Hertz 2015 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

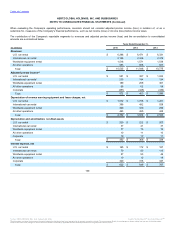

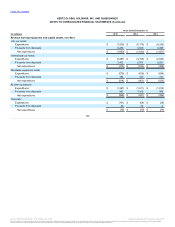

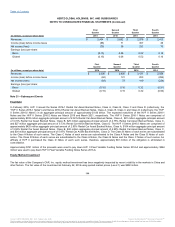

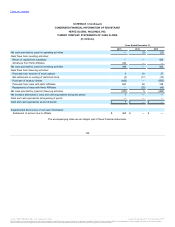

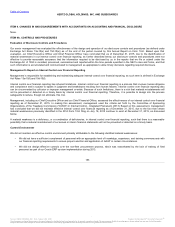

Revenues: $ 2,454

$ 2,692

$ 2,976

$ 2,413

Income (loss) before income taxes (86)

71

307

49

Net income (loss) (70)

36

237

70

Earnings (loss) per share:

Basic (0.15)

0.08

0.52

0.16

Diluted (0.15)

0.08

0.52

0.16

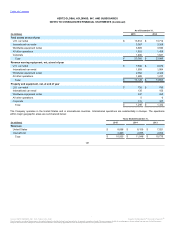

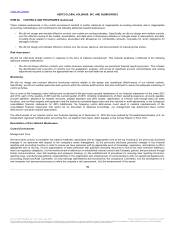

Revenues: $ 2,536

$ 2,830

$ 3,121

$ 2,559

Income (loss) before income taxes (62)

121

203

(284)

Net income (loss) (69)

72

149

(234)

Earnings (loss) per share:

Basic (0.15)

0.16

0.32

(0.51)

Diluted (0.15)

0.15

0.32

(0.50)

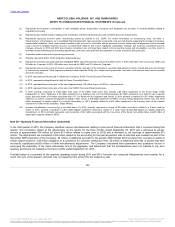

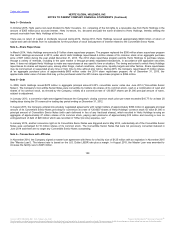

In February 2016, HVF II issued the Series 2016-1 Rental Car Asset Backed Notes, Class A, Class B, Class C and Class D (collectively, the

“HVF II Series 2016-1 Notes”) and Series 2016-2 Rental Car Asset Backed Notes, Class A, Class B, Class C and Class D (collectively, the “HVF

II Series 2016-2 Notes”) in an aggregate principal amount of approximately $1.06 billion. The expected maturities of the HVF II Series 2016-1

Notes and the HVF II Series 2016-2 Notes are March 2019 and March 2021, respectively. The HVF II Series 2016-1 Notes are comprised of

approximately $333 million aggregate principal amount of 2.32% Rental Car Asset Backed Notes, Class A, $81 million aggregate principal amount

of 3.72% Rental Car Asset Backed Notes, Class B, $25 million aggregate principal amount of 4.75% Rental Car Asset Backed Notes, Class C,

and $27 million aggregate principal amount of 5.73% Rental Car Asset Backed Notes, Class D. The HVF II Series 2016-2 Notes are comprised of

approximately $425 million aggregate principal amount of 2.95% Rental Car Asset Backed Notes, Class A, $104 million aggregate principal amount

of 3.94% Rental Car Asset Backed Notes, Class B, $32 million aggregate principal amount of 4.99% Rental Car Asset Backed Notes, Class C,

and $34 million aggregate principal amount of 5.97% Rental Car Asset Backed Notes, Class D. The Class B Notes of each series are subordinated

to the Class A Notes of such series. The Class C Notes of each series are subordinated to the Class A Notes and the Class B Notes of such

series. The Class D Notes of each series are subordinated to the Class A Notes, the Class B Notes and the Class C Notes of such series. An

affiliate of HVF II purchased the Class D Notes of each such series, therefore, approximately $61 million of the obligation is eliminated in

consolidation.

Approximately $741 million of the proceeds were used to pay down HVF II Fleet Variable Funding Notes Series 2014-A and approximately $264

million was used to pay down HVF II Fleet Variable Funding Notes Series 2013-A.

The fair value of the Company's CAR, Inc. equity method investment has been negatively impacted by recent volatility in the markets in China and

other factors. The fair value of the investment at February 22, 2016 using quoted market prices (Level 1) was $292 million.

144

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.