Hertz 2015 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

and the United Kingdom; and Enterprise (operating the Enterprise brand) in France, Germany, Ireland and the United Kingdom.

In Asia Pacific, the principal participants in the market place throughout the region are ABG, operating the Avis, Budget and Zipcar brands, and

Europcar, operating the Europcar and Keddy brands.

In Latin America, the principal participants are ABG, operating the Avis, Budget and Zipcar brands, and Enterprise Holdings, which operates the

Alamo Rent A Car brand in the region. Other key players in the region are Localiza, Unidas and Movida.

Competition among car rental industry participants is intense and is primarily based on price, vehicle availability and quality, service, reliability,

rental locations, product innovation, competition from on-line travel agents and car rental brokers. We believe that the prominence and service

reputation of the Hertz brand, our extensive worldwide ownership of car rental operations and our commitment to innovation and service provide us

with a competitive advantage. Additionally, our Dollar, Thrifty and Firefly brands enable us to compete across multiple market segments.

Our car rental operations are a seasonal business, with decreased levels of business in the winter months and heightened activity during spring

and summer for the majority of countries where we generate our revenues. To accommodate increased demand, we increase our available fleet

and staff during the second and third quarters of the year. As business demand declines, fleet and staff are decreased accordingly. Certain

operating expenses, including real estate taxes, rent, insurance, utilities, maintenance and other facility-related expenses, the costs of operating

our information technology systems and minimum staffing costs, remain fixed and cannot be adjusted for seasonal demand.

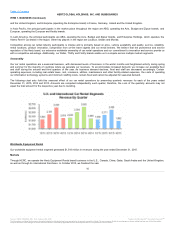

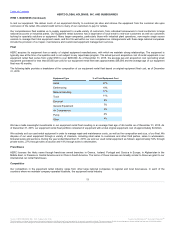

The following chart sets forth this seasonal effect of our car rental operations by presenting quarterly revenues for each of the years ended

December 31, 2015, 2014 and 2013. Amounts are computed independently each quarter, therefore, the s um of the quarterly amounts may not

equal the total amount for the respective year due to rounding.

Our worldwide equipment rental segment generated $1,518 million in revenues during the year ended December 31, 2015.

Through HERC, we operate the Hertz Equipment Rental brand business in the U.S., Canada, China, Qatar, Saudi Arabia and the United Kingdom,

as well as through its international franchises. In October 2015, we finalized the sale

10

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.