Hertz 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

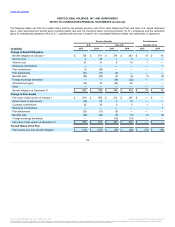

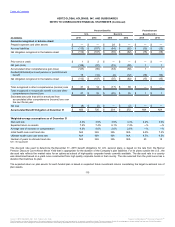

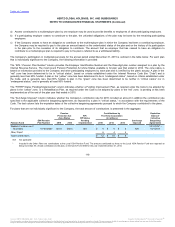

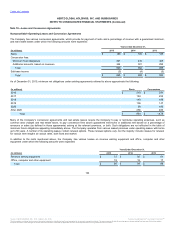

The following table sets forth the net periodic pension and postretirement (including health care, life insurance and auto) expense:

Service cost $ 3

$ 28

$ 27

$ 1

$ 2

$ 3

$ —

$ —

$ —

Interest cost 27

31

28

8

10

9

1

1

1

Expected return on plan assets (40)

(40)

(36)

(15)

(15)

(13)

—

—

—

Net amortizations 2

2

7

2

—

—

—

—

—

Settlement loss 4

4

—

1

—

—

—

—

—

Curtailment gain —

(10)

—

—

—

—

—

—

—

Special termination cost —

4

—

—

—

—

—

—

—

Net pension and postretirement

expense $ (4)

$ 19

$ 26

$ (3)

$ (3)

$ (1)

$ 1

$ 1

$ 1

Weighted-average discount rate for

expense (January 1) 3.9%

4.8%

4.0%

3.3%

3.2%

4.3%

3.8%

4.4%

3.6%

Weighted-average assumed long-

term rate of return on assets

(January 1) 7.4%

7.6%

7.6%

7.3%

7.4%

7.4%

N/A

N/A

N/A

Initial health care cost trend rate N/A

N/A

N/A

N/A

N/A

N/A

7.3%

7.5%

7.8%

Ultimate health care cost trend rate N/A

N/A

N/A

N/A

N/A

N/A

4.5%

4.5%

4.5%

Number of years to ultimate trend

rate N/A

N/A

N/A

N/A

N/A

N/A

14

15

16

N/A - Not applicable

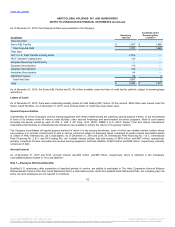

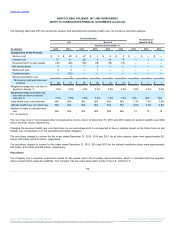

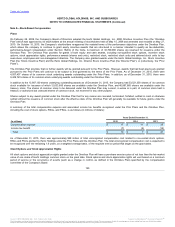

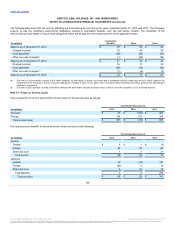

The net of tax loss in “Accumulated other comprehensive income (loss)” at December 31, 2015 and 2014 relating to pension benefits was $102

million and $101 million, respectively.

Changing the assumed health care cost trend rates by one percentage point is not expected to have a material impact on the total of service and

interest cost components or on the postretirement benefit obligation.

The provisions charged to income for the years ended December 31, 2015, 2014 and 2013 for all other pension plans were approximately $12

million, $10 million and $10 million, respectively.

The provisions charged to income for the years ended December 31, 2015, 2014 and 2013 for the defined contribution plans were approximately

$30 million, $18 million and $18 million, respectively.

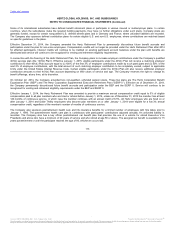

The Company has a long-term investment outlook for the assets held in the Company sponsored plans, which is consistent with the long-term

nature of each plan's respective liabilities. The Company has two major plans which reside in the U.S. and the U.K.

116

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.