Hertz 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

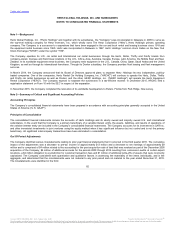

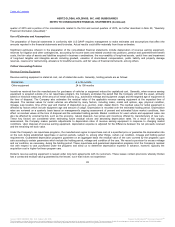

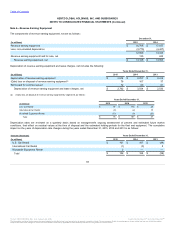

Income Taxes

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement

carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted

tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The

effect of a change in tax rates is recognized in the statement of operations in the period that includes the enactment date. Valuation allowances

are recorded to reduce deferred tax assets when it is more likely than not that a tax benefit will not be realized. Subsequent changes to enacted

tax rates and changes to the global mix of earnings will result in changes to the tax rates used to calculate deferred taxes and any related

valuation allowances. Provisions are not made for income taxes on undistributed earnings of international subsidiaries that are intended to be

indefinitely reinvested outside the United States or are expected to be remitted free of taxes. Future distributions, if any, from these international

subsidiaries to the United States or changes in U.S. tax rules may require recording a tax on these amounts. The Company has recorded a

deferred tax asset for unutilized net operating loss carry forwards in various tax jurisdictions. The taxing authorities may examine the positions that

led to the generation of those net operating losses. If the utilization of any of those losses are disallowed a deferred tax liability may have to be

recorded.

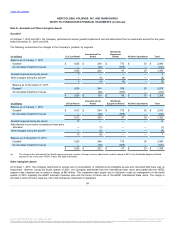

Acquisitions

The Company records acquisitions resulting in the consolidation of an enterprise using the acquisition method of accounting. Under this method,

the acquiring company records the assets acquired, including intangible assets that can be identified and named, and liabilities assumed based on

their estimated fair values at the date of acquisition. The purchase price in excess of the fair value of the identifiable assets acquired and liabilities

assumed is recorded as goodwill. If the assets acquired, net of liabilities assumed, are greater than the purchase price paid then a bargain

purchase has occurred and the Company will recognize the gain immediately in earnings. Among other sources of relevant information, the

Company may use independent appraisals and actuarial or other valuations to assist in determining the estimated fair values of the assets and

liabilities. Various assumptions are used in the determination of these estimated fair values including discount rates, market and volume growth

rates, expected royalty rates, EBITDA margins and other prospective financial information. Transaction costs associated with acquisitions are

expensed as incurred.

Revenue Recognition

The Company reports revenues net of any taxes or non-concession fees collected from customers on behalf of governmental authorities.

Rental Car Operations

The Company derives revenue through rental activities by the operations and licensing of the Hertz, Dollar, Thrifty and Firefly brands under

franchise agreements. The Company also derives revenue from other forms of rental related activities, such as sales of loss damage waivers,

insurance products, fuel and fuel service charges, navigation units, new equipment sales and other consumable items. Revenue is recognized

when persuasive evidence of an arrangement exists, the services have been rendered to customers, the pricing is fixed or determinable and

collection is reasonably assured.

Franchise fees are based on a percentage of net sales of the franchised business and are recognized as earned and when collectability is

reasonably assured. Initial franchise fees are recorded as deferred income when received and are recognized as revenue when all material

services and conditions related to the franchise fee have been substantially performed. Renewal franchise fees are recognized as revenue when

the license agreements are effective and collectability is reasonably assured.

Revenue and expenses associated with gasoline, vehicle licensing and airport concessions are recorded on a gross basis within revenue and

operating expenses.

86

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.