Hertz 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

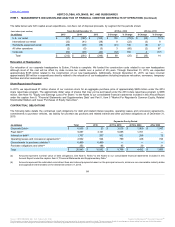

for long-lived assets that management expects to hold and use is based on the estimated fair value of the asset. Long-lived assets to be disposed

of are reported at the lower of carrying amount or estimated fair value less costs to sell.

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement

carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted

tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The

effect of a change in tax rates is recognized in the statement of operations in the period that includes the enactment date. Valuation allowances

are recorded to reduce deferred tax assets when it is more likely than not that a tax benefit will not be realized. Subsequent changes to enacted

tax rates and changes to the global mix of earnings will result in changes to the tax rates used to calculate deferred taxes and any related

valuation allowances. Provisions are not made for income taxes on undistributed earnings of international subsidiaries that are intended to be

indefinitely reinvested outside the United States or are expected to be remitted free of taxes. Future distributions, if any, from these international

subsidiaries to the United States or changes in U.S. tax rules may require recording a tax on these amounts. We have recorded a deferred tax

asset for unutilized net operating loss carry forwards in various tax jurisdictions. The taxing authorities may examine the positions that led to the

generation of those net operating losses. If the utilization of any of those losses are disallowed a deferred tax liability may have to be recorded.

See Note 12, "Taxes on Income (Loss)," to the Notes to our consolidated financial statements included in this Annual Report under the caption

Item 8, "Financial Statements and Supplementary Data.”

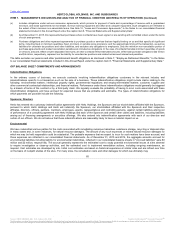

We are exposed to a variety of market risks, including the effects of changes in interest rates, gasoline and diesel fuel prices and foreign currency

exchange rates. We manage exposure to these market risks through regular operating and financing activities and, when deemed appropriate,

through the use of financial instruments. Financial instruments are viewed as risk management tools and have not been used for speculative or

trading purposes. In addition, financial instruments are entered into with a diversified group of major financial institutions in order to manage our

exposure to counterparty nonperformance on such instruments. We account for all financial instruments in accordance with U.S.GAAP, which

requires that they be recorded on the balance sheet as either assets or liabilities measured at their fair value. For financial instruments that are

designated and qualify as hedging instruments, we designate the hedging instrument, based upon the exposure being hedged, as either a fair value

hedge or a cash flow hedge. The effective portion of changes in fair value of financial instruments designated as cash flow hedging instruments is

recorded as a component of other comprehensive income (loss). Amounts included in accumulated other comprehensive income (loss) for cash

flow hedges are reclassified into earnings in the same period that the hedged item is recognized in earnings. The ineffective portion of changes in

the fair value of financial instruments designated as cash flow hedges is recognized currently in earnings within the same line item as the hedged

item, based upon the nature of the hedged item. For financial instruments that are not part of a qualified hedging relationship, the changes in their

fair value are recognized currently in earnings.

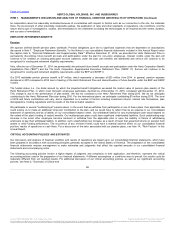

The cost of employee services received in exchange for an award of equity instruments is based on the grant date fair value of the award. The

compensation expense for RSUs and PSUs is recognized ratably over the vesting period. In addition to service vesting conditions, PSUs may

have additional vesting conditions which call for the number of units that will be awarded based on achievement of certain pre-determined

performance goals as defined in the applicable award agreements, over the applicable measurement period.

The cost of employee services received in exchange for an award of equity instruments is based on the grant date fair value of the award. That

cost is recognized over the period during which the employee is required to provide service in exchange for the award. We estimated the fair value

of options issued at the date of grant using a Black-Scholes option-pricing model, which includes assumptions related to volatility, expected term,

dividend yield, and risk-free interest rate. These factors combined with the stock price on the date of grant result in a fixed expense which is

recorded on a straight-line basis over the vesting period.

70

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.