Hertz 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

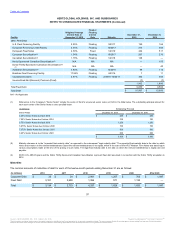

HVF II U.S. ABS Program

In November 2013, Hertz established a securitization platform, the HVF II U.S. ABS Program, designed to facilitate its financing activities relating

to the vehicle fleet used by Hertz in the U.S. daily car rental operations of its Hertz, Dollar, Thrifty and Firefly brands. Hertz Vehicle Financing II

LP, a bankruptcy remote, indirect, wholly -owned, special purpose subsidiary of Hertz ("HVF II") is the issuer under the HVF II U.S. ABS Program.

HVF II has entered into a base indenture that permits it to issue term and revolving rental car asset-backed securities, secured by one or more

shared or segregated collateral pools consisting primarily of portions of the rental car fleet used in its U.S. car rental operations and contractual

rights related to such vehicles that have been allocated as the ultimate indirect collateral for HVF II's financings. HVF II uses proceeds from its

note issuances to make loans to Hertz Vehicle Financing LLC ("HVF") pursuant to the HVF Series 2013-G1 Supplement (the “HVF Series 2013-G1

Notes”) and Rental Car Finance Corp. ("RCFC") pursuant to the RCFC Series 2010-3 Supplement (the "RCFC Series 2010-3 Notes"), in each case

on a continuing basis.

The assets of HVF II and HVF II GP Corp. are owned by HVF II and HVF II GP Corp., respectively, and are not available to satisfy the claims of

Hertz’s general creditors.

References to the “HVF II U.S. ABS Program” include HVF II’s U.S. Fleet Variable Funding Notes and HVF II U.S. Fleet Medium Term Notes.

HVF II U.S. Fleet Variable Funding Notes

References to the “HVF II U.S. Fleet Variable Funding Notes ” include the HVF II Series 2013-A Notes, the HVF II Series 2013-B Notes and the

HVF II Series 2014-A Notes.

In connection with the establishment of the HVF II U.S. ABS Program, HVF II executed a $3,175 million committed financing arrangement,

allocated between the HVF II Series 2013-A Notes and the HVF II Series 2013-B Notes, each of which ultimately are backed by segregated

collateral pools.

The initial aggregate maximum principal amount of the HVF II Series 2013-A Notes was $2,575 million (subject to borrowing base availability). The

initial aggregate maximum principal amount of the HVF II Series 2013-B Notes was $600 million (subject to borrowing case availability). At

inception, the HVF II Series 2013-A Notes allowed for approximately $900 million of aggregate maximum principal amount of such notes to be

transitioned to the aggregate maximum principal amount of HVF II Series 2013-B Notes and the HVF II Series 2013-B Notes allowed for all of the

aggregate maximum principal amount of such notes to be transitioned to the HVF II Series 2013-A Notes (in each case, subject to borrowing base

availability).

The net proceeds from the initial sale of the HVF II Series 2013-A Notes were used to refinance nearly all of the outstanding Series 2009-1

Variable Funding Rental Car Asset-Backed Notes previously issued by HVF, the collateral for which consisted primarily of a substantial portion of

the rental car fleet used in Hertz’s and certain of its subsidiaries’ U.S. car rental operations. No commitments remain available under the HVF

Series 2009-1 Notes and there are no longer any HVF Series 2009-1 Notes outstanding.

The net proceeds from the initial sale of the HVF II Series 2013-B Notes were used to refinance the Series 2010-3 Variable Funding Rental Car

Asset-Backed Notes previously issued by RCFC, the collateral for which consisted primarily of a substantial portion of the rental car fleet used in

Dollar Thrifty’s and certain of its affiliates’ U.S. car rental operations.

In July 2014, HVF II executed a $1,000 million committed financing arrangement, the “Series 2014-A Variable Funding Rental Car Asset-Backed

Notes," or the “HVF II Series 2014-A Notes”, backed by the same collateral pool that supports the HVF II Series 2013-A Notes. The initial

aggregate maximum principal amount of the HVF II Series 2014-A Notes was $1,000 million (subject to borrowing base availability).

In October 2014, HVF II entered into various agreements to amend certain terms of the HVF II Series 2013-A Notes and the HVF II Series 2013-B

Notes. The amendments, among other things, extended the maturity of each facility to October 2016. In addition, HVF II transitioned $250 million

of commitments available under the HVF II Series 2013-A Notes to the HVF II Series 2013-B Notes, such that after giving effect to such

transitions the aggregate maximum

101

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.