Hertz 2015 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

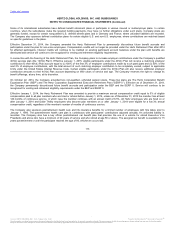

On July 16, 2015, the Company filed its 2014 Form 10-K and its Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2015. As

a result, any potential and/or actual defaults and potential amortization events ceased to exist and were deemed to have been cured for all

purposes of the related transaction documents.

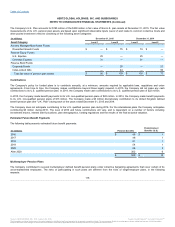

As a result of the contractual restrictions on Hertz's or its subsidiaries' ability to pay dividends (directly or indirectly) under various terms of its

debt, as of December 31, 2015, the restricted net assets of its subsidiaries exceeded 25% of its total consolidated net assets.

Under the terms of its Senior Term Facility and Senior ABL Facility, the Company is not subject to ongoing financial maintenance covenants;

however, under the Senior ABL Facility, failure to maintain certain levels of liquidity will subject Hertz to a contractually specified fixed charge

coverage ratio of not less than 1:1 for the four quarters most recently ended. As of December 31, 2015, the Company was not subject to the fixed

charge coverage ratio test.

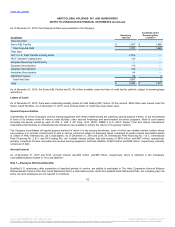

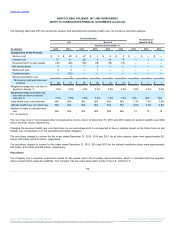

Certain amounts of cash and cash equivalents are restricted for the purchase of revenue earning vehicles and other specified uses under the Fleet

Debt facilities and the Like-Kind Exchange Program ("LKE Program".) As of December 31, 2015 and December 31, 2014, the portion of total

restricted cash and cash equivalents that was associated with the Fleet Debt facilities was $289 million and $515 million, respectively. Restricted

cash balances fluctuate based on the timing of purchases and sales of revenue earning vehicles and could also be impacted by the occurrence of

an amortization event.

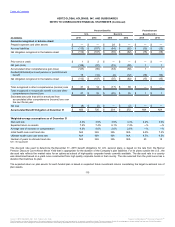

The Company's borrowing capacity and availability comes from its "revolving credit facilities," which are a combination of asset-backed

securitization facilities and asset-based revolving credit facilities. Creditors under each of its revolving credit facilities have a claim on a specific

pool of assets as collateral. The Company's ability to borrow under each revolving credit facility is a function of, among other things, the value of

the assets in the relevant collateral pool. The Company refers to the amount of debt the Company can borrow given a certain pool of assets as the

borrowing base.

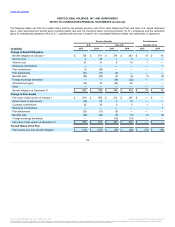

The Company refers to "Remaining Capacity" as the maximum principal amount of debt permitted to be outstanding under the respective facility

(i.e., the amount of debt the Company could borrow assuming the Company possessed sufficient assets as collateral) less the principal amount of

debt then-outstanding under such facility. The Company refers to "Availability Under Borrowing Base Limitation" as the lower of Remaining

Capacity or the borrowing base less the principal amount of debt then-outstanding under such facility (i.e., the amount of debt the Company could

borrow given the collateral the Company possesses at such time).

111

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.