Hertz 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

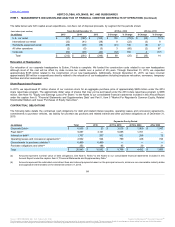

be responsible cannot be reasonably estimated because of uncertainties with respect to factors such as our connection to the site, the materials

there, the involvement of other potentially responsible parties, the application of laws and other standards or regulations, site conditions, and the

nature and scope of investigations, studies, and remediation to be undertaken (including the technologies to be required and the extent, duration,

and success of remediation).

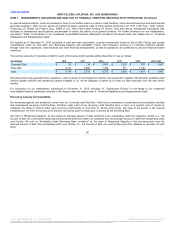

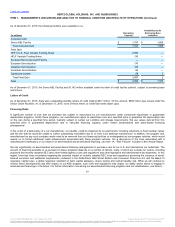

We sponsor defined benefit pension plans worldwide. Pension obligations give rise to significant expenses that are dependent on assumptions

discussed in Note 7, "Employee Retirement Benefits," to the Notes to our consolidated financial statements included in this Annual Report under

the caption Item 8, "Financial Statements and Supplementary Data." Effective December 31, 2014, we amended the Hertz Retirement Plan to

permanently discontinue future benefit accruals and participation under the plan for non-union employees. Interest credits under the plan will

continue to be credited on existing participant account balances under the plan until benefits are distributed and service will continue to be

recognized for vesting and retirement eligibility requirements.

Also, effective as of December 31, 2014, we permanently discontinued future benefit accruals and participation under the Hertz Corporation Benefit

Equalization Plan (“BEP") and the The Hertz Corporation Supplemental Executive Retirement Plan (“SERP II”). Service will continue to be

recognized for vesting and retirement eligibility requirements under the BEP and SERP II.

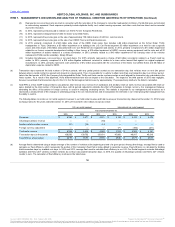

Our 2015 worldwide pre-tax pension benefit is $7 million, which represents a decrease of $23 million from 2014. In general, pension expense

decreased in 2015 compared to 2014 due to freezing of the Hertz Retirement Plan and discontinuation of future benefits under the BEP and SERP

II plans.

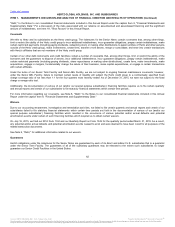

The funded status (i.e., the dollar amount by which the projected benefit obligations exceeded the market value of pension plan assets) of the

Hertz Retirement Plan, in which most domestic employees participate, declined as of December 31, 2015, compared with December 31, 2014.

This change is due to the performance of plan assets. We did not contribute to the Hertz Retirement Plan during 2015. We do not anticipate

contributing to the Hertz Retirement Plan plan during 2016. For the international plans, we anticipate contributing $3 million during 2016. The level

of 2016 and future contributions will vary, and is dependent on a number of factors including investment returns, interest rate fluctuations, plan

demographics, funding regulations and the results of the final actuarial valuation.

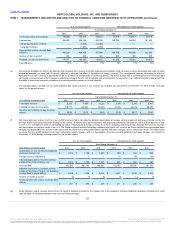

We participate in several "multiemployer" pension plans. In the event that we withdraw from participation in one of these plans, then applicable law

could require us to make an additional lump-sum contribution to the plan, and we would have to reflect that as an expense in our consolidated

statement of operations and as a liability on our consolidated balance sheet. Our withdrawal liability for any multiemployer plan would depend on

the extent of the plan's funding of vested benefits. Our multiemployer plans could have significant underfunded liabilities. Such underfunding may

increase in the event other employers become insolvent or withdraw from the applicable plan or upon the inability or failure of withdrawing

employers to pay their withdrawal liability. In addition, such underfunding may increase as a result of lower than expected returns on pension fund

assets or other funding deficiencies. The occurrence of any of these events could have a material adverse effect on our consolidated financial

position, results of operations or cash flows. For a discussion of the risks associated with our pension plans, see Item 1A, "Risk Factors” in this

Annual Report.

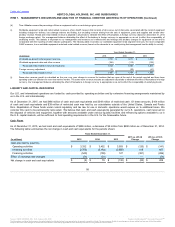

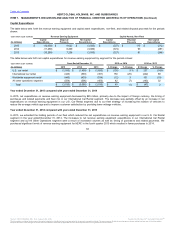

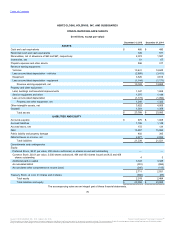

Our discussion and analysis of financial condition and results of operations are based upon our consolidated financial statements, which have

been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of the consolidated

financial statements requires management to make estimates and judgments that affect the reported amounts in our consolidated financial

statements and accompanying notes.

The following accounting policies involve a higher degree of judgment and complexity in their application, and therefore, represent the critical

accounting policies used in the preparation of our financial statements. If different assumptions or conditions were to prevail, the results could be

materially different from our reported results. For additional discussion of our critical accounting policies, as well as our significant accounting

policies, see Note 2, "Summary of Critical and

66

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.