Hertz 2015 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

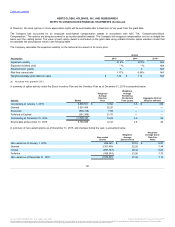

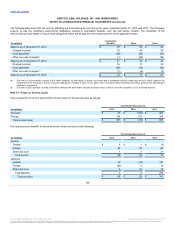

As of December 31, 2015, deferred tax assets of $47 million were recorded for U.S. federal alternative minimum tax ("AMT") credits and various

state tax credits. The state tax credits expire over various years beginning in 2018 depending upon when they were generated and the particular

jurisdiction. The carryover period for the AMT credits is indefinite.

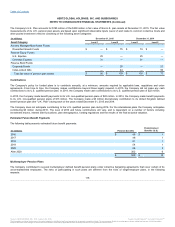

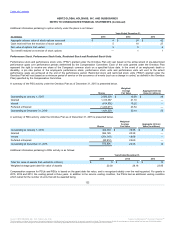

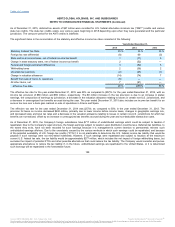

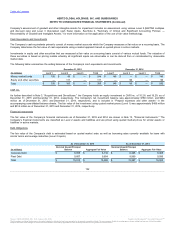

The significant items in the reconciliation of the statutory and effective income tax rates consisted of the following:

Statutory Federal Tax Rate 35 %

35 %

35 %

Foreign tax rate differential (8)

69

(3)

State and local income taxes, net of federal income tax benefit 1

(11)

5

Change in state statutory rates, net of federal income tax benefit 2

(52)

—

Federal and foreign permanent differences 3

(52)

5

Withholding taxes 2

(36)

2

Uncertain tax positions (2)

(45)

(1)

Change in valuation allowance (14)

(74)

7

Benefit from sale of non-U.S. operations (6)

—

—

All other items, net 7

(91)

—

Effective Tax Rate 20 %

(257)%

50 %

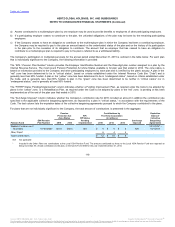

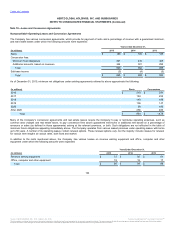

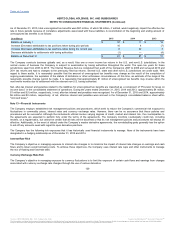

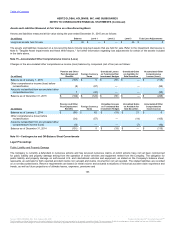

The effective tax rate for the year ended December 31, 2015 was 20% as compared to (257)% for the year ended December 31, 2014, with an

income tax provision of $68 million and $59 million, respectively. The $9 million increase in the tax provision is due to an increase in pretax

earnings, the composition of earnings by jurisdiction, a decrease in the valuation allowance relating to losses in certain non-U.S. jurisdictions, and

a decrease in unrecognized tax benefits accrued during the year. The year ended December 31, 2015 also includes an income tax benefit for an

excess tax loss over a book gain realized on sale of operations in France and Spain.

The effective tax rate for the year ended December 31, 2014 was (257)% as compared to 50% in the year ended December 31, 2013. The

provision for taxes on income decreased $242 million, primarily due to lower income before income taxes, changes in geographic earnings mix,

and decreased state and local tax rates and a decrease in the valuation allowance relating to losses in certain non-U.S. jurisdictions for which tax

benefits are not realized, offset by an increase in unrecognized tax benefits accrued during the year and non-deductible transaction costs.

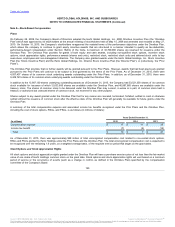

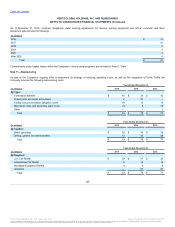

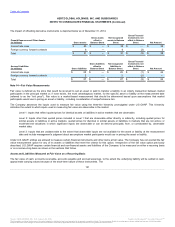

As of December 31, 2015, the Company's foreign subsidiaries have $717 million of undistributed earnings which could be subject to taxation if

repatriated. Due to the Company's legal structure, the foreign earnings subject to taxation upon distribution could be less. Deferred tax liabilities, to

the extent they exist, have not been recorded for such earnings because it is management’s current intention to permanently reinvest such

undistributed earnings offshore. Due to the uncertainty caused by the various methods in which such earnings could be repatriated, and because

of the potential availability of U.S. foreign tax credits (“FTCs”) it is not practicable to determine the U.S. federal income tax liability that would be

payable if such earnings were not reinvested indefinitely. However, if such earnings were repatriated and subject to taxation at the maximum

current U.S. federal tax rate, the tax liability would be approximately $277 million, which includes the net impact of foreign withholding taxes, but

excludes the impact of potential FTCs and other possible alternatives that could reduce the tax liability. The Company would consider and pursue

appropriate alternatives to reduce the tax liability if, in the future, undistributed earnings are repatriated to the United States, or it is determined

such earnings will be repatriated in the foreseeable future.

128

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.