Hertz 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

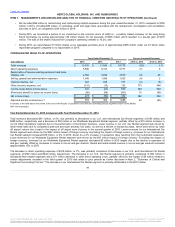

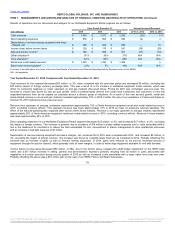

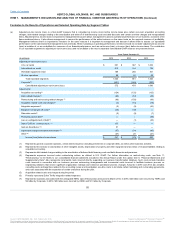

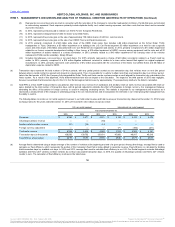

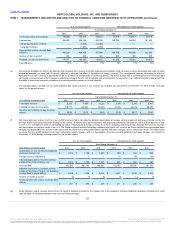

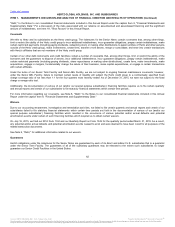

Adjusted pre-tax income decreased $69 million, or 27%. See footnote (a) in the "Footnotes to the Results of Operations and Selected Operating

Data by Segment Tables" for a summary and description of these adjustments on a consolidated basis.

Total revenues for the segment increased $32 million, or 2%, when compared with the prior year period and increased $54 million, or 4% excluding

the impact of foreign currency exchange rates. HERC experienced increases of 6% and 2% in worldwide equipment rental volumes and pricing,

respectively. The increase in volume was driven by growth in the non-residential construction industry, new account wins, and efforts to diversify

our customer base. Although higher than in 2013, overall segment revenues were negatively impacted by a $18 million decline in equipment sales

resulting from the closure of two dealerships and a distribution center.

Direct operating expenses for our Worldwide Equipment Rental segment increased $37 million, or 4%, from the prior year due primarily to additional

fleet related expenses of $25 million as a result of higher maintenance costs as we refresh the equipment rental fleet.

Depreciation of revenue earning equipment and lease charges, net increased $30 million, or 10%, from the prior year. The increase was driven by a

5% increase in the average acquisition cost of rental equipment operated during the period and a $17 million decrease in gain on sale of used

equipment as HERC sold an increased amount of equipment through the auction channel in order to better align equipment available for rent with

demand.

Income before income taxes decreased $71 million, or 29%, from the prior year due mainly to the factors described above and a $30 million

increase in SG&A expenses primarily resulting from costs for the anticipated HERC spin-off transaction as well as increased costs associated

with a larger sales force. SG&A expense is further described on a consolidated basis in the Consolidated Results of Operations section of this

MD&A.

Adjusted pre-tax income decreased $43 million, or 14%, from the prior year. See footnote (a) in the "Footnotes to the Results of Operations and

Selected Operating Data by Segment Tables" for a summary and description of these adjustments on a consolidated basis.

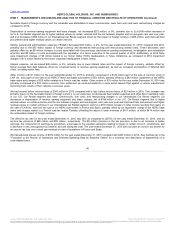

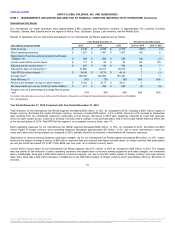

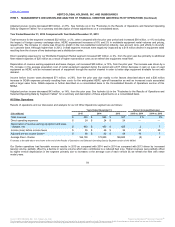

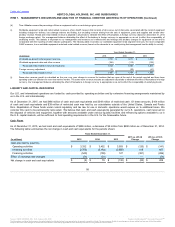

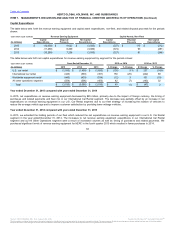

Results of operations and our discussion and analysis for our All Other Operations segment are as follows:

Total revenues $ 583

$ 568

$ 527

3 %

8%

Direct operating expenses $ 24

$ 24

$ 24

—

—

Depreciation of revenue earning equipment and lease

charges, net $ 463

$ 455

$ 425

2

7

Income (loss) before income taxes $ 55

$ 46

$ 36

20

28

Adjusted pre-tax income (loss)(a) $ 68

$ 62

$ 58

10

7

Average Fleet - Donlen 164,100

172,800

169,600

(5)

2

Footnotes to the table above are shown at the end of the Results of Operations and Selected Operating Data by Segment section of this MD&A.

Our Donlen operations had favorable revenue results in 2015 as compared with 2014 and in 2014 as compared with 2013 driven by increased

leasing volume, partially offset by a decline in service volume which also contributes to a reduced fleet size. Higher revenues were partially offset

by higher vehicle depreciation in the segment primarily due to increases in the average cost of each vehicle as we refresh the fleet with newer

model years.

54

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.