Hertz 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

to rent our equipment. We deliver much of our equipment directly to customer job sites and retrieve the equipment from the customer site upon

conclusion of the rental. We extend credit terms to many of our customers to pay for rentals.

Our comprehensive fleet enables us to supply equipment to a wide variety of customers, from individual homeowners to local contractors to large

national accounts or industrial plants. Our equipment rental business has a large base of local small to mid-size customers as well as customers

looking for specialty solutions or equipment. Many larger companies, particularly those with industrial plant operations, now require single source

vendors to manage their total equipment needs, and this fits well within our core competencies. Arrangements with these large national companies

include the provision of our repair, maintenance and customized equipment management services.

HERC acquires its equipment from a variety of original equipment manufacturers, with which we maintain strong relationships.The equipment is

typically new at the time of acquisition and is not subject to any repurchase program. The actual per-unit acquisition cost of rental equipment in our

equipment rental fleet varies from under $100 to over $200,000. As of December 31, 2015, the average per-unit acquisition cost (excluding small

equipment purchased for less than $5,000 per unit) for our equipment rental fleet was approximately $38,000and the average age of our equipment

fleet was 46months.

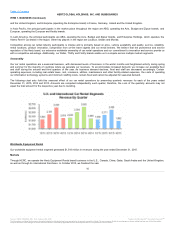

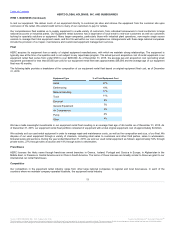

The following table provides a breakdown of the composition of our equipment rental fleet based on original equipment fleet cost, as of December

31, 2015:

Aerial

27%

Earthmoving

19%

Material Handling

17%

Truck

11%

Electrical

9%

General Equipment

7%

Air Compressors

4%

Pump

2%

Other

4%

We have made meaningful investments in our equipment rental fleet resulting in an average fleet age of 46 months as of December 31, 2015. As

of December 31, 2015, our equipment rental fleet portfolio consisted of equipment with a total original equipment cost of approximately $4 billion.

We routinely sell our used rental equipment in order to manage repair and maintenance costs, as well as the composition and size, of our fleet. We

dispose of our used equipment through a variety of channels, including retail sales to customers and other third parties, sales to wholesalers,

brokered sales and auctions. During the year ended December 31, 2015, we sold our used rental equipment as follows: approximately 54% through

private sales, 27% through sales at auction and 19% through sales to wholesalers.

HERC licenses the Hertz name through franchisee owned branches in Greece, Iceland, Portugal and Corsica in Europe, in Afghanistan in the

Middle East, in Panama in Central America and in Chile in South America. The terms of those licenses are broadly similar to those we grant to our

international car rental franchisees.

Our competitors in the equipment rental industry range from other large national companies to regional and local businesses. In each of the

countries where we maintain company-operated locations, the equipment rental industry

13

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.