Hertz 2015 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Pursuant to the Nomination and Standstill Agreement, the Company and the Icahn Group entered into a confidentiality agreement pursuant to

which the Icahn Group agreed to treat any and all information concerning or relating to Hertz Holdings or any of its subsidiaries or affiliates

furnished to the Icahn Group or their representatives as confidential. In addition, the Company and the Icahn Group agreed to enter into a

customary registration rights agreement.

In connection with its car and equipment rental businesses, the Company enters into millions of rental transactions every year involving millions of

customers. In order to conduct those businesses, the Company also procures goods and services from thousands of vendors. Some of those

customers and vendors may be affiliated with members of the Company's Board. The Company believes that all such rental and procurement

transactions have been conducted on an arms‑length basis and involved terms no less favorable to the Company than those that it believes would

have been obtained in the absence of such affiliation. It is Company management’s policy to bring to the attention of its Board any transaction with

a related party, even if the transaction arises in the ordinary course of business, if the terms of the transaction would be less favorable to the

Company than those to which it would agree to in normal commercial circumstances.

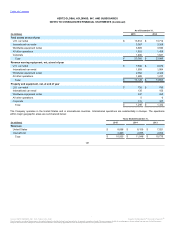

In March 2014, the Company announced a $1 billion share repurchase program (the "2014 share repurchase program"). The program replaced the

$300 million share repurchase program that the Company announced in 2013, under which the Company repurchased 4 million shares of its

common stock at an aggregate purchase price of $87 million during the year ended December 31, 2013. The 2014 share repurchase program

permits the Company to purchase shares through a variety of methods, including in the open market or through privately negotiated transactions,

in accordance with applicable securities laws. It does not obligate the Company to make any repurchases at any specific time or situation. The

timing and extent to which the Company repurchases its shares will depend upon, among other things, market conditions, share price, liquidity

targets and other factors. Share repurchases may be commenced or suspended at any time or from time to time without prior notice. During 2015,

the Company repurchased 37 million shares at an aggregate purchase price of approximately $605 million under the 2014 share repurchase

program. Repurchases are included in treasury stock in the accompanying condensed consolidated balance sheets as of December 31, 2015. As

of December 31, 2015, the approximate dollar value of shares that may yet be purchased under the 2014 share repurchase program is $396

million.

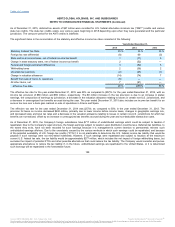

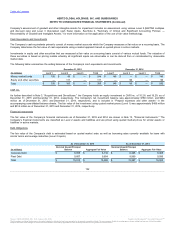

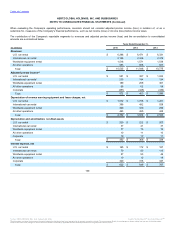

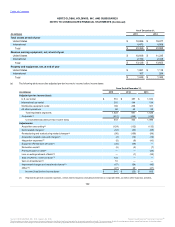

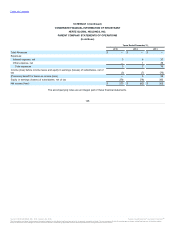

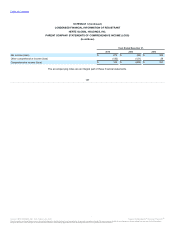

Basic earnings per share has been computed based upon the weighted average number of common shares outstanding. Diluted earnings per share

has been computed based upon the weighted average number of common shares outstanding plus the effect of all potentially dilutive common

stock equivalents, except when the effect would be anti-dilutive.

137

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.