Hertz 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

"Debt," to the Notes to our consolidated financial statements included in this Annual Report under the caption Item 8, "Financial Statements and

Supplementary Data." For a discussion of the risks associated with our reliance on asset-backed and asset-based financing and the significant

amount of indebtedness, see Item 1A, "Risk Factors" in this Annual Report.

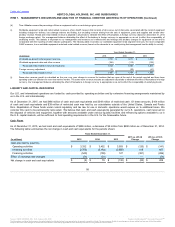

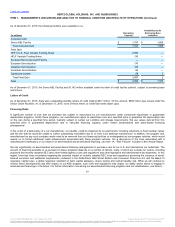

We refer to Hertz and its subsidiaries as the Hertz credit group. The indentures for the Senior Notes contain covenants that, among other things,

limit or restrict the ability of the Hertz credit group to incur additional indebtedness, incur guarantee obligations, prepay certain indebtedness, make

certain restricted payments (including paying dividends, redeeming stock or making other distributions to parent entities of Hertz and other persons

outside of the Hertz credit group), make investments, create liens, transfer or sell assets, merge or consolidate, and enter into certain transactions

with Hertz's affiliates that are not members of the Hertz credit group.

Certain of our other debt instruments and credit facilities contain a number of covenants that, among other things, limit or restrict the ability of the

borrowers and the guarantors to dispose of assets, incur additional indebtedness, incur guarantee obligations, prepay certain indebtedness, make

certain restricted payments (including paying dividends, share repurchases or making other distributions), create liens, make investments, make

acquisitions, engage in mergers, fundamentally change the nature of their business, make capital expenditures, or engage in certain transactions

with certain affiliates.

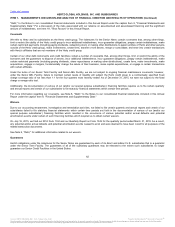

Under the terms of our Senior Term Facility and Senior ABL Facility, we are not subject to ongoing financial maintenance covenants; however,

under the Senior ABL Facility, failure to maintain certain levels of liquidity will subject the Hertz credit group to a contractually specified fixed

charge coverage ratio of not less than 1:1 for the four quarters most recently ended. As of December 31, 2015, we were not subject to the fixed

charge coverage ratio test.

Additionally, the documentation of various of our (and/or our special purpose subsidiaries’) financing facilities requires us to file certain quarterly

and annual reports and certain of our subsidiaries to file statutory financial statements within certain time periods.

For more information regarding our covenants, see Note 6, "Debt," to the Notes to our consolidated financial statements included in this Annual

Report under the caption Item 8, "Financial Statements and Supplementary Data."

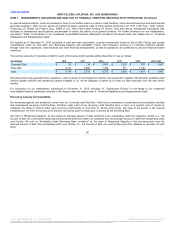

Due to our accounting restatement, investigation and remediation activities, we failed to file certain quarterly and annual reports and certain of our

subsidiaries failed to file statutory financial statements within certain time periods set forth in the documentation of various of our (and/or our

special purpose subsidiaries’) financing facilities which resulted in the occurrence of various potential and/or actual defaults and potential

amortization events under certain of such financing facilities which required us to obtain certain waivers.

On July 16, 2015, we filed our 2014 Form 10-K and our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2015. As a result,

any potential and/or actual defaults and potential amortization events ceased to exist and were deemed to have been cured for all purposes of the

related transaction documents.

See Note 6, "Debt," for additional information related to our waivers.

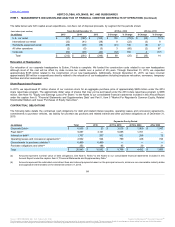

Hertz's obligations under the indentures for the Senior Notes are guaranteed by each of its direct and indirect U.S. subsidiaries that is a guarantor

under the Senior Term Facility. The guarantees of all of the subsidiary guarantors may be released to the extent such subsidiaries no longer

guarantee our Senior Credit Facilities in the United States.

62

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.