Hertz 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

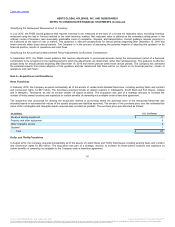

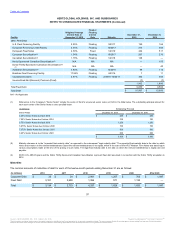

The acquisition was accounted for utilizing the acquisition method of accounting where the purchase price of the franchises was allocated based

on estimated fair values of the assets acquired and liabilities assumed. The excess of the purchase price over the estimated fair value of the net

tangible and intangible assets acquired was recorded as goodwill. The purchase price was allocated as follows:

Revenue earning equipment $ 43

Property and other equipment 1

Other intangible assets 7

Goodwill 11

Total $ 62

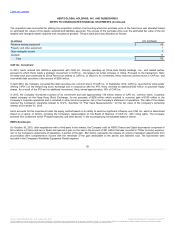

In 2013, Hertz entered into definitive agreements with CAR Inc. formerly operating as China Auto Rental Holdings, Inc., and related parties

pursuant to which Hertz made a strategic investment in CAR Inc., the largest car rental company in China. Pursuant to the transaction, Hertz

invested cash and contributed its China Rent-a-Car entities to CAR Inc. In return for its investment, Hertz received common stock in CAR Inc. and

convertible debt securities in the amount of $236 million.

In April 2014, the Company converted the debt securities into common stock of CAR Inc. In September 2014, CAR Inc. launched its initial public

offering ("IPO") on the Hong Kong stock exchange and in conjunction with the IPO, Hertz invested an additional $30 million to purchase equity

shares. As a result of the IPO and its additional investment, Hertz owned approximately 16% of CAR Inc.

In 2015, the Company monetized a portion of its investment and sold approximately 138 million shares of CAR Inc. common stock, a publicly

traded company on the Hong Kong Stock Exchange, for net proceeds of $236 million which resulted in a pre-tax gain of $133 million in the

Company's corporate operations and is included in other (income) expense, net in the Company's statement of operations. The sale of the shares

reduced the Company's ownership interest to 10.2%. See Note 14, "Fair Value Measurements," for the fair value of the Company's ownership

interest at December 31, 2015.

Hertz accounts for this investment under the equity method based on its ability to exercise significant influence over CAR Inc. which is determined

based on a variety of factors, including the Company's representation on the Board of Directors of CAR Inc. with voting rights. The Company

presents this investment within "Prepaid expenses and other assets" in the accompanying consolidated balance sheets.

On October 30, 2015, after negotiations with a third party in the market, the Company sold its HERC France and Spain businesses comprised of

60 locations in France and two in Spain and realized a gain on the sale in the amount of $51 million that was recorded in "Other (income) expense,

net" in the Company's statements of operations. A portion of the gain, $42 million, represents the release of currency translation adjustments from

accumulated other comprehensive income with the remainder of the gain attributable to the assets and liabilities sold. The businesses were

included in the Company's Worldwide Equipment Rental segment.

92

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.