Hertz 2015 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

instances, for natural resource damages. The amount of any such expenses or related natural resource damages for which the Company may be

held responsible could be substantial. In addition, Hertz has entered into customary indemnification agreements with Hertz Holdings, those certain

private investment funds (collectively, the "Sponsors") who through Hertz Investors Inc., acquired all of Hertz common stock from Ford Holdings

LLC in 2006 and former stockholders affiliated with the Sponsors, pursuant to which Hertz Holdings and Hertz will indemnify the Sponsors, its

former stockholders affiliated with the Sponsors and their respective affiliates, directors, officers, partners, members, employees, agents,

representatives and controlling persons, against certain liabilities arising out of performance of a consulting agreement with Hertz Holdings and

each of the Sponsors and certain other claims and liabilities, including liabilities arising out of financing arrangements or securities offerings. The

Company has also entered into customary indemnification agreements with each of its directors. Performance under these indemnification

obligations would generally be triggered by a breach of terms of the contract or by a third party claim. The Company regularly evaluates the

probability of having to incur costs associated with these indemnification obligations and have accrued for expected losses that are probable and

estimable.

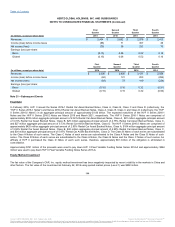

On September 15, 2014, Hertz Holdings entered into a definitive Nomination and Standstill Agreement (the “Nomination and Standstill Agreement”)

with Mr. Carl C. Icahn, High River Limited Partnership, Hopper Investments LLC, Barberry Corp., Icahn Partners LP, Icahn Partners Master Fund

LP, Icahn Enterprises G.P. Inc., Icahn Enterprises Holdings L.P., IPH GP LLC, Icahn Capital LP, Icahn Onshore LP, Icahn Offshore LP, Beckton

Corp., Vincent J. Intrieri, Samuel Merksamer and Daniel A. Ninivaggi (collectively, the “Icahn Group”).

Pursuant to the Nomination and Standstill Agreement, Mr. Vincent J. Intrieri, Mr. Samuel Merskamer and Mr. Daniel A. Ninivaggi (collectively, the

“Icahn Designees”) were appointed to the Board of Directors of Hertz Holdings as Class II, Class I and Class I directors respectively effective as

of September 15, 2014. Messrs. Intrieri, Merksamer and Ninivaggi were also appointed to the Board of Directors of Hertz. Pursuant to the

Nomination and Standstill Agreement, so long as an Icahn Designee is a member of the Board, the Board will not be expanded to greater than ten

directors without the approval from the Icahn Designees then on the Board. In addition, pursuant to the Nomination and Standstill Agreement,

subject to certain restrictions and requirements, the Icahn Group will have certain replacement rights in the event an Icahn Designee resigns or is

otherwise unable to serve as a director (other than as a result of not being nominated by Hertz Holdings for an annual meeting subsequent to Hertz

Holdings' 2015 annual meeting of stockholders).

Until the date that no Icahn Designee is a member of the Board (or otherwise deemed to be on the Board pursuant to the terms of the Nomination

and Standstill Agreement) (the “Board Representation Period”), the Icahn Group agrees to vote all of its shares of common stock of Hertz Holdings

in favor of the election of all of Hertz Holdings’ director nominees at each annual or special meeting of Hertz Holdings. Also pursuant to the

Nomination and Standstill Agreement, during the Board Representation Period, and subject to limited exceptions, the Icahn Group will adhere to

certain standstill obligations, including the obligation to not solicit proxies or consents or influence others with respect to the same. The Icahn

Group further agrees that during the Board Representation Period, subject to certain limited exceptions, the Icahn Group will not acquire or

otherwise beneficially own more than 20% of Hertz Holdings’ outstanding voting securities.

In addition, pursuant to the Nomination and Standstill Agreement, the Board agreed not to create a separate executive committee of the board so

long as an Icahn Designee is a member of the Board.

If at any time the Icahn Group ceases to hold a “net long” position, as defined in the Nomination and Standstill Agreement, in at least (A)

28,500,000 shares of Hertz Holdings’ common stock, the Icahn Group will cause one Icahn Designee to promptly resign from the Board; (B)

22,800,000 shares of Hertz Holdings’ common stock, the Icahn Group will cause two Icahn Designees to promptly resign from the Board; and (C)

19,000,000 shares of Hertz Holdings’ common stock, the Icahn Group will cause all of the Icahn Designees to promptly resign from the Board and

Hertz Holdings’ obligations under the Nomination and Standstill Agreement will terminate.

136

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.