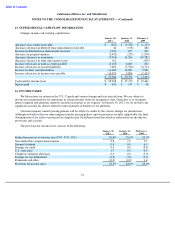

The acquisition of the franchised stores is part of management’s vertical retail growth strategy. The reacquired

franchise rights are amortized on a straight-line basis over their estimated useful lives. Goodwill is reviewed for

65

Inventory

$

325

Prepaid and other current assets

9

Property and equipment

174

Goodwill

6,371

Total assets acquired

6,879

Current and non

-

current liabilities

269

Total liabilities assumed

269

Net assets acquired

$

6,610

Inventory

$

306

Prepaid and other current assets

2

Property and equipment

261

Reacquired franchise rights

780

Total assets acquired

1,349

Unredeemed gift card liability

172

Total liabilities assumed

172

Net assets acquired

$

1,177

Inventory

$

234

Prepaid and other current assets

38

Property and equipment

249

Reacquired franchise rights

1,755

Total assets acquired

2,276

Unredeemed gift card liability

52

Total liabilities assumed

52

Net assets acquired

$

2,224