Lululemon 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

lululemon athletica inc. and Subsidiaries

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

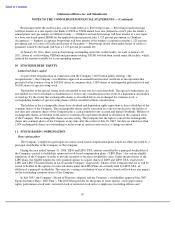

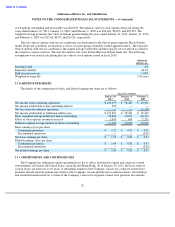

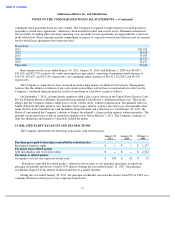

Borrowings under the credit facility can be made either as i) Revolving Loans — Revolving loan borrowings

will bear interest at a rate equal to the Bank’s CDN$ or USD$ annual base rate (defined as zero% plus the lender’s

annual prime rate) per annum, ii) Offshore Loans — Offshore rate loan borrowings will bear interest at a rate equal

to a base rate based upon LIBOR for the applicable interest period, plus 1.125 percent per annum, iii) Bankers

Acceptances — Bankers acceptance borrowings will bear interest at the bankers acceptance rate plus 1.125 percent

per annum and iv) Letters of Credit and Letters of Guarantee — Borrowings drawn down under letters of credit or

guarantee issued by the banks will bear a 1.125 percent per annum fee.

At January 30, 2011, there were no borrowings outstanding under this credit facility. As well, at January 30,

2011, letters of credit totaling USD$nil and guarantees totaling USD$1,466 had been issued under the facility, which

reduced the amount available by a corresponding amount.

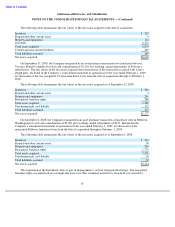

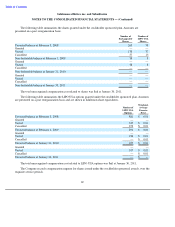

Authorized share capital

As part of the reorganization in connection with the Company’s 2007 initial public offering (“the

reorganization”), the Company’s stockholders approved an amended and restated certificate of incorporation that

provides for the issuance of up to 200,000 shares of common stock, 5,000 shares of undesignated preferred stock and

30,000 shares of special voting stock.

The holders of the special voting stock are entitled to one vote for each share held. The special voting shares are

not entitled to receive dividends or distributions or receive any consideration in the event of a liquidation, dissolution

or wind-up. To the extent that exchangeable shares as described below are exchanged for common stock, a

corresponding number of special voting shares will be cancelled without consideration.

The holders of the exchangeable shares have dividend and liquidation rights equivalent to those of holders of the

common shares of the Company. The exchangeable shares can be converted on a one for one basis by the holder at

any time into common shares of the Company plus a cash payment for any accrued and unpaid dividends. Holders of

exchangeable shares are entitled to the same or economically equivalent dividend as declared on the common stock

of the Company. The exchangeable shares are non-voting. The Company has the right to convert the exchangeable

shares into common shares of the Company at any time after the earlier of July 26, 2047, the date on which less than

2,094 exchangeable shares are outstanding or in the event of certain events such as a change in control.

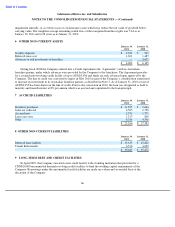

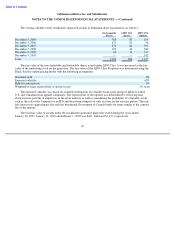

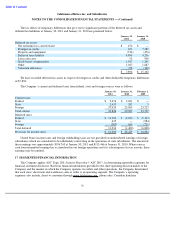

Share option plans

The Company’s employees participate in various stock-

based compensation plans which are either provided by a

principal stockholder of the Company or the Company.

During the year ended January 31, 2006, LIPO and LIPO USA, entities controlled by a principal stockholder of

the Company, created a stockholder sponsored stock-based compensation plans (“LIPO Plans”) for certain eligible

employees of the Company in order to provide incentive to increase stockholder value. Under the provisions of the

LIPO plans, the eligible employees were granted options to acquire shares of LIPO and LIPO USA, respectively.

LIPO and LIPO USA held shares in LACI and the Company, respectively. Shares of the Company that are or will be

issued to holders of the options or restricted shares under the LIPO Plans are currently held by LIPO USA, an

affiliate of a principal stockholder. The exercise, vesting or forfeiture of any of these awards will not have any impact

on the outstanding common shares of the Company.

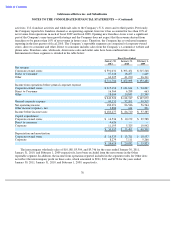

In July 2007, the Company’s Board of Directors adopted, and the Company’s stockholders approved the 2007

Equity Incentive Plan (“2007 Plan”). The 2007 Plan provides for the grants of stock options, stock appreciation

rights, performance stock units, restricted stock or restricted stock units to employees (including officers and

67

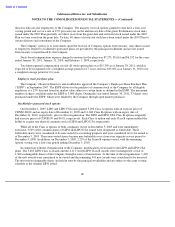

10

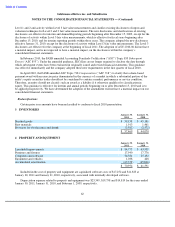

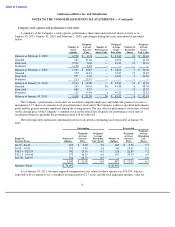

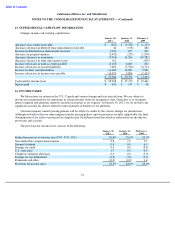

STOCKHOLDERS

’

EQUITY

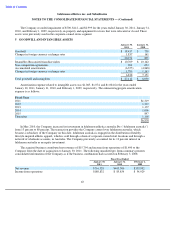

11

STOCK

-

BASED COMPENSATION