Hertz 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

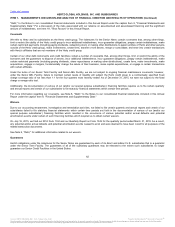

The assumed volatility for our stock is based on our historical stock price data. The assumed dividend yield is zero. The risk-free interest rate is

the implied zero-coupon yield for U.S. Treasury securities having a maturity approximately equal to the expected term of the options, as of the

grant dates. The non-cash stock-based compensation expense associated with the Hertz Global Holdings, Inc. Stock Incentive Plan (“Stock

Incentive Plan”) the Hertz Global Holdings, Inc. Director Stock Incentive Plan (“Director Plan”) and the Hertz Global Holdings, Inc. 2008 Omnibus

Incentive Plan (“Omnibus Plan”) are pushed down from Hertz Holdings and recorded on the books at the Hertz level. See Note 8, "Stock-Based

Compensation," to the Notes to our consolidated financial statements included in this Annual Report under the caption Item 8, "Financial

Statements and Supplementary Data.”

We record acquisitions resulting in the consolidation of an enterprise using the acquisition method of accounting. Under this method, the acquiring

company records the assets acquired, including intangible assets that can be identified and named, and liabilities assumed based on their

estimated fair values at the date of acquisition. The purchase price in excess of the fair value of the assets acquired and liabilities assumed is

recorded as goodwill. If the assets acquired, net of liabilities assumed, are greater than the purchase price paid then a bargain purchase has

occurred and we will recognize the gain immediately in earnings. Among other sources of relevant information, we may use independent appraisals

and actuarial or other valuations to assist in determining the estimated fair values of the assets and liabilities. Various assumptions are used in the

determination of these estimated fair values including discount rates, market and volume growth rates, expected royalty rates, EBITDA margins

and other prospective financial information. Transaction costs associated with acquisitions are expensed as incurred.

For a discussion of recent accounting pronouncements, see Note 2, "Summary of Critical and Significant Accounting Policies," — "Recent

Accounting Pronouncements," to the Notes to our consolidated financial statements included in this Annual Report under the caption Item 8,

"Financial Statements and Supplementary Data.”

For a discussion of additional risks arising from our operations, including vehicle liability, general liability and property damage insurable risks, see

“Item 1—Business—Risk Management” in this Annual Report.

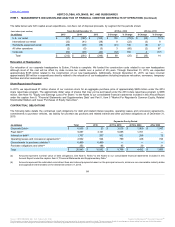

We are exposed to a variety of market risks, including the effects of changes in interest rates (including credit spreads), foreign currency

exchange rates and fluctuations in fuel prices. We manage our exposure to these market risks through our regular operating and financing

activities and, when deemed appropriate, through the use of derivative financial instruments. Derivative financial instruments are viewed as risk

management tools and have not been used for speculative or trading purposes. In addition, derivative financial instruments are entered into with a

diversified group of major financial institutions in order to manage our exposure to counterparty nonperformance on such instruments.

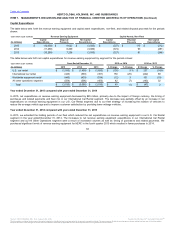

We have a significant amount of debt with a mix of fixed and variable rates of interest. Floating rate debt carries interest based generally on

LIBOR, Euro inter-bank offered rate (“EURIBOR”) or their equivalents for local currencies or bank conduit commercial paper rates plus an

applicable margin. Increases in interest rates could therefore significantly increase the associated interest payments that we are required to make

on this debt. See Note 6, "Debt," to the Notes to our consolidated financial statements included in this Annual Report under the caption Item 8,

"Financial Statements and Supplementary Data.”

We have assessed our exposure to changes in interest rates by analyzing the sensitivity to our earnings assuming various changes in market

interest rates. Assuming a hypothetical increase of one percentage point in interest rates

71

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.