Hertz 2015 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

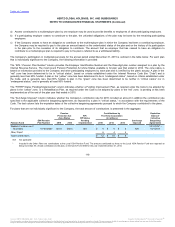

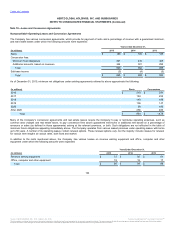

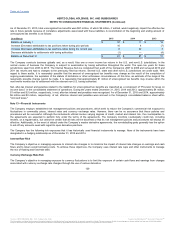

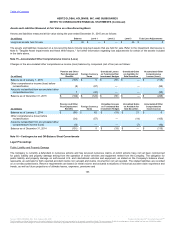

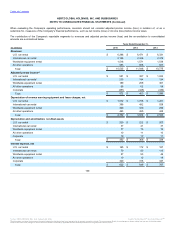

As of December 31, 2015, total unrecognized tax benefits were $81 million, of which $6 million, if settled, would negatively impact the effective tax

rate in future periods because of correlative adjustments associated with these liabilities. A reconciliation of the beginning and ending amount of

unrecognized tax benefits is as follows:

Balance at January 1 $ 57

$ 11

$ 19

Increase (Decrease) attributable to tax positions taken during prior periods 16

4

(7)

Increase (Decrease) attributable to tax positions taken during the current year 9

42

3

Decrease attributable to settlements with taxing authorities (1)

—

(4)

Balance at December 31 $ 81

$ 57

$ 11

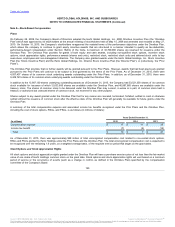

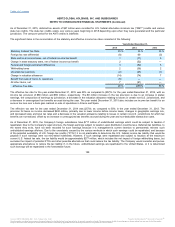

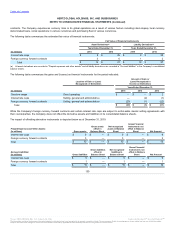

The Company conducts business globally and, as a result, files one or more income tax returns in the U.S. and non-U.S. jurisdictions. In the

normal course of business the Company is subject to examination by taxing authorities throughout the world. The open tax years for these

jurisdictions span from 2003 to 2015. The Internal Revenue Service completed their audit of the Company's 2007 to 2009 and surveyed 2010 and

2011 tax returns and had no changes to the previously filed tax returns. Several U.S. state and other non-U.S. jurisdictions are under audit. With

regard to these audits, it is reasonably possible that the amount of unrecognized tax benefits may change as the result of the completion of

ongoing examinations, the expiration of the statute of limitations or other unforeseen circumstances. At this time, an estimate of the range of the

reasonably possible change cannot be made. It is reasonable that approximately $1 million of unrecognized tax benefits may reverse within the

next twelve months due to settlement with the relevant non-U.S. taxing authorities.

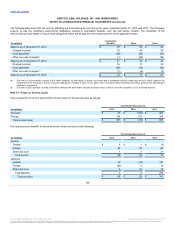

Net, after-tax interest and penalties related to the liabilities for unrecognized tax benefits are classified as a component of “Provision for taxes on

income (loss)” in the consolidated statement of operations. During the years ended December 31, 2015, 2014 and 2013, approximately $4 million,

$1 million and $(1) million, respectively, in net, after-tax interest and penalties were recognized. As of December 31, 2015 and 2014, approximately

$6 million and $3 million, respectively, of net, after-tax interest and penalties were accrued in the Company's consolidated balance sheet within

"Accrued taxes."

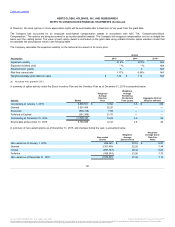

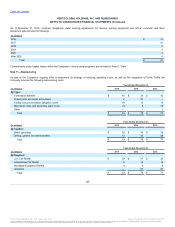

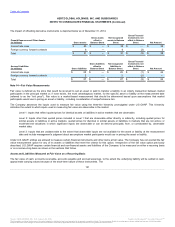

The Company employs established risk management policies and procedures, which seek to reduce the Company’s commercial risk exposure to

fluctuations in commodity prices, interest rates and currency exchange rates. However, there can be no assurance that these policies and

procedures will be successful. Although the instruments utilized involve varying degrees of credit, market and interest risk, the counterparties to

the agreements are expected to perform fully under the terms of the agreements. The Company monitors counterparty credit risk, including

lenders, on a regular basis, but cannot be certain that all risks will be discerned or that its risk management policies and procedures will always be

effective. Additionally, in the event of default under the Company’s master derivative agreements, the non-defaulting party generally has the option

to set-off any amounts owed with regard to open derivative positions.

The Company has the following risk exposures that it has historically used financial instruments to manage. None of the instruments have been

designated in a hedging relationship as of December 31, 2015 and 2014.

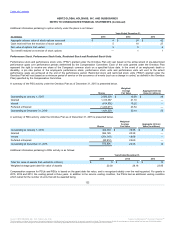

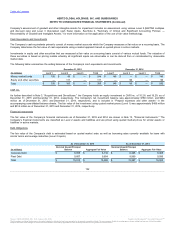

The Company’s objective in managing exposure to interest rate changes is to minimize the impact of interest rate changes on earnings and cash

flows and to lower overall borrowing costs. To achieve these objectives, the Company uses interest rate caps and other instruments to manage

the mix of floating and fixed-rate debt.

The Company’s objective in managing exposure to currency fluctuations is to limit the exposure of certain cash flows and earnings from changes

associated with currency exchange rate changes through the use of various derivative

129

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.